Where to buy house in usa

Best Places to Buy House in the USA for Price Appreciation

by Michele Lawrie ·

· 17 min read

It’s no secret that the US real estate market has been on fire lately. Home prices have been rising steadily for the past few years, and there’s no end.

However, being a huge real estate market, the US still has relatively lower house prices than other markets like the UK, Canada, China, India, etc. This is one of the reasons to invest in US real estate.

When you are buying a home in the USA as a foreigner, one thing that matters the most is location. It should be at a place where you can get a decent value appreciation. So, whether you live there or rent it out, you’ll have handsome profits when you sell your property.

In this listicle, we compiled the 10 best places to buy a house in the US in 2023 for best value appreciation and other valuable factors.

Table of Contents

- Things to Look for Before Choosing a Location to Buy Your Home in the USA!

- Top 10 Places to Buy a House in the USA for Foreign Investors!

- 1. Atlanta, Georgia

- 2. Austin, Texas

- 3. Charlotte, North Carolina

- 4. Dallas / Fort Worth, Texas

- 5. Denver, Colorado

- 6. Houston, Texas

- 7. Las Vegas, Nevada

- 8. Orlando, Florida

- 9. Phoenix, Arizona

- 10. Portland, Oregon

- Tips to Keep in Mind Before Investing in Real Estate.

- Still, Confused about Where to Buy?

- Frequently Asked Questions

Things to Look for Before Choosing a Location to Buy Your Home in the USA!

When you’re ready to purchase your first home or investment property, you must be aware of a few things. The following are some of the most critical factors you’ll want to keep in mind when narrowing down your search for the best places to buy a home, especially as a foreign investor:

1.

Growth

GrowthReal estate investing may be challenging, especially when you are looking to support out of your home country! To truly maximize the potential of your investment, it’s crucial to strike the appropriate balance between demand and market value. It would help if you looked at the growth trends in particular regions to determine what is now in order and booming.

However, you shouldn’t just rush into the industry with the most alluring growth right now. These cities look attractive to you now but they also appear inviting to everyone else. In light of this, it is possible for the market to become oversaturated and overvalued in a short period, which could cause an investment to stagnate or even lose value when the bubble inevitably bursts.

To determine where a market is predicted to be in three, five, or ten years, you should look at that sector’s forecast growth. Long-term sustainability is considerably better for medium-growth markets, which also have the advantage of being desirable both now and in the future.

2. Jobs Added and Planned

Foreign individuals are willing to relocate and purchase homes in an area if it can offer more jobs, mainly from well-known, reputable, or highly-paying businesses. As a result, a foreign investor should consider investing in a place with substantial job opportunities, has recently been a hub for a significant corporation, or is anticipated to get a trustworthy industry soon.

For instance, as corporations like Amazon establish national centers, towns compete to become the next destination of choice. When a business like this enters the housing market, it guarantees employment, spurs neighborhood development, and brings in new residents and homebuyers.

To find out what plans are in the works for the near future, you may also check current building permits from a particular area. This may give you a sneak preview of significant initiatives that could completely change a city before any announcements are made.

3. Current Home Values and the Vacancy Rate

Even if a region has strong growth potential, you shouldn’t buy property there. A market where there is already a high vacancy rate or sky-high housing costs could make it tough to rent out investment properties.

A market where there is already a high vacancy rate or sky-high housing costs could make it tough to rent out investment properties.

Even in a thriving economy, a balance between occupancy and profitability will be difficult if the neighborhood has a high vacancy rate. Since you’ll compete with other vacant properties and property rentals to attract tenants, you won’t get the rental rates you deserve, especially if the area is famous.

4. Cost of living and affordability

Several metrics can be used to assess a city’s affordability, including median home value, median rent, median listing price, state and local income tax rates, and the cost of living index, which measures your regional purchasing power in comparison to the national average for things like purchase price, rent, utilities, food, and transit. As a foreign investor spending dollars, you must keep these calculations in mind.

5. Potential Growth and Income

When evaluating a real estate investment in a foreign market, it’s essential to determine the property’s capacity to create rental revenue. To accomplish this, compare the rental records of comparable properties in the area. The possible future worth of the property should also be considered; for example, if a property isn’t renting well but is rising in value, it might still be a wise investment.

To accomplish this, compare the rental records of comparable properties in the area. The possible future worth of the property should also be considered; for example, if a property isn’t renting well but is rising in value, it might still be a wise investment.

To determine whether buying a property is a suitable investment, you should estimate your future income. To determine that amount, divide the income (revenue minus expenses) by the cap rate, which is the anticipated yearly return on an investment property. Ten percent is typically regarded as a respectable cap rate.

Source: Investopedia.comIn the last two years, house sales in specific real estate markets in the United States have seen a record increase, especially amongst foreign investors looking to buy a house for investment purposes. Buyers are searching for the best cities that provide contemporary comforts, lovely vistas, and a high return on investment across the United States. Check this list of Top Housing Markets in the US to take your pick from!

1.

Atlanta, Georgia

Atlanta, GeorgiaAtlanta, Georgia, is one of the best places to invest in real estate in the United States. The city’s population is increasing, and there is a strong demand for housing. There are several reasons for this being the number 1 city right now!

- The median sales price in Atlanta is relatively affordable, and the city has a diverse economy immune to downturns in specific industries. In addition,

- According to experts, Atlanta’s home prices and existing home sales will increase faster than the nation in 2022. Atlanta’s price growth is expected to be 3.5 percent, which is significantly higher than the national average of 2.9 percent, according to Realtor.com.

- Recent statistics show that Metro Atlanta’s population has increased by 1.5% annually and 15% over the last decade. By 2050, the city is expected to add 1.2 million additional employees.

- Atlanta also offers a cost of living that is 60% more affordable than most cities, especially that of Manhattan, and about 50% less expensive than that of San Francisco.

- Atlanta rentals have increased by 23 percent over the past year and continue to rise. For instance, investors can anticipate median rents of $2,095 for a three-bedroom apartment in Atlanta.

As a result, Atlanta has excellent potential for rental income and capital gains. For these reasons, Atlanta is an ideal place to invest in real estate.

Source: Zillow.com2. Austin, Texas

Austin’s housing market is poised for a boom due to a lack of supply, high demand, rising prices, and a booming labor market. Tesla, Samsung, and Apple have all accepted the city’s offers of tax cuts for corporations coming here, either by moving entirely or by establishing sizable offices of major companies, such as Tesla and Apple. Texas continues to recruit new inhabitants, and Austin relocations in 2021 are down by 45% from those in 2020.

- The progressive and resolutely eccentric city has expanded by more than 30% over the past ten years, partly due to an infusion of new tech firms and the growth of the regional semiconductor and software industries.

- The unemployment rate in Austin is at 4.2 percent, which is significantly lower than the national average.

- Austin has far cheaper living expenses than San Francisco and New York City. According to Numbeo’s cost of living index, which takes into account the price of consumer goods such as groceries, restaurants, transportation, and utilities, Austin scored 62.96 out of 100 in March 2021, which means that living there is over 40% less expensive than living in New York City. It is one of the cheapest cities to reside in!

- Although the median home rent is an inexpensive $1,431, rents are steadily increasing.

- The Austin housing market is a wise long-term investment, with property values increasing by almost 90% since 2012.

3. Charlotte, North Carolina

The financial and tech sectors of Charlotte have experienced significant job growth. A young workforce is supported by its 25 colleges and institutions. It is simpler to acquire there than in other IT clusters, thanks to its low property taxes. Some of the reasons why it’s one of the best places to buy a house in the US are:

Some of the reasons why it’s one of the best places to buy a house in the US are:

- By 2050, the Charlotte region is anticipated to have grown by 50%, with suburban York and Lancaster counties likely to see the most significant growth rates in real estate sales.

- Over the last 12 months, the Charlotte region generated 75,491 jobs, with the fastest increase occurring in transportation and warehousing, finance, insurance, and real estate. The majority of the 300,000 new jobs expected to be produced in North Carolina through 2028 will be in Charlotte and the neighboring city of Raleigh.

- As of May 2022, Charlotte’s Zillow Home Value Index (ZHVI) is $396,619 per square foot. According to the most current Realtor.com study, a single-family home in Charlotte has a median list price of $400,000. (as of April 2022).

- In Charlotte, rents have gone up 8% since last year. According to the most recent research from Zumper, a 3-bedroom property in Charlotte may be rented for an average monthly rate of $1,900.

(as of June 2022).

(as of June 2022). - Charlotte home prices have decreased by 12.4% since the last real estate cycle’s high. Home prices in Charlotte have increased by more than 77 percent since the latest real estate cycle market bottom.

- Surrounding Suburbs such as Fort Mill and Rock Hill, as well as Cabarrus County’s downtown area of Concord, are excellent future investments. They’re becoming more popular among families who can purchase extra space and access good schools.

4. Dallas / Fort Worth, Texas

Dallas’ mixed economy, offering jobs for individuals at every income level, is one of its economic strengths. Renting is more inexpensive than buying, and the demand for rental properties has risen sharply in recent years. It has one of the cheapest rates of homeownership in the nation.

- The Dallas-Fort Worth area continues to grow in population and is now the 4th largest metro area in the US, up from 6th place in 2010. According to the latest recent census, the number of people in the City of Dallas increased by nearly 9% over the previous ten years.

- Dallas’s median family income is $72,882, and its per capita income is $36,368.

- According to the BLS, employment growth in Dallas-Fort Worth is 5.6 percent annually, and the metro area is home to close to 3.9 million people.

- Dallas’s $390,505 Zillow Home Value Index (ZHVI) is valid through May 2022. Over the previous year, home values in Dallas rose by 30.3 percent.

- Dallas’s single-family homes are selling for an average of $430,000, according to the most recent report from the Texas Real Estate Research Center (May 2022).

5. Denver, Colorado

One of the top 10 cities in the nation to live in is Denver, Colorado. The metropolis of Denver is situated in northern Colorado, in the center of the country. Kids, yuppies, families, retirees, and people of all ages have enough to choose from. It’s a terrific area for locals, tourists, and in-migrants because there are many family-friendly activities available during all four seasons.

- Denver’s median house price is $599,742. Denver’s median house value has already climbed by 19.1% in the past year. Nevertheless, despite the quick rate of appreciation, prices are anticipated to rise gradually.

- Rental rates rise sharply in a year, rising 14.9 percent year over year, similar to their counterparts in property prices.

- Over the last ten years, its population increased by around 20%, and there are no indicators that this growth will soon decrease. The need for housing will rise as a result of this inflow of people.

6. Houston, Texas

Houston is the most populous city in Texas and the fourth-largest in the United States. It is a multicultural city with a strong economy, making it a great place to live and work. The energy industry, health care, and transportation are some main sectors.

- The job market in Houston is very diverse, with opportunities in the energy, healthcare, and aerospace industries, attracting foreign students and job seekers.

The city’s population is diverse, with over 145 languages spoken.

The city’s population is diverse, with over 145 languages spoken. - According to the most recent census, there are now more than 205,000 more people living in the City of Houston than there were ten years ago. Through 2029, Houston’s population is projected to increase by more than 1.2 million, continuing a decade-long trend of rapid growth.

- Houston’s median property values increased by 7.03 percent over the previous year, while the city’s median household income increased by 5.8 percent.

- The Greater Houston Partnership claims that home prices in Houston are still increasing at double-digit rates. Recently (May 2022), the median sale price of a single-family home in Houston surpassed $350,000, an increase of more than 40% from two years prior.

- The Houston Association of Realtors estimates that a single-family home in Houston will sell for a median price of $314,000.

- Although the cost of living is high, it is still cheaper to live in Houston than in other major cities such as New York or Los Angeles.

- The average monthly rent for a one-bedroom apartment is $1,191, and the median home price is $261,171.

7. Las Vegas, Nevada

The market in Las Vegas has been erratic, possibly witnessing one of the worst busts in the country during the Great Recession. However, its comeback has been rapid due to several circumstances, including a low cost of living, the absence of state taxes, and a diversified economic environment. Additionally, Californians who can work remotely will find it simple to relocate. Traditionally reliant on tourism and hospitality, the city has expanded into the high-tech, healthcare, and commercial real estate sectors.

- Nearly 671,000 people call Las Vegas home, and the Las Vegas-Henderson-Paradise metropolitan area is home to more than 2.2 million people. According to the most recent census, Las Vegas’s population has grown by 1.57 percent annually and 10 percent in the past ten years.

- The typical family income in the Las Vegas metro region is $61,048, while the per capita income is $31,651.

- The Federal Reserve Bank of St. Louis estimates that the Las Vegas-Henderson-Paradise, NV MSA’s GDP is over $119 billion and has increased by about 38 percent over the last ten years.

- At the end of May 2022, the median sale price of a single-family home in Las Vegas was $483,000, up more than 25% from the same period in 2017.

8. Orlando, Florida

Orlando is the fourth-largest and the state’s largest inland city in Florida. It is the center of the Orlando metropolitan area, with a population of about 2.5 million. Orlando, the location of Disneyworld, is in the middle of the Sunshine State. It’s close enough to major cities like Miami and Daytona Beach to be a driving distