How to put value on your house

8 Ways To Increase Your Home's Value

Whether your goal is to renovate your home this year or sell it, making home improvements can increase your home’s value.

LightbulbHome improvement statistics

- Homeowners spent an average of $10,341 on home improvements in 2021, a 25 percent increase from 2020, according to a recent report by Angi.

- Homeowners who completed work did an average of 3.7 projects, with an average cost per project of $2,800, according to the Angi report.

- In 2021, homeowners spent $376.9 billion in total on home improvements, according to a separate study by Angi.

- Increasing the home’s value ranked as the second-most important goal for home improvement spending, behind fixing existing issues, according to another recent report by Angi.

- The top five projects that add the most dollar value to a sale in 2022 are refinishing hardwood floors, installing new wood floors, upgrading insulation, converting a basement to a living area and renovating closets, according to a joint report by the National Association of Realtors (NAR) and the National Association of the Remodeling Industry (NARI).

- Seventy-one percent of homeowners with upcoming renovations plan to forge ahead with the projects despite supply chain and inflation challenges, according to a January 2022 survey from Nationwide.

8 ways to increase the value of your home

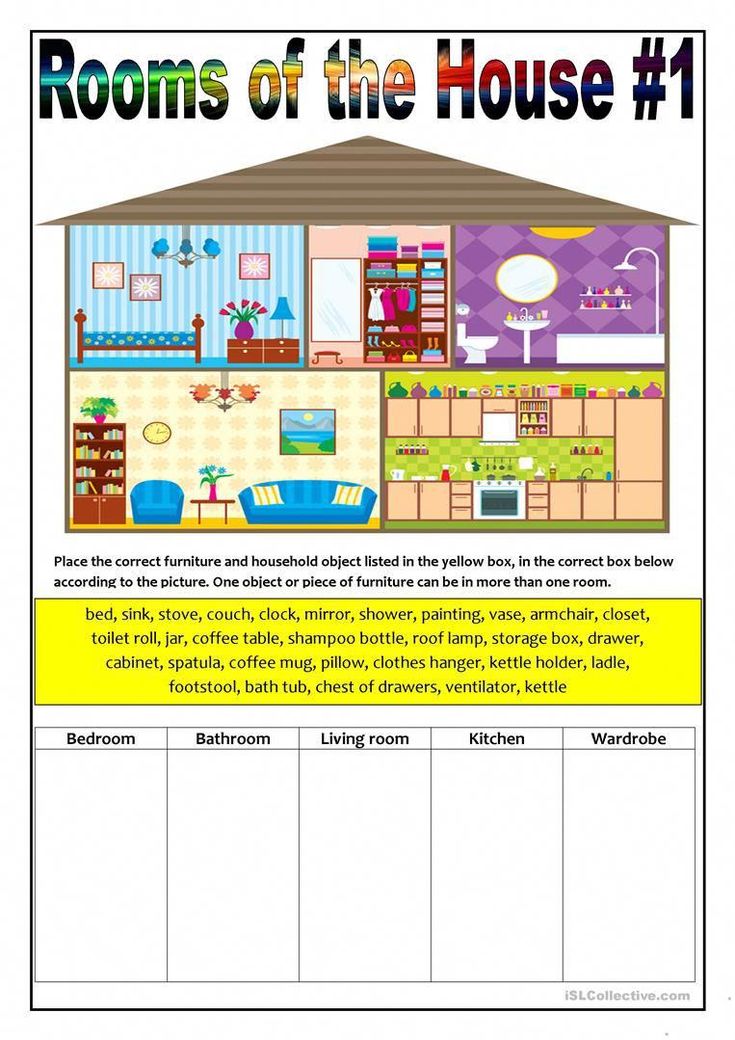

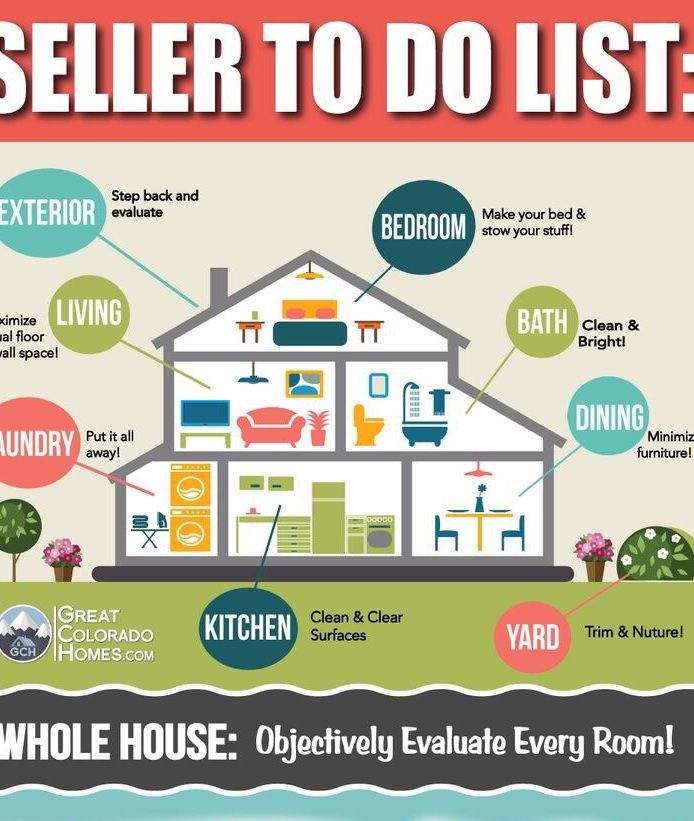

1. Clean and declutter

To help boost the value of your home, begin by decreasing the amount of stuff that’s inside it. Cleaning and decluttering are relatively inexpensive tasks, even in bigger homes. Professionally cleaning a four-bedroom home costs between $200 and $225, according to HomeAdvisor.

Of course, you could save money by doing the work yourself. Start by going through cabinets and closets and making donation piles. Then clean out drawers and other storage areas, making sure you’re not keeping anything you don’t need or want.

