Adding equity to your home

6 Ways to Increase the Value of Your Home

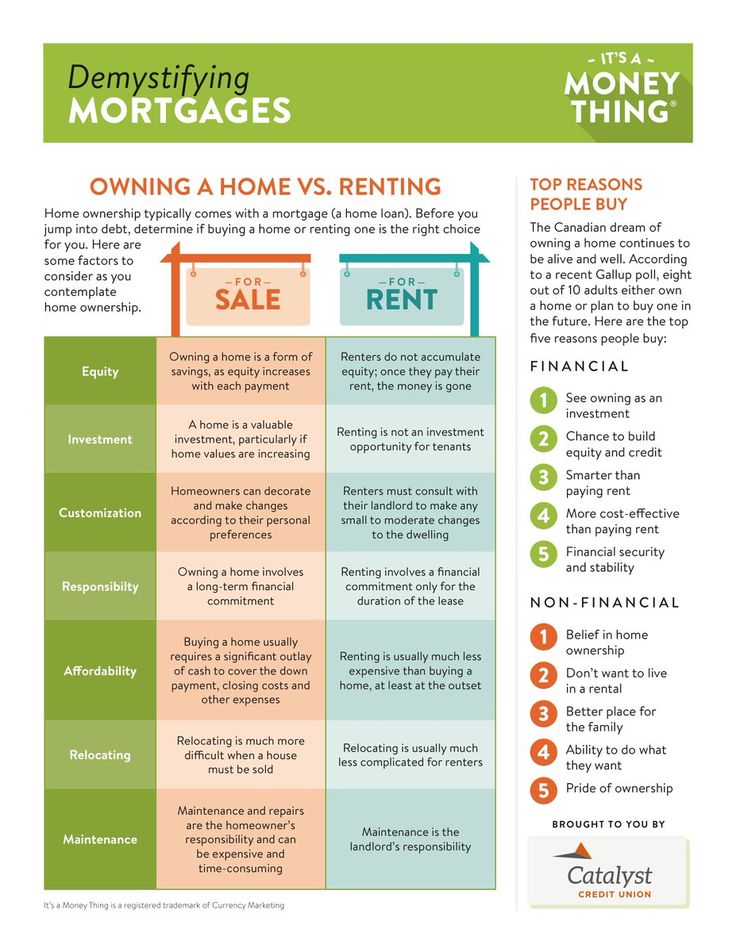

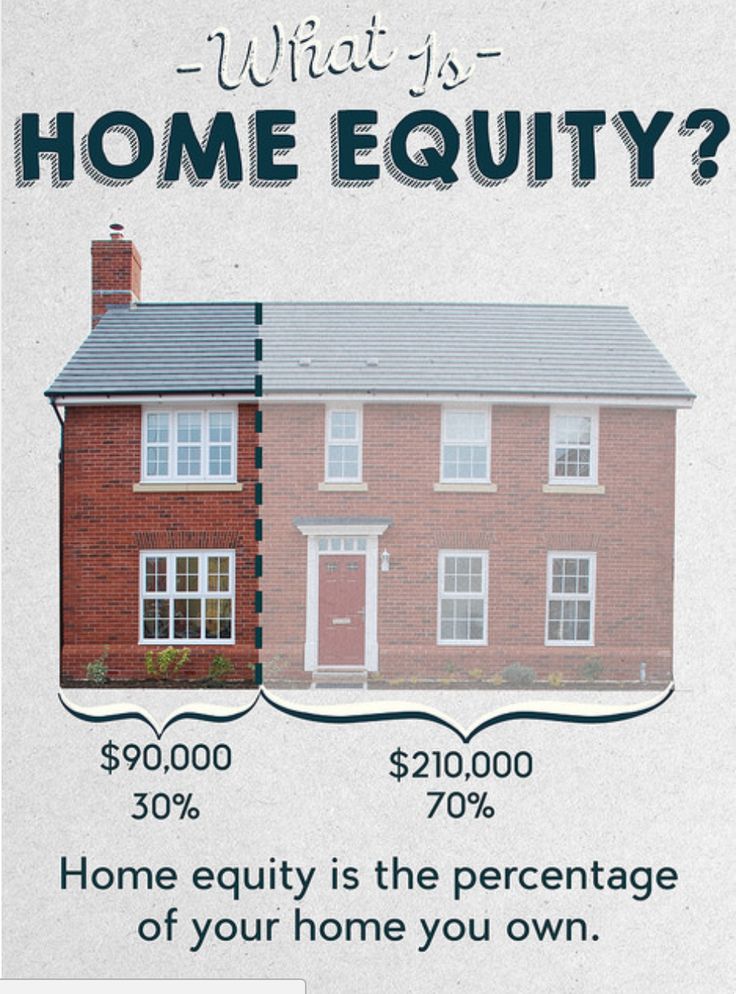

Owning a home isn’t only an emotional experience. It’s also a financial decision that can pay dividends as you build up equity in your home and see your property value increase over time.

The rate of this property value increase can depend on a number of different factors, including the community where your home is located, local demand for housing, and the economy as a whole. But homeowners can also affect their home’s value over time by making upgrades and changes that increase its appeal and merit a higher selling price.