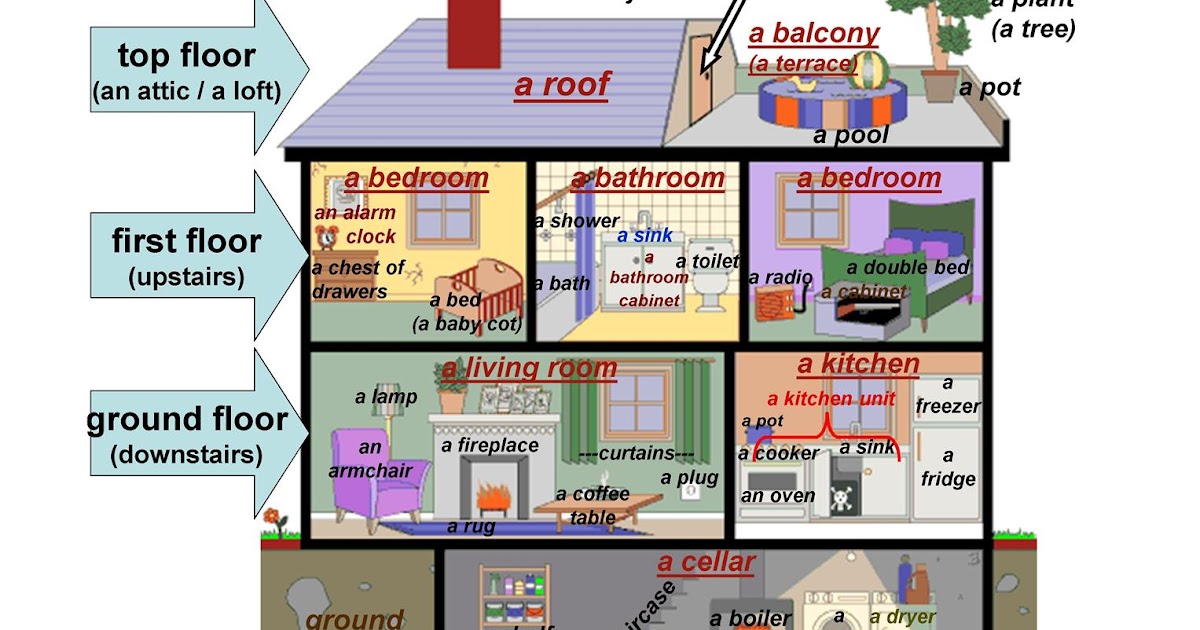

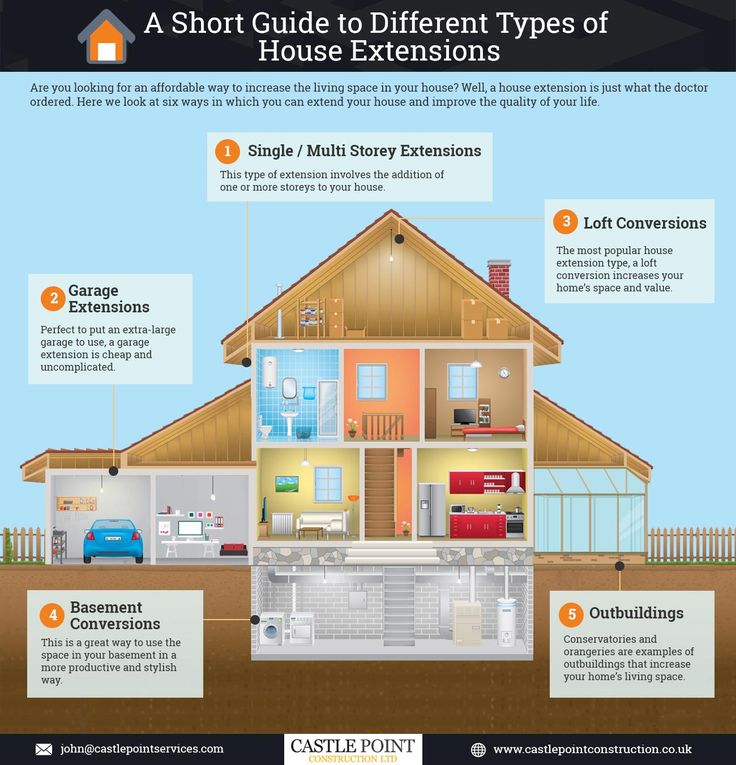

2. Add usable square footage

Adding more usable space to an existing home can make a lot of financial sense, and that’s especially true in areas with limited available real estate where land and space are finite.

Homes are valued and priced by the livable square feet they contain, and the more livable square feet, the better, says Benjamin Ross, a Realtor and real estate investor based in Corpus Christi, Texas. As a result, adding a bathroom, a great room or another needed space to a home can increase function and add value.

Adding a separate mother-in-law suite can also be a smart idea, says Ross, noting that “most homes do not have this feature, so adding one sets you apart from the competition when it is time to sell.”

The national average cost to build an addition is $49,562, according to estimates from HomeAdvisor. The actual cost will vary depending on the type of room you’re looking to add. For example, tacking on a laundry room to your home might be as little as around $8,000, while adding a new bedroom with an en suite bathroom might run up to $100,000.

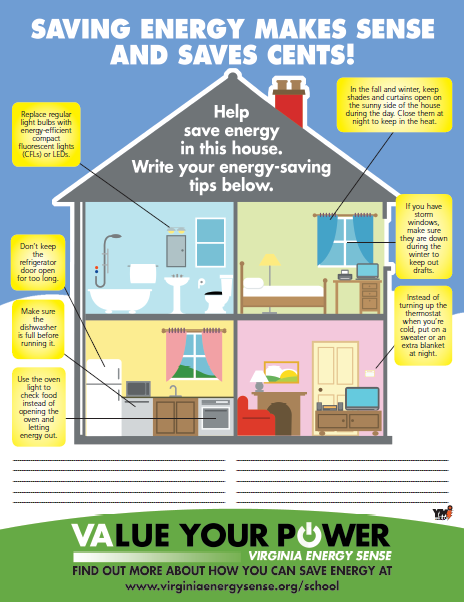

3. Make your home more energy-efficient

Projects that lower utility bills is a smart way to increase the value of your home. Installing a smart thermostat, for example, helps improve efficiency and save money, says Scott Ewald of Trane, an HVAC company.

Installing a smart thermostat, for example, helps improve efficiency and save money, says Scott Ewald of Trane, an HVAC company.

“The right smart thermostat will allow a homeowner to control their home’s climate from anywhere, giving them the power to manage energy costs regardless of whether they are sitting on the couch or away on vacation,” says Ewald. “Such investments in home tech — particularly when connected to the HVAC, which is the largest mechanical system in the home — provides a strong selling point and highlights the home’s overall comfort, functionality, energy efficiency and convenience.”

It can cost between $200 to $500 to make this quick upgrade, according to Fixr, or an average of about $300.

Other ways to improve your home’s efficiency and value include replacing old, leaky windows, installing energy-efficient home appliances and adding insulation to your home. Keep in mind, though, that new windows and new appliances will be a much more expensive project.

4. Spruce it up with fresh paint

One of the most popular home improvement projects in 2022 is painting or wallpapering, according to Angi. A fresh coat of paint can make even dated exteriors and interiors look fresh and new — and it’s not that expensive, either.

Begin by repainting any rooms with an “odd” color scheme, says Timothy Wiedman, a former professor and personal finance expert who has flipped homes over his career. For example, did you let your then-11-year-old daughter paint her bedroom hot pink 16 years ago? If so, that’s a good place to start.

Your painting budget will depend on which rooms you’re hoping to give a new splash of color. For example, HomeAdvisor pegs painting a bathroom — usually the smallest room in the house — somewhere between $150 and $350, while a 330-square-foot living room might cost as much as $2,000.

5. Work on your curb appeal

From power washing your driveway to hiring someone to wash your windows and mow the lawn, improving curb appeal can make a big difference in your home’s value. In fact, curb appeal can account for as much as 7 percent of it, according to a 2020 joint study out of the University of Texas at Arlington and the University of Alabama.

In fact, curb appeal can account for as much as 7 percent of it, according to a 2020 joint study out of the University of Texas at Arlington and the University of Alabama.

Upgrading your landscape can go a long way, says Joe Raboine, director of Residential Hardscapes with Belgard.

Some ideas: a fresh walkway, shrubs, planters, mulching or even a new paver patio or outdoor kitchen.

6. Upgrade your exterior doors

Also in the vein of curb appeal, replacing an old front door can work wonders, says Wiedman. In the late ’90s, he and his wife replaced an old, ugly door with a solid mahogany door with a frosted, oval piece of lead glass. He stained the door himself to save money, and the result was “simply stunning.”

Don’t forget the garage doors, too, says Randy Oliver, president of Hollywood-Crawford Door Company. At a 93 percent return-on-investment, you’ll get back nearly every cent you spend, according to Remodeling magazine’s 2022 Cost vs. Value Report.

“The front of the home is the first thing you, your neighbors and prospective buyers will see,” says Oliver. “Garage doors often take up the most amount of space on the front of your home, so installing a modern glass panel door or a rustic wood door will dramatically improve your home’s appearance.”

“Garage doors often take up the most amount of space on the front of your home, so installing a modern glass panel door or a rustic wood door will dramatically improve your home’s appearance.”

7. Give your kitchen an updated look

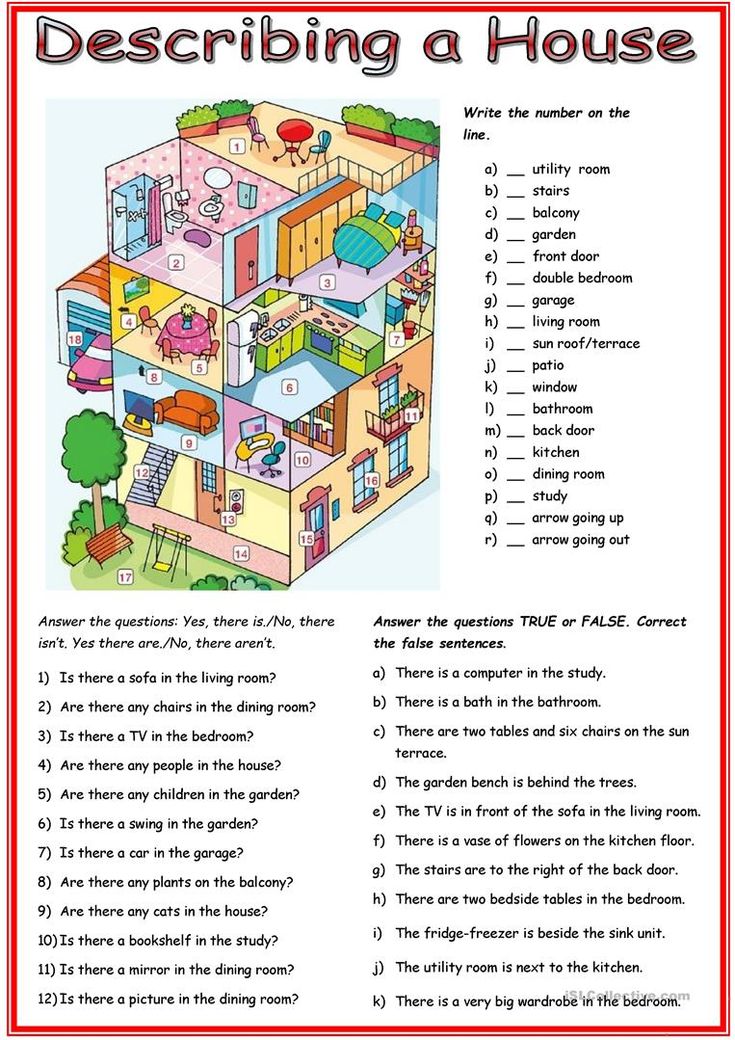

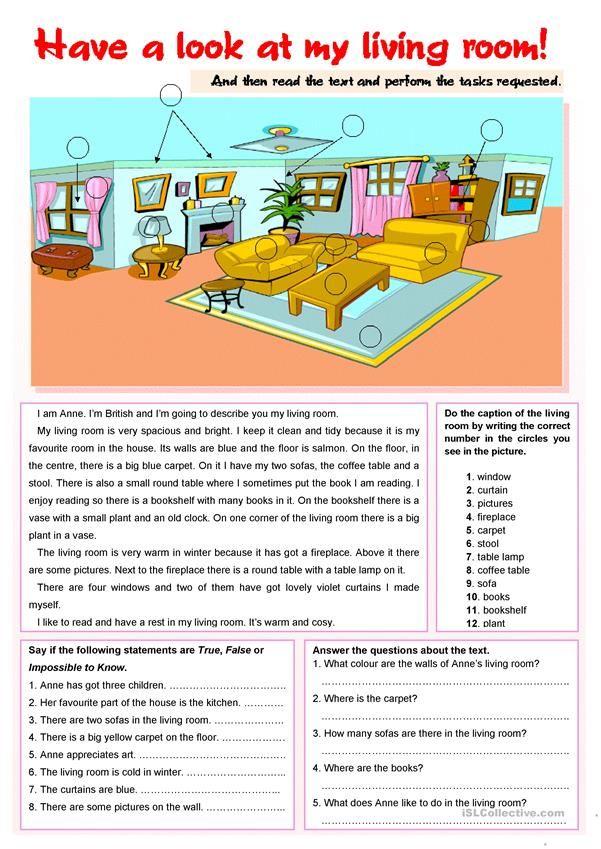

Many buyers zero in on the kitchen as the central feature of a home, so if yours is outdated, it can ultimately affect how much you garner from a sale. Likewise, if you aren’t able to utilize your kitchen fully due to layout, space or other concerns, you won’t be maximizing the space.

This project, though, will require a lot of money, and you likely won’t get every dollar you invest back. According to the NAR/NARI report, the average kitchen remodel costs around $80,000, and a homeowner would likely get around $60,000 of value when it’s time to sell.

If updating your entire kitchen is too big of an undertaking, a minor remodel could still have an impact on your home’s value — think coordinating appliances and installing modern hardware on your cabinets. Talk with a real estate agent about what makes the most sense and what will command the most dollars from prospective buyers.

Talk with a real estate agent about what makes the most sense and what will command the most dollars from prospective buyers.

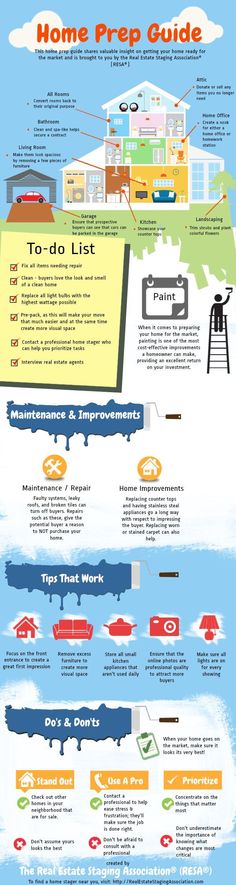

8. Stage your home

If you’re planning to list your home for sale, consider skipping cosmetic home improvements and go with a home staging service instead. Seventy-three percent of staged homes sold for over list price — an average of $40,000 higher — and staged homes move off the market nine days faster than the average, according to the Real Estate Staging Association.

Staging costs just over $1,600 on average, according to HomeAdvisor, but the cost varies based on your needs and home. Staging services range widely, from decluttering and depersonalization (for example, removing family photos or specific decor) to bringing in rented furnishings, repainting and more. Simply put, the more work involved to stage it, the more expensive the production will be. A real estate agent can help you determine which staging services would make an impact on your home’s value.

How to pay for home improvements to increase value

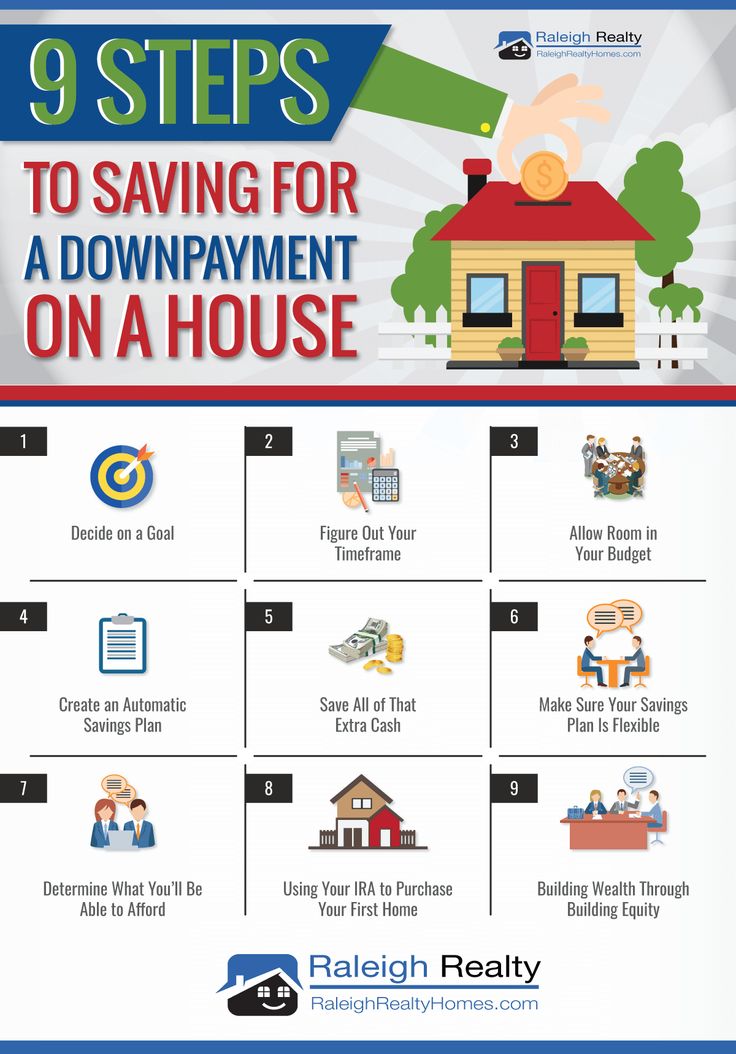

Whether you plan to sell your home or just want to enjoy it more while you live there, it’s important to consider how you’ll pay for these value-adding projects. You can work to save the cash to pay for home improvements as you go, but there are also plenty of financing options that can help you remodel your home sooner rather than later.

Personal loan

Personal loans allow you to borrow a fixed amount of money with a fixed interest rate. These loans are unsecured, meaning you don’t have to put your home or other property up as collateral to get approved. Many personal loan lenders let you borrow as much as $35,000 for home improvements — sometimes more — which you can then repay over time. The rates for a personal loan can vary widely, so be sure to compare options to get the lowest-cost loan for your project.

Home equity loan or HELOC

Home equity loans are similar to personal loans in that you receive a lump sum of cash with a fixed interest rate and fixed monthly payment. Home equity lines of credit, also known as HELOCs, work like credit cards, and come with variable rates and a line of credit you can borrow against.

Home equity lines of credit, also known as HELOCs, work like credit cards, and come with variable rates and a line of credit you can borrow against.

These borrowing options require you to put your home up as collateral to qualify. The good news is, you could score a lower interest rate with one of these types of loans compared to a personal loan or home improvement loan. In addition, no matter which option you go with, the interest might be deductible if you use the money to make eligible home improvements.

0% APR credit card

If you need to borrow a small amount of cash for your home improvement plans, you might be able to skip the loan and go with a 0% APR credit card instead. Many cards have no interest payments on balances for up to 18 months, which can be ideal if you have a smaller-scale project in mind. A credit card can also work well if you’re able to pay your contractor with it.

Just remember: If you don’t pay your balance off by the time your zero-percent APR offer ends, your card’s interest rate will reset to a much higher variable rate, costing you more.

Cash-out refinance

If you have built equity in your home and you’re looking to do a major renovation, a cash-out refinance could provide you with the funds you need while getting you a lower rate on your current mortgage. The refinancing process is just as paperwork-heavy as taking out a mortgage, however, and there are closing costs to consider. If you go this route, take the time to shop around for the best refinance rates so you maximize your savings.

Improvements to increase value FAQ

-

Different renovations can have varying degrees of impact on your home’s value. Replacing your garage door, for example, might add more than $3,700 to resale value, while replacing windows can add more than $13,000.Rather than think about how much a renovation will increase your home’s value, it’s important to determine how much that renovation will cost to get a sense of what you will be able to recoup. The best projects are the renovations that retain most of their value in the eyes of a new buyer.

-

There are financing options that allow you to buy a home and pay for renovation expenses at the same time.For example, the Fannie Mae HomeStyle loan bundles the money you need to buy a new property and the money you need for renovations into one loan. The maximum you can borrow is 75 percent of the as-completed value of the home after the renovation. FHA 203(k) loans are also designed to cover renovations when buying a home, although there are some additional limitations with this route: A 203(k) loan can’t cover luxury add-ons like a swimming pool or outdoor fireplace.

-

You can make some major upgrades to your home with a $100,000 budget. For example, you might convert your attic into living space (around $40,000, according to HomeAdvisor), add a standard bathroom (around $35,000), a 50-square-foot mudroom ($12,000) and a simple sunroom (somewhere between $8,000 and $11,000).

No matter what you decide to do to your home, you can stretch that $100,000 further by focusing on more affordable materials: lower-cost cabinets, cheaper wallpaper and non luxury finishes, for instance.

No matter what you decide to do to your home, you can stretch that $100,000 further by focusing on more affordable materials: lower-cost cabinets, cheaper wallpaper and non luxury finishes, for instance. -

The time to complete a kitchen renovation depends on the size of the kitchen and the scope of the work.For example, if your plans include a new backsplash, a fresh coat of paint on the cabinets and a new dishwasher, the project shouldn’t take long — maybe a week or two. However, if your project involves rearranging the layout of the room, installing new electrical wiring, ripping up the floor and other major steps, be ready to order out (or move out of your house) for a while.What you want to accomplish isn’t the only factor, either. The current labor shortage and supply chain issues — stories of six-month delays for sourcing cabinets are common, for example – are stretching the timeline further.

-

Establish your goals.

For example, is the renovation so you can enjoy the home for the foreseeable future, or are you aiming to increase the value and sell it in hopes of turning a profit? Then, create an outline of everything you want to accomplish, and get quotes from multiple contractors for the cost and timeline. You don’t have to go with the cheapest option; go with the one that is most reputable. Before you go too far down the path to starting the project, make a plan for what you’re going to do during the renovation. Will you be able to live there during the construction, or do your plans call for gutting the home? If you need to relocate for part of the project, it’s important to figure out how to minimize those short-term living costs.

For example, is the renovation so you can enjoy the home for the foreseeable future, or are you aiming to increase the value and sell it in hopes of turning a profit? Then, create an outline of everything you want to accomplish, and get quotes from multiple contractors for the cost and timeline. You don’t have to go with the cheapest option; go with the one that is most reputable. Before you go too far down the path to starting the project, make a plan for what you’re going to do during the renovation. Will you be able to live there during the construction, or do your plans call for gutting the home? If you need to relocate for part of the project, it’s important to figure out how to minimize those short-term living costs.

17 best ways to add value to your home

(Image credit: Creative Tonic Design)

Knowing the best ways to add value to your home has always been important – but never more so than in 2022, as house prices and mortgage rates* continue to rise following the pandemic.

Knowing how to make your house stand out to potential buyers can often feel overwhelming – especially in such an ever-changing, competitive market – but the process doesn't need to be complex. If you steer away from the home improvements that won't add value – and focus on the renovation ideas that will sell your home (for the right price) fast.

The home improvements that can add value – according to experts

Designing your dream home doesn’t come cheap, and when it comes to renovating a house, it's imperative to ensure you’re spending your money wisely.

Our advice, before you begin any major project, is to speak with a trusted local real estate agent for advice about which home improvements they think will make the most difference where you live. However, while each property differs, some are usually always worth the investment. Here are the top renovation and decorating ideas to try this year.

1. Boost curb appeal

(Image credit: Dulux)

The best place to begin when creating a powerful first impression is on the outside. Whether you're experimenting with new front door color ideas or you hire a professional landscaper to accentuate your front yard, you only have one chance to set the tone your home deserves.

Whether you're experimenting with new front door color ideas or you hire a professional landscaper to accentuate your front yard, you only have one chance to set the tone your home deserves.

'Hiring a landscaper is time and money well spent,' says Chase Michels of The Michels Group by Compass. 'A review of research by Alex X. Niemiera, a horticulturist at Virginia Tech, found that a well-landscaped home had a 5.5-12.7% price advantage over a home with no landscaping. That translates into an extra $16,500 to $38,100 in value on a $300,000 home,' Chase says.

'Niemera states that the number-one thing that buyers are looking for in landscaping is a sophisticated design. Close behind are plant size and maturity.'

2. Adding stone veneer

(Image credit: GettyImages)

According to Chase, adding stone veneer is one of the most impactful ways to generate a profit from a renovation.

'Adding manufactured stone veneer is the number one project for recouping your investment. The 2020 national average stone veneer job costs $9,357 and the average resale value added was $8,943 for a cost recoup of 95.6%.' So, if you're looking for traditional garden ideas with economical benefits, this renovation is the solution.

The 2020 national average stone veneer job costs $9,357 and the average resale value added was $8,943 for a cost recoup of 95.6%.' So, if you're looking for traditional garden ideas with economical benefits, this renovation is the solution.

3. Replacing your garage door

(Image credit: Antoine Bootz)

Designing and organizing a garage may not seem impactful in the overall scheme of your home. However, Chase explains, it is one of the best investments you can make to generate a return. 'The 2020 average job cost was $3,695 and added $3,491 in resale value for a 94.5% cost recoup,' the realtor shares. However, he recommends doing it sooner rather than later, so you can enjoy its benefits for a longer time.

'Go ahead and make the updates while you live in the home instead of making them right before you resell it,' he says.

4. Painting and giving your interiors a decor refresh

(Image credit: Annie Sloan)

The old adage holds true: flirting with new paint ideas does wonders. The same can be said for wallpaper, new carpeting or drapes or just simply a general decor refresh. However, painting is one of the cheapest and impactful ways to add value to your home.

The same can be said for wallpaper, new carpeting or drapes or just simply a general decor refresh. However, painting is one of the cheapest and impactful ways to add value to your home.

'On average, a gallon of paint costs around $25, leaving you plenty of money to buy rollers, tape, drop cloths, and brushes. Studies show that painting the interior of a home has an average return of 100-120% on the investment,' Chase says. 'A crisp, clean property appeals to the buyer and makes a huge difference.'

And even if you're not selling, there's no harm in redecorating now and again to ensure your home looks its best. So you can continue to enjoy living there too.

5. Paint your exteriors

(Image credit: Jody Stewart)

Don't use all your color ideas up on your interiors. While it is important to colorize the inside of your home, the exterior is just as impactful.

'Painting the exterior is also a cost-effective upgrade for a home. According to Consumer Reports, an exterior paint job can potentially increase the value of your home from 2-5%,' Chase says. 'Selecting the right exterior paint will give your home a clean look and the widest range of buyers and help improve its value.'

'Selecting the right exterior paint will give your home a clean look and the widest range of buyers and help improve its value.'

6. Adding a conservatory or sunroom

(Image credit: James Balston)

Research shows that adding a new conservatory or sunroom is one of the most cost-effective ways to add value to your home.

The average cost is around $12,000, but adding one will bring an estimated 6% uplift to the value of your property. On a house price of $320,000, that’s a boost of $19,000, adding $8,000 to your property’s price once the cost of the project is accounted for.

7. Replacing a dated kitchen

(Image credit: DeVOL)

Updating your kitchen ideas is nearly always money well spent. At upwards of $12,000, it’s an expensive home improvement but one that can boost your property's value by 5.5%, which equates to $17,400 on the average property.

Once the cost of the work is covered, a new kitchen will still add $6,700 in additional value to your home. Failing that, replacing a tired old kitchen worktop is an easy win when considering ways to improve your home.

Failing that, replacing a tired old kitchen worktop is an easy win when considering ways to improve your home.

Heather from MyJobQuote agrees. 'Not only will this improve the overall aesthetic of your kitchen, but it can also be completed with minimal disruption.'

8. Manicuring your front yard

(Image credit: Proven Winners)

If you have ever walked past a home and 'stopped to smell the roses', you'll recognize the importance of a beautifully manicured front garden. But what can you do to make sure your front yard landscaping ideas set the right tone for the rest of your home?

A report found that 67% of people are more inclined to view a house if the garden is up to scratch, as it means less work and better views. Surveying 3,400 people, OnBuy’s Garden Furniture sector presented images of 20 similar-looking houses with different plants in the front garden and asked respondents to rank the houses from most to least desirable.

Hydrangeas rank first, with 78% choosing them as most desirable. The bold flowers are perfect as the ever-changing blooms bring a new sense of character to the front garden. Although their gorgeous appearance can seem high maintenance, with the correct care, they are fairly easy to grow.

The bold flowers are perfect as the ever-changing blooms bring a new sense of character to the front garden. Although their gorgeous appearance can seem high maintenance, with the correct care, they are fairly easy to grow.

In second place are lilies; these minimal effort flowers caught the eye of 71% of potential buyers, who think it makes a home’s exterior more attractive. The flowers return year after year and require minimal care, so they’re definitely worth planting.

Lavender is the third most desired choice, with the fragrant flowering plant attracting 64% of respondents’ attention. The Mediterranean evergreen shrub repels bugs due to its fragrance, and it’s easy to grow, as long as it is kept away from moist, wet areas.

The secret to having a garden that appeals to more of your senses is to choose scented flowers that bloom at different times of the year and give perfume at different times of the day. For example, lavender planted on either side of a path is popular for good reason as you brush the blooms as you pass, and so release the scent.

9. Updating a boiler / central heating

(Image credit: The Radiator Company)

A new boiler or central heating system ($2,883) is an important factor to consider, especially if you live in the Northern Hemisphere.

And, if you are planning to sell your home, a dated or inefficient boiler can put potential buyers off. It's important to tend to these basics before you put any love into your decor.

10. Fixing a damaged roof

(Image credit: Matthew Millman)

A new roof ($2,200) is essential for insulation and structural reasons. So, while it may seem like a costly investment now, it is better to ensure your home is safe and leak-free before inviting surveyors, estate agents, and potential buyers to your home.

11. Adding a new bathroom

(Image credit: Studio Thomas James/Costa Christ)

Playing with new bathroom ideas (around $1,762) is also one of the best tasks to undertake regarding the value-added once the cost of the work is accounted for. It is often said that potential buyers' look at the kitchen and bathroom first before pursuing a property.

It is often said that potential buyers' look at the kitchen and bathroom first before pursuing a property.

12. Adding double glazing

(Image credit: Paper & Paint Library )

Double glazing doesn’t add much immediate value and it is costly, however, it will cover its own cost and will bring a long-term benefit where energy efficiency is concerned – and it will save buyers from having to take on the task.

13. Accentuating a sunny spot in the garden

(Image credit: Maximon)

A recent survey conducted by Rightmove in the UK showed that homes with highly-coveted south-facing gardens could be worth up to $30,000 more than those without. The data looked at just under 400,000 three and four bedroom homes and found that a south-facing garden was one of the prime factors for adding value to a home.

Of course, there's not much you can do to change the orientation of your garden, but if you are planning to sell and don't already have one, it's time to create a defined seating area in a sunny spot in your garden so that potential buyers can picture themselves enjoying the weather.

'Without a doubt, we’ve seen huge demand for homes with a south-facing garden,' says David Phillip, partner of David Phillip Real Estate Agents in Yorkshire. 'You’d be amazed at how many people turn up to a viewing and use the compass on their phone to work out where the sun is coming from; it’s a really important requirement.'

14. Playing with a Scandinavian-style decor scheme

(Image credit: James Merrell / Future)

Scandinavian decor has been influencing the way we design our homes for decades, but did you know that it can also add value to your home once it comes time to sell up and move on?

Following analysis by Bankrate of the most popular décor designs and hundreds of house prices on online real estate platform Zoopla to determine which interior design style adds the most value to your home, Scandinavian-style was declared the most popular.

15. Decluttering and depersonalizing to add value

(Image credit: Jessica Nelson Design/Carina Skrobecki)

Buyers need to see the space they are getting to see how good value it is. They want to see the condition of the walls and floor, which is difficult when most of it is covered with other people’s belongings. When following the right decluttering tips, you are also allowing the buyer to see the space and imagine themselves living in it – you are selling a lifestyle and a dream.

They want to see the condition of the walls and floor, which is difficult when most of it is covered with other people’s belongings. When following the right decluttering tips, you are also allowing the buyer to see the space and imagine themselves living in it – you are selling a lifestyle and a dream.

Nobody has the exact same taste in décor, and future buyers must be able to visualize themselves living in your space, so consider removing any decoration that shows too much personality. Just because something adds character to the property to make it your home, this doesn’t necessarily mean any value is being added to the property’s saleability.

16. Wash the windows

(Image credit: James Merrell)

Getting down to basics now... Prospective buyers will pay more attention to windows, and they will immediately give a sense of how well maintained the rest of the house is. If you have easy access give them a thorough wash and if your house has wooden windows, then consider giving them a fresh lick of paint to stop them looking old and cracked.

17. Making your home improvements 'smart'

(Image credit: Brent Darby)

Energy-saving and environmentally-friendly enhancements may be good for the planet – but they are also good for your home and your pocket. So what are the top eco-friendly, 'smart' home improvements that you could be making?

With ‘home improvement’ searches up 380% according to Google Trends, it seems we’re focused on updating and fixing-up our homes during lockdown. Interestingly, according to a recent report by Rated People , nearly a third of homeowners (31%) are looking to specifically take on eco-related work at home this year – showing that energy efficiency and green issues are of high importance to homeowners.

The report, which surveyed over 1,000 homeowners, also reveals the top 10 eco focuses that homeowners are tackling – with the number one improvement simply being to install smart lighting, energy efficient LED bulbs that can be automated and controlled via an app. Nearly a third (31%) are making this style of lighting their priority with their home improvements, with upgrading to eco-friendly appliances and double-glazing next on the list, followed by home chargers for electric cars and upgrading insulation.

*According to a Housing Market Prediction by Forbes.

Jennifer is the Digital Editor at Homes & Gardens. Having worked in the interiors industry for a number of years, spanning many publications, she now hones her digital prowess on the 'best interiors website' in the world. Multi-skilled, Jennifer has worked in PR and marketing, and the occasional dabble in the social media, commercial and e-commerce space. Over the years, she has written about every area of the home, from compiling design houses from some of the best interior designers in the world to sourcing celebrity homes, reviewing appliances and even the odd news story or two.

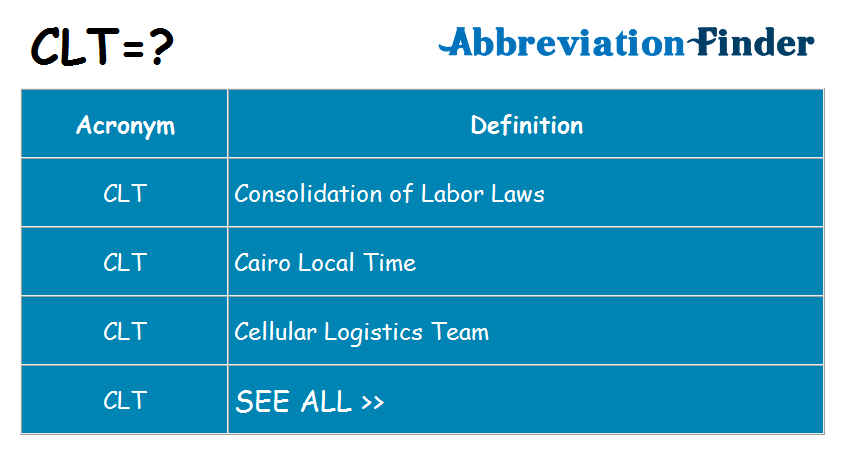

Home Appraisal 🏠 in Russia, Home Appraisal Calculator Online Free

- Home

- Appraisal

- House

Accurate home valuation in Russia online using the calculator for free to find out the market value of the house at the address for subsequent sale. Just estimate how much the house costs and whether it is profitable to buy it at the moment. A quick online home appraisal in Russia has become the ideal way to calculate the appraised value of a home. The evaluation methodology was created using the ad base, part of the directories, and more matrices that make evaluation adjustments. Valuing a home in this way is an extension of the benchmarking method that brings visible benefits. Almost always, the error in online valuation is no more than 3%, which is perfectly acceptable even if the valuation is carried out by an appraisal company. API 9 requirements0011

City

It is advisable to choose a city from the list, if it is not available, you can indicate your settlement: village, town, farm, etc.

Street

The street should be indicated without abbreviations, dots and commas, the words street, st. do not need to be specified, for example: Azovskaya, Prospekt Mira, Garage passage.

do not need to be specified, for example: Azovskaya, Prospekt Mira, Garage passage.

House

House should be indicated without abbreviations, dots and commas, the words house, d. do not need to be indicated, for example: 12, 1a, 2/10, 5 building 1, 10 building 2.

Type of house

DOCTURPICIAL-MONOLITENOMONOLITNOLITAMNOLITALLITELOT-DRIVEN

Building

The number of floors

The area of the object

The area of the object should be indicated by separating points or commas, for example: 100.2 or 100.2/80/20/20.

Water supply

AnyIndividualCentralAutonomousWellWell

Number of rooms

AnyStudio123456

Condition

Any is full of black decoration Belovaya, the repairs are repaired on Western standards. Repair is full of repair on the author’s project. Reconstruction will be, overhaul, cosmetic repair

Repair is full of repair on the author’s project. Reconstruction will be, overhaul, cosmetic repair

- Enforcement

is useful for real estate

- Real estate without intermediaries

- New buildings

- Real estate rating

- Ads on the map

- Price Real estate prices

- Mortgage Calculator

- Determine the

- sale and sale agreement

- List of houses 9000 real estate and the List why is she needed

What is a real estate appraisal?

Real estate appraisal is a thorough analysis and study of an object in order to determine its market value. nine0011

Why do an expert appraisal of an apartment with a mortgage?

Mortgage can be concluded for a long term - up to 30 years.

During this time, the solvency of the borrower can change dramatically. Therefore, the guarantor of debt repayment is a pledge of real estate or rights of claim under an agreement on participation in shared construction (when housing construction is not completed). In case of default, the bank may sell real estate at public auction in order to avoid financial losses. nine0011

During this time, the solvency of the borrower can change dramatically. Therefore, the guarantor of debt repayment is a pledge of real estate or rights of claim under an agreement on participation in shared construction (when housing construction is not completed). In case of default, the bank may sell real estate at public auction in order to avoid financial losses. nine0011 In order for a bank to issue a mortgage loan, it is necessary to provide a package of documents, and one of the most important is a real estate appraisal report, which indicates its market and liquidation price. The bank needs this document to establish the liquid value of the property, which will act as a guarantor of debt repayment if the borrower becomes insolvent. This reduces his risks, since the bank has the opportunity to return the funds even with an unfavorable outcome. nine0011

Is it necessary to conduct a mortgage appraisal?

Yes, because in accordance with the Federal Law of July 16, 1998 N 102-FZ "On Mortgage (Pledge of Real Estate)", when buying an apartment using credit funds, the market value of real estate must be indicated in the mortgage, and if a mortgage agreement is drawn up, then real estate appraisal specified in the mortgage agreement (Articles 9, 14).

It must also be carried out for an insurance company, since mortgage lending requires the conclusion of a property insurance contract (Article 31). nine0011

When else do you need a property appraisal?

In many cases, an assessment is not required, but getting an independent review will allow you to quickly resolve the following issues:

challenging the cadastral value of an object

emergence of disputes with tax authorities

the need to assess the damage caused to real estate, for example, in the event of robbery, fire or flooding nine0011

property disputes that have arisen, for example, in the event of a divorce or buyout of a business share from a partner

Who conducts real estate appraisals?

The appraisal can be carried out by an independent appraiser or by the bank itself.

Independent experts must be involved if a mortgage was issued during a mortgage transaction. The activities of appraisers are regulated by the Federal Law of 2907.1998 N 135-FZ "On appraisal activities in the Russian Federation", therefore its procedure is strictly regulated. For example, the law imposes special requirements on the rules for reporting, and also obliges the appraiser to insure his civil liability. In addition, he must have a diploma in the relevant specialty and be a member of a self-regulatory organization of appraisers (SRO).

The bank itself can assess the value of the property if no mortgage was issued in the mortgage transaction. However, in case of disputes about the value of real estate, it will be necessary to resort to an independent examination. nine0011

What are the types of value?

These 4 types are most commonly used:

Market.

The average price in the market, which is determined based on comparison with objects similar in area, location and layout. It allows you to understand the fair price of real estate.

The average price in the market, which is determined based on comparison with objects similar in area, location and layout. It allows you to understand the fair price of real estate. liquidation. A price that is usually below market value. It is established when the seller needs to quickly sell the property. As a rule, this cost is a benchmark for banks, since if the borrower ceases to fulfill its loan obligations, they will be able to quickly sell housing. nine0011

Investment. The value of real estate when using the object for investment purposes.

Cadastral. The cost established as a result of the state cadastral valuation.

This list of value types is not exhaustive. The appraiser has the right to use other types of value.

What factors affect market prices? nine0101

We list a few of the main ones:

house location

building age

number of storeys

availability and quality of repair

availability of balconies

ceiling height

total footage of the object

area infrastructure level nine0011

home improvement

quality of materials used in construction

What are the methods of real estate appraisal?

There are three main approaches used when conducting an assessment within the framework of the Federal Valuation Standard, approved by Order of the Ministry of Economic Development of Russia dated May 20, 2015 No.

297:

297: income approach. The appraiser predicts the future income that the object is capable of bringing, as well as the costs associated with it. Most often, it is used to evaluate commercial or residential real estate that is planned to be rented out. nine0011

Cost approach. It is based on the calculation of the costs required for the acquisition or reproduction of the appraisal object, taking into account the depreciation and obsolescence of the property. It is mainly used to evaluate facilities under construction.

Comparative approach. This is the most common method, which is most often used for residential real estate. For example, an apartment is compared with similar objects in terms of the number of rooms, footage, area, etc., and based on this, an assessment is formed. This approach is the least time-consuming, although no less complicated, since it is worth considering a huge number of factors, because even absolutely identical apartments in the same building, but on different floors will differ in price.

nine0011

nine0011 How to choose an appraiser?

Typically, a bank offers a whole list of appraisal companies, from which you can choose any, depending on the timing and prices. But you can also find it on your own, the main thing is to check whether the company has accreditation with a bank. Pay attention to how long the company has been on the market, study reviews about it.

What documents are required for a home appraisal? nine0101

The list of required documents is slightly different for new buildings and secondary housing.

To assess housing under construction:

the passport

act of acceptance

agreement on participation in shared construction (agreement of assignment of rights under an agreement on participation in shared construction)

For resale property appraisal: nine0011

the passport

documents confirming the right of ownership (extract from the USRN, certificate of state registration of real estate)

documents-grounds for the emergence of ownership (for example, a contract of sale)

technical documents (for example, technical passport, floor plan with explication)

What else may be needed to draw up a report should be clarified directly with the appraisal company.

nine0011

nine0011 Do I need a reassessment when refinancing a mortgage?

Yes, a reassessment is required. The refinancing rate will depend on it, because anything could happen to housing during the time of payments on the initial loan. At the same time, this procedure is mandatory, even if the refinancing agreement is concluded in the same bank where the mortgage loan was issued.

Can the parties to the transaction influence the result of the assessment conducted by an independent appraiser? nine0101

No, neither the bank nor the borrower can affect the result of the appraisal, since it is carried out by a company that does not have any benefit from the increased or reduced value of the object in the report. Appraisers value their reputation, so they will not break the law and deliberately change the final price of real estate.

Is it possible to conduct an assessment on my own?

Yes, you can do it yourself.

This will allow you to understand the average prices in the market and roughly evaluate your property. But such an assessment will not be taken into account in court or by the bank in case of disputes. Therefore, in order to protect yourself from this risk, it is better to turn to the services of a professional appraiser. nine0011

This will allow you to understand the average prices in the market and roughly evaluate your property. But such an assessment will not be taken into account in court or by the bank in case of disputes. Therefore, in order to protect yourself from this risk, it is better to turn to the services of a professional appraiser. nine0011 How is real estate appraised?

Real estate appraisal is carried out in several stages:

You agree with the bank on the choice of an accredited appraiser.

You enter into an agreement with the appraisal company where the appraiser works.

The appraiser goes to the object to inspect it. Some appraisers may request a photo, but it is better to insist on a personal visit, as this is the responsibility of the appraiser. nine0011

The appraiser prepares an appraisal report and provides it to the customer.