Whether you’re planning to sell in the near future or you simply want to continue to grow the value of your home investment, there are many steps you can take to increase the value of your home. Here are six proven strategies that can pay dividends when it finally comes time to sell.

1. Update your home’s finishes.

Superficial changes can make a bigger impact on buyers than more intensive renovations. Many real estate agents rave about the difference a fresh coat of paint can make—especially given the low cost of this upgrade.

Some experts argue that a fresh coat of paint throughout your house can increase the home’s sale price by as much as 5 percent. Other simple upgrades, from replacing old light fixtures to changing out your front door, can also give your home a nice bump in value.

2. Upgrade to energy-efficient features and appliances.

Energy-efficient upgrades reduce your utilities bills while you own the home. When it comes time to sell, these upgrades will also offer more appeal to buyers, many of whom are interested in energy-efficient features to lower their own costs as a homeowner.

If your home currently features old appliances that guzzle energy and date your interiors, an upgrade—even if it’s installing modestly priced modern appliances—can help you net a higher sale price.

3. Freshen up your curb appeal.

Simple landscaping features such as new plants and fresh mulch can help your home make a great first impression.

These changes don’t cost much, and you can do many of them on your own. Both potential buyers and appraisers will be influenced by this visual impact.

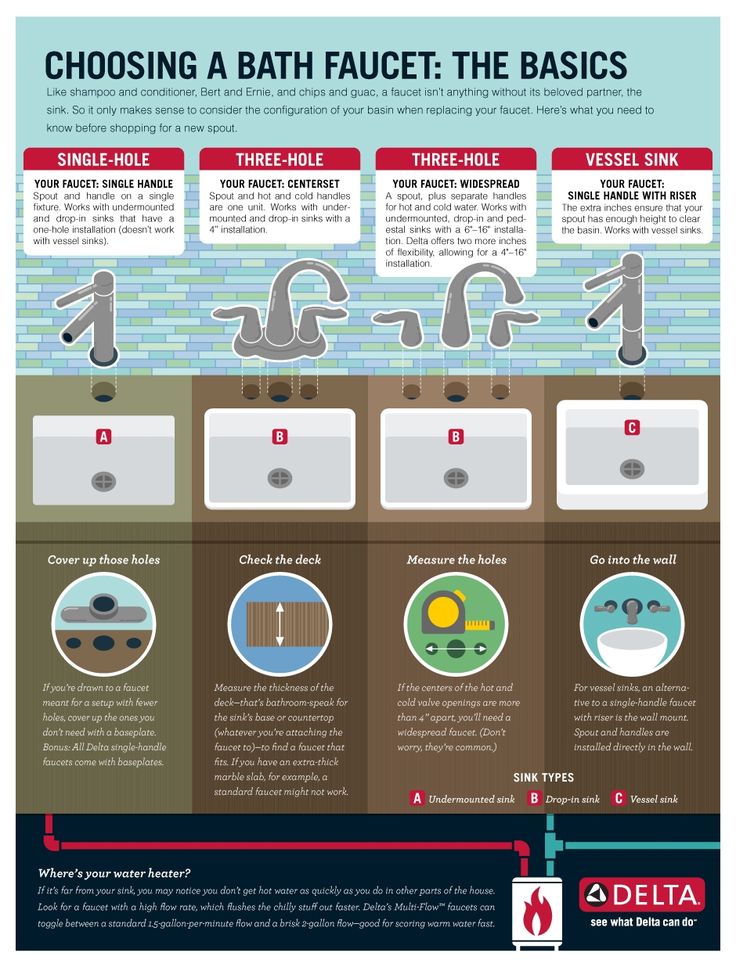

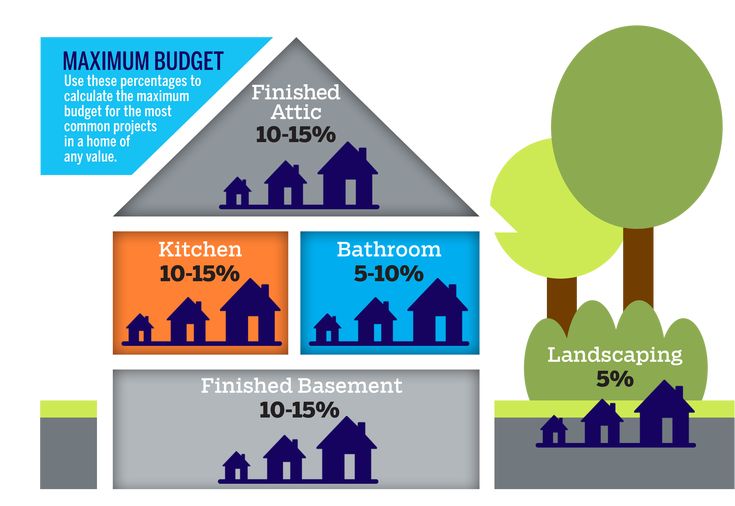

4. Put your money into your kitchen and bathroom.

Many real estate agents will tell you that kitchens and bathrooms are the rooms that sell homes.

In many cases, a kitchen or bathroom remodel can offer a 100 percent or greater return on your investment—and that number could be even higher depending on the finishes you choose, the amount of labor you’re willing to do yourself, and how much of an upgrade these changes offer over your home’s current condition.

If you have a renovation budget, kitchen and bathroom upgrades are the best way to increase the value of your home.

5. Finish off your basement or other unfinished spaces.

Finished square footage is an important calculation when determining your home’s fair market value.

Even if you don’t want to invest in a heavy-duty makeover, simple steps like putting up drywall and adding carpet to a room can turn unfinished space into a profitable addition to your home. This allows you to increase the value of your home by expanding the footprint of this finished space.

This allows you to increase the value of your home by expanding the footprint of this finished space.

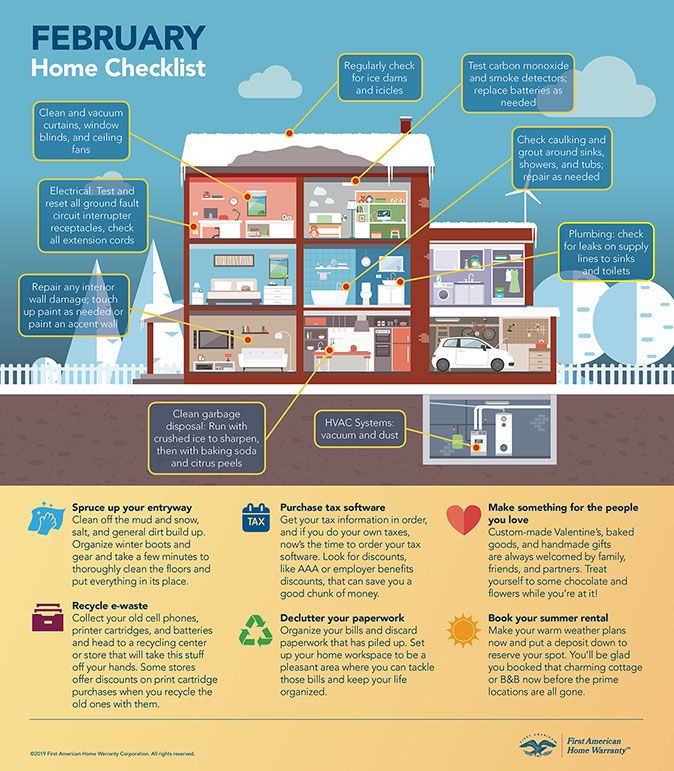

6. Clean and declutter before showing your home.

When you’re selling or getting an appraisal on your home, a little deep cleaning can go a long way. Take this opportunity to dust in high places, wash your baseboards, give floors a good mop, and haul excess junk and clutter to a donation center.

Bonus tip: Use a fresh coat of paint to revive worn spots.

Is your home looking a little worn, inside or out? A DIY paint job carries a low cost for materials, but it can have a big impact on the eye appeal of your home.

Whether you’re painting your living room, bedrooms, or even just the front door of your home, a bright coat of paint can make old surfaces look brand-new—and add some instant charm to your home.

Selling a home can be a great way to pocket some profit after taking good care of that property as your equity grows. With some simple, budget-friendly tricks to beautify and update your home, you can push that potential sales price—and your earnings potential—to its upper limit.

Discover more financial strategies for leveraging your home’s value—download The Smart Homeowner’s Guide to Refinancing today.

*Originally published June 2020. Updated March 2022.

8 Ways To Increase Your Home's Value

Whether your goal is to renovate your home this year or sell it, making home improvements can increase your home’s value.

LightbulbHome improvement statistics

- Homeowners spent an average of $10,341 on home improvements in 2021, a 25 percent increase from 2020, according to a recent report by Angi.

- Homeowners who completed work did an average of 3.7 projects, with an average cost per project of $2,800, according to the Angi report.

- In 2021, homeowners spent $376.9 billion in total on home improvements, according to a separate study by Angi.

- Increasing the home’s value ranked as the second-most important goal for home improvement spending, behind fixing existing issues, according to another recent report by Angi.

- The top five projects that add the most dollar value to a sale in 2022 are refinishing hardwood floors, installing new wood floors, upgrading insulation, converting a basement to a living area and renovating closets, according to a joint report by the National Association of Realtors (NAR) and the National Association of the Remodeling Industry (NARI).

- Seventy-one percent of homeowners with upcoming renovations plan to forge ahead with the projects despite supply chain and inflation challenges, according to a January 2022 survey from Nationwide.

8 ways to increase the value of your home

1. Clean and declutter

To help boost the value of your home, begin by decreasing the amount of stuff that’s inside it. Cleaning and decluttering are relatively inexpensive tasks, even in bigger homes. Professionally cleaning a four-bedroom home costs between $200 and $225, according to HomeAdvisor.

Of course, you could save money by doing the work yourself. Start by going through cabinets and closets and making donation piles. Then clean out drawers and other storage areas, making sure you’re not keeping anything you don’t need or want.

Start by going through cabinets and closets and making donation piles. Then clean out drawers and other storage areas, making sure you’re not keeping anything you don’t need or want.

2. Add usable square footage

Adding more usable space to an existing home can make a lot of financial sense, and that’s especially true in areas with limited available real estate where land and space are finite.

Homes are valued and priced by the livable square feet they contain, and the more livable square feet, the better, says Benjamin Ross, a Realtor and real estate investor based in Corpus Christi, Texas. As a result, adding a bathroom, a great room or another needed space to a home can increase function and add value.

Adding a separate mother-in-law suite can also be a smart idea, says Ross, noting that “most homes do not have this feature, so adding one sets you apart from the competition when it is time to sell.”

The national average cost to build an addition is $49,562, according to estimates from HomeAdvisor. The actual cost will vary depending on the type of room you’re looking to add. For example, tacking on a laundry room to your home might be as little as around $8,000, while adding a new bedroom with an en suite bathroom might run up to $100,000.

The actual cost will vary depending on the type of room you’re looking to add. For example, tacking on a laundry room to your home might be as little as around $8,000, while adding a new bedroom with an en suite bathroom might run up to $100,000.

3. Make your home more energy-efficient

Projects that lower utility bills is a smart way to increase the value of your home. Installing a smart thermostat, for example, helps improve efficiency and save money, says Scott Ewald of Trane, an HVAC company.

“The right smart thermostat will allow a homeowner to control their home’s climate from anywhere, giving them the power to manage energy costs regardless of whether they are sitting on the couch or away on vacation,” says Ewald. “Such investments in home tech — particularly when connected to the HVAC, which is the largest mechanical system in the home — provides a strong selling point and highlights the home’s overall comfort, functionality, energy efficiency and convenience. ”

”

It can cost between $200 to $500 to make this quick upgrade, according to Fixr, or an average of about $300.

Other ways to improve your home’s efficiency and value include replacing old, leaky windows, installing energy-efficient home appliances and adding insulation to your home. Keep in mind, though, that new windows and new appliances will be a much more expensive project.

4. Spruce it up with fresh paint

One of the most popular home improvement projects in 2022 is painting or wallpapering, according to Angi. A fresh coat of paint can make even dated exteriors and interiors look fresh and new — and it’s not that expensive, either.

Begin by repainting any rooms with an “odd” color scheme, says Timothy Wiedman, a former professor and personal finance expert who has flipped homes over his career. For example, did you let your then-11-year-old daughter paint her bedroom hot pink 16 years ago? If so, that’s a good place to start.

Your painting budget will depend on which rooms you’re hoping to give a new splash of color. For example, HomeAdvisor pegs painting a bathroom — usually the smallest room in the house — somewhere between $150 and $350, while a 330-square-foot living room might cost as much as $2,000.

For example, HomeAdvisor pegs painting a bathroom — usually the smallest room in the house — somewhere between $150 and $350, while a 330-square-foot living room might cost as much as $2,000.

5. Work on your curb appeal

From power washing your driveway to hiring someone to wash your windows and mow the lawn, improving curb appeal can make a big difference in your home’s value. In fact, curb appeal can account for as much as 7 percent of it, according to a 2020 joint study out of the University of Texas at Arlington and the University of Alabama.

Upgrading your landscape can go a long way, says Joe Raboine, director of Residential Hardscapes with Belgard.

Some ideas: a fresh walkway, shrubs, planters, mulching or even a new paver patio or outdoor kitchen.

6. Upgrade your exterior doors

Also in the vein of curb appeal, replacing an old front door can work wonders, says Wiedman. In the late ’90s, he and his wife replaced an old, ugly door with a solid mahogany door with a frosted, oval piece of lead glass. He stained the door himself to save money, and the result was “simply stunning.”

He stained the door himself to save money, and the result was “simply stunning.”

Don’t forget the garage doors, too, says Randy Oliver, president of Hollywood-Crawford Door Company. At a 93 percent return-on-investment, you’ll get back nearly every cent you spend, according to Remodeling magazine’s 2022 Cost vs. Value Report.

“The front of the home is the first thing you, your neighbors and prospective buyers will see,” says Oliver. “Garage doors often take up the most amount of space on the front of your home, so installing a modern glass panel door or a rustic wood door will dramatically improve your home’s appearance.”

7. Give your kitchen an updated look

Many buyers zero in on the kitchen as the central feature of a home, so if yours is outdated, it can ultimately affect how much you garner from a sale. Likewise, if you aren’t able to utilize your kitchen fully due to layout, space or other concerns, you won’t be maximizing the space.

This project, though, will require a lot of money, and you likely won’t get every dollar you invest back. According to the NAR/NARI report, the average kitchen remodel costs around $80,000, and a homeowner would likely get around $60,000 of value when it’s time to sell.

According to the NAR/NARI report, the average kitchen remodel costs around $80,000, and a homeowner would likely get around $60,000 of value when it’s time to sell.

If updating your entire kitchen is too big of an undertaking, a minor remodel could still have an impact on your home’s value — think coordinating appliances and installing modern hardware on your cabinets. Talk with a real estate agent about what makes the most sense and what will command the most dollars from prospective buyers.

8. Stage your home

If you’re planning to list your home for sale, consider skipping cosmetic home improvements and go with a home staging service instead. Seventy-three percent of staged homes sold for over list price — an average of $40,000 higher — and staged homes move off the market nine days faster than the average, according to the Real Estate Staging Association.

Staging costs just over $1,600 on average, according to HomeAdvisor, but the cost varies based on your needs and home. Staging services range widely, from decluttering and depersonalization (for example, removing family photos or specific decor) to bringing in rented furnishings, repainting and more. Simply put, the more work involved to stage it, the more expensive the production will be. A real estate agent can help you determine which staging services would make an impact on your home’s value.

Staging services range widely, from decluttering and depersonalization (for example, removing family photos or specific decor) to bringing in rented furnishings, repainting and more. Simply put, the more work involved to stage it, the more expensive the production will be. A real estate agent can help you determine which staging services would make an impact on your home’s value.

How to pay for home improvements to increase value

Whether you plan to sell your home or just want to enjoy it more while you live there, it’s important to consider how you’ll pay for these value-adding projects. You can work to save the cash to pay for home improvements as you go, but there are also plenty of financing options that can help you remodel your home sooner rather than later.

Personal loan

Personal loans allow you to borrow a fixed amount of money with a fixed interest rate. These loans are unsecured, meaning you don’t have to put your home or other property up as collateral to get approved. Many personal loan lenders let you borrow as much as $35,000 for home improvements — sometimes more — which you can then repay over time. The rates for a personal loan can vary widely, so be sure to compare options to get the lowest-cost loan for your project.

Many personal loan lenders let you borrow as much as $35,000 for home improvements — sometimes more — which you can then repay over time. The rates for a personal loan can vary widely, so be sure to compare options to get the lowest-cost loan for your project.

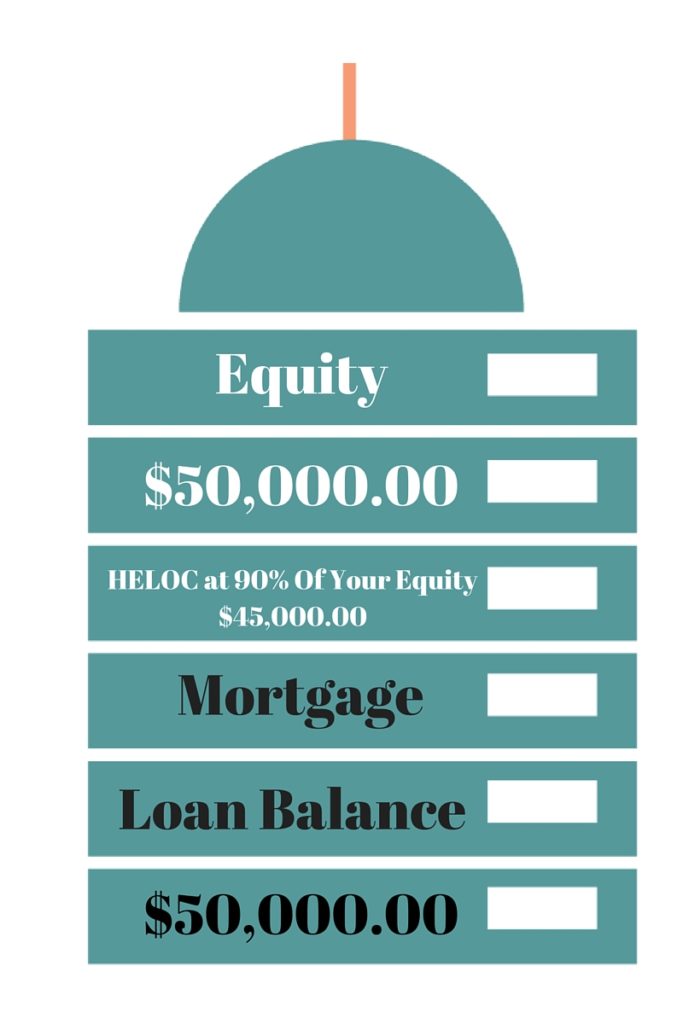

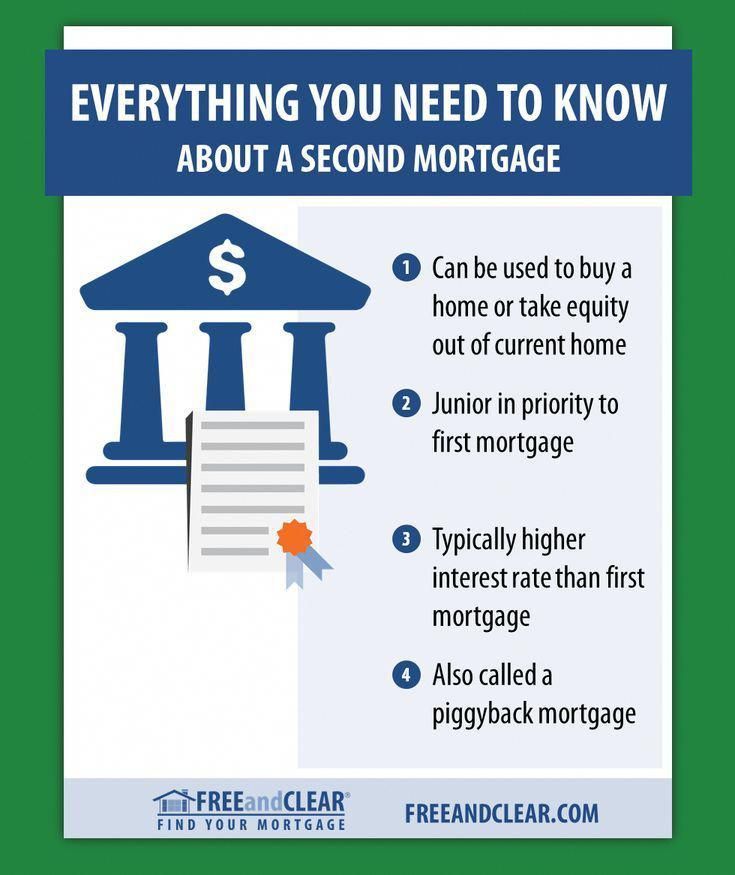

Home equity loan or HELOC

Home equity loans are similar to personal loans in that you receive a lump sum of cash with a fixed interest rate and fixed monthly payment. Home equity lines of credit, also known as HELOCs, work like credit cards, and come with variable rates and a line of credit you can borrow against.

These borrowing options require you to put your home up as collateral to qualify. The good news is, you could score a lower interest rate with one of these types of loans compared to a personal loan or home improvement loan. In addition, no matter which option you go with, the interest might be deductible if you use the money to make eligible home improvements.

0% APR credit card

If you need to borrow a small amount of cash for your home improvement plans, you might be able to skip the loan and go with a 0% APR credit card instead. Many cards have no interest payments on balances for up to 18 months, which can be ideal if you have a smaller-scale project in mind. A credit card can also work well if you’re able to pay your contractor with it.

Many cards have no interest payments on balances for up to 18 months, which can be ideal if you have a smaller-scale project in mind. A credit card can also work well if you’re able to pay your contractor with it.

Just remember: If you don’t pay your balance off by the time your zero-percent APR offer ends, your card’s interest rate will reset to a much higher variable rate, costing you more.

Cash-out refinance

If you have built equity in your home and you’re looking to do a major renovation, a cash-out refinance could provide you with the funds you need while getting you a lower rate on your current mortgage. The refinancing process is just as paperwork-heavy as taking out a mortgage, however, and there are closing costs to consider. If you go this route, take the time to shop around for the best refinance rates so you maximize your savings.

Improvements to increase value FAQ

-

Different renovations can have varying degrees of impact on your home’s value.

Replacing your garage door, for example, might add more than $3,700 to resale value, while replacing windows can add more than $13,000.Rather than think about how much a renovation will increase your home’s value, it’s important to determine how much that renovation will cost to get a sense of what you will be able to recoup. The best projects are the renovations that retain most of their value in the eyes of a new buyer.

Replacing your garage door, for example, might add more than $3,700 to resale value, while replacing windows can add more than $13,000.Rather than think about how much a renovation will increase your home’s value, it’s important to determine how much that renovation will cost to get a sense of what you will be able to recoup. The best projects are the renovations that retain most of their value in the eyes of a new buyer. -

There are financing options that allow you to buy a home and pay for renovation expenses at the same time.For example, the Fannie Mae HomeStyle loan bundles the money you need to buy a new property and the money you need for renovations into one loan. The maximum you can borrow is 75 percent of the as-completed value of the home after the renovation. FHA 203(k) loans are also designed to cover renovations when buying a home, although there are some additional limitations with this route: A 203(k) loan can’t cover luxury add-ons like a swimming pool or outdoor fireplace.

-

You can make some major upgrades to your home with a $100,000 budget. For example, you might convert your attic into living space (around $40,000, according to HomeAdvisor), add a standard bathroom (around $35,000), a 50-square-foot mudroom ($12,000) and a simple sunroom (somewhere between $8,000 and $11,000).No matter what you decide to do to your home, you can stretch that $100,000 further by focusing on more affordable materials: lower-cost cabinets, cheaper wallpaper and non luxury finishes, for instance.

-

The time to complete a kitchen renovation depends on the size of the kitchen and the scope of the work.For example, if your plans include a new backsplash, a fresh coat of paint on the cabinets and a new dishwasher, the project shouldn’t take long — maybe a week or two. However, if your project involves rearranging the layout of the room, installing new electrical wiring, ripping up the floor and other major steps, be ready to order out (or move out of your house) for a while.

What you want to accomplish isn’t the only factor, either. The current labor shortage and supply chain issues — stories of six-month delays for sourcing cabinets are common, for example – are stretching the timeline further.

What you want to accomplish isn’t the only factor, either. The current labor shortage and supply chain issues — stories of six-month delays for sourcing cabinets are common, for example – are stretching the timeline further. -

Establish your goals. For example, is the renovation so you can enjoy the home for the foreseeable future, or are you aiming to increase the value and sell it in hopes of turning a profit? Then, create an outline of everything you want to accomplish, and get quotes from multiple contractors for the cost and timeline. You don’t have to go with the cheapest option; go with the one that is most reputable. Before you go too far down the path to starting the project, make a plan for what you’re going to do during the renovation. Will you be able to live there during the construction, or do your plans call for gutting the home? If you need to relocate for part of the project, it’s important to figure out how to minimize those short-term living costs.

what are the risks and options

In 2020, the first child was born in our family, and we received a certificate for maternity capital. Now we are thinking about how best to use it. We already own two apartments and have no loans, so we don’t really like the option of buying another apartment. As for other methods, the value of the certificate will decrease in the distant future. And in general, I don’t believe in our state: today they gave it, tomorrow they took it.

My sister is now going to buy an apartment in our city. I thought that I could help her pay off the mortgage with our certificate on the condition that she allocate a share in the apartment to my child. The concept itself suits her - it remains only to understand how to formalize the process correctly, if at all it is permissible from the point of view of the law. nine0003

The plan is this: she takes out a mortgage, but lists me or my husband as a co-borrower. Later, we help her pay off part of the debt with a certificate, and then we formalize the property and transfer our shares under a donation agreement to the child. As a result, there are two owners left: a sister and our child.

As a result, there are two owners left: a sister and our child.

Is it enough to list my husband as a co-borrower? Or should we both be listed in order to then use the mother's capital to repay the loan? I am on maternity leave, so for the bank I am not a candidate for co-borrowers. What is the best way to allocate shares to all participants, including a minor? nine0003

Anastasia Kornilova

lawyer

Author profile

Anastasia, alas, your scheme may not work. Maternity capital funds are not just money that can be spent as you like. The state strictly regulated how mother capital could be used. And investing them in someone else's apartment is quite problematic. I will tell you what the pitfalls are, and you decide whether to use the certificate for this purchase or whether it is better to spend it in another way.

Where can I invest maternity capital

It is possible to spend maternity capital - in 2020 it is 466,617 R, and from January 1, 2021 483,881. 83 R in general - it is possible only for purposes approved by the state.

83 R in general - it is possible only for purposes approved by the state.

Regardless of the child's age, maternity capital funds can be used as follows:

- spend on a down payment on a mortgage to buy or build a home;

- pay off their debt and mortgage interest;

- buy goods for the adaptation of disabled children;

- pay for a paid nursery or kindergarten; nine0026

- receive monthly payments for a child.

You have to wait until your child is three years old if you want to:

- buy a home without a mortgage;

- build or renovate a house without a mortgage;

- pay for a child's education on a commercial basis other than pre-school;

- to invest in mum's funded pension.

/prava/matcapital/

Rights of parents with maternity capital

How to buy an apartment using maternity capital

Since you want to invest your mother's capital in an apartment with a mortgage, you don't have to wait until your child is three years old. Housing can only be purchased in the common ownership of parents and children. You can determine the size of the shares by agreement of the parties.

Housing can only be purchased in the common ownership of parents and children. You can determine the size of the shares by agreement of the parties.

Part 4 10 of the law "On additional measures of state support for families with children"

The law does not limit how shares should be distributed, but all family members must become owners. Please note that notaries and courts recommend allocating shares in the amount of at least the invested maternity capital. As a result, it will turn out that part of the apartment that your sister is going to buy should be registered for you, your husband and child. nine0003

What to do? 06/10/19

How to allocate shares to children in an apartment if you used maternity capital?

One of you, you or your spouse, can become your sister's co-borrower. And when she pays off the mortgage and removes the deposit, it will be possible to allocate shares to the second spouse and child. But not all banks lend to borrowers who are not members of the same family. Therefore, you will have to try to convince bank employees of the solvency of each borrower.

Therefore, you will have to try to convince bank employees of the solvency of each borrower.

In addition, banks usually involve spouses as mortgage co-borrowers. In your case, there may be three co-borrowers in one contract, or even four if your sister is married. Not every bank will issue a loan on such conditions. nine0003

What are the risks in your scheme

The Pension Fund will not transfer money. Maternity capital is intended to improve living conditions. And the pension fund, as a rule, closely monitors transactions in which shares in any housing are bought at the expense of maternity capital. Often, the transfer of money is denied. As a result, certificate holders are forced to go to court to invalidate such a refusal.

Courts, when considering such disputes, as a rule, find out whether housing conditions have improved after the acquisition of a particular share in the apartment. For example, if the family already has housing and the share being purchased is insignificant, the court will support the FIU. nine0003

nine0003

Thus, in Tatarstan, a family bought a 1/3 share in the right of common shared ownership of an apartment. But the pension fund refused to transfer the mother's capital under the deal. The family went to court, and he sided with the foundation. The court substantiated the decision as follows: the obligatory condition of the allocated funds, the improvement of living conditions, was violated. At the time of the transaction, the woman and her minor children were registered and lived in a hostel and were not going to move to housing purchased at the expense of mother capital.

Amazing story 06/10/20

You can use mother capital to buy a share in an apartment from relatives

At the same time, if a family acquires ownership of an entire apartment or increases the share that it previously owned in this housing, the court may consider that housing conditions have actually improved and will oblige the pension fund to transfer money.

For example, in Perm, the court decided that as a result of the purchase of 1/2 of the share in the ownership of the room, the room as a whole became the property of family members. Due to this, the total area of \u200b\u200bliving premises for all family members has increased - which means that living conditions have improved. nine0003

You write that you already own two apartments. There is a risk that the FIU will not consider the purchase of a small share in another apartment as an improvement in living conditions. And if you go to court, you can take the side of the pension fund.

/list/kvartira-na-matkapital/

Spent maternity capital on an apartment. What can go wrong?

In addition, there is a possibility that the PFR will refuse to transfer the payment for the repayment of the principal debt and the payment of interest under the loan agreement, since the co-borrowers are strangers to each other. Thus, the law contains a requirement that housing purchased with the help of state support must be registered as common property for the owner of the certificate, spouse and children. The sister is not on this list. It turns out that you want to add your sister to the closed list of co-owners, and this is against the law. nine0003

The sister is not on this list. It turns out that you want to add your sister to the closed list of co-owners, and this is against the law. nine0003

You will have to pay the loan. Let's say your sister stops paying off her mortgage. Then you will have to pay the entire amount yourself or be jointly and severally liable with your sister for the delay.

For example, when a citizen who took out a mortgage stopped paying contributions, the bank went to court. The debtor's wife was a co-borrower. As a result, the court decided to collect the debt, interest and penalties from the co-borrowers jointly and severally.

Relationships can deteriorate. nine0072 The money issue often affects relationships. Someone could not make a payment on time - the other had to transfer money for both. It is necessary to make repairs in the apartment, install meters, pay utility bills and contributions for overhaul. All this is a lot of reasons for conflict.

There will be difficulties with the sale. If your sister wants to sell the apartment, it will be very difficult to do this, because part of the apartment will belong to a minor child. The deal will have to be coordinated with guardianship, and these are additional difficulties. Perhaps now she simply does not think about it, but when a problem arises, she will most likely begin to blame you for the situation. nine0003

If your sister wants to sell the apartment, it will be very difficult to do this, because part of the apartment will belong to a minor child. The deal will have to be coordinated with guardianship, and these are additional difficulties. Perhaps now she simply does not think about it, but when a problem arises, she will most likely begin to blame you for the situation. nine0003

/guide/rebenok-sobstvennik/

How to sell an apartment owned by a minor

Selling is not easy for you either. Let's say your family has 1/4 of the apartment, and you want to sell your part. But if you only sell it, it will cost several times cheaper. This is a common story in the real estate market: for a part of an object, the seller receives a smaller amount than when the property is sold as a whole, and the money is divided among the sellers in proportion to the shares. nine0003

Your sister may refuse to sell the apartment or buy out your share and prevent you from using the property. As a result, a situation will arise when you have property, but you cannot dispose of it at your discretion.

As a result, a situation will arise when you have property, but you cannot dispose of it at your discretion.

What to do? 03/05/20

I want to sell a share in an apartment, but my sister is against

What other options are there

In fact, buying an apartment in shares can bring you more problems than good in the future. There is a chance that you will become a co-borrower, and the PFR will refuse to transfer the money, and the court will uphold this decision. As a result, you will be forced to make payments on the loan, and you will not build capital. nine0003

If you don't want to buy a third apartment, consider building a house or paying for your child's additional education. We talked about four ways to spend maternity capital - perhaps some of these tips will come in handy.

What to do? 18.02.19

How to spend maternity capital on building a house?

What to do? Readers ask - experts answer

Ask your question

4 new buildings, 16 reviews, company information

Developer Vash DoM: 4 new buildings, 16 reviews, information about the companyFlip screen

- Novostroy-M.ru

- •

- Sellers and developers

- •

- Vash DoM

Year of establishment: 2009

Address: Moscow, st. Ostrovityanova 11, building 1

New buildings of Vash DoM company

View more

2

Your Home

Rumyantsevo Project

Moscow, Novomoskovsky AO

Rumyantsevo

15 minutes. nine0003

nine0003

n/a

n/a

n/a

n/a

n/a

View more

3 nine0003

Your House

Zvenigorod project

Moscow region, Odintsovsky district

Zvenigorod (railway)

11 min.

n.a.

n.a.

n.a.

n.a.

n.a.

View 9 more0003

1

YOUR HOME

Under Construction

Mamonovo project

Moscow region, Odintsovo G/P

Bakovka

3 min. nine0003

nine0003

n/a

n/a

n/a

n/a

n/a

View more

1 nine0003

YOUR HOME

Under construction

Ninth Line project

Moscow region, Balashikha city district

Nikolskoye (railway)

15 minutes.

n.a.

n.a.

n.a.

n.a.

n.a.

nine0003

View all new buildings Vash DoM

How to get here?

View all special offers

Company news

On June 23, 2014, the Moscow Arbitration Court found justified the application to declare the PURP insolvent (bankrupt)

Dear contributors PURP Your DoM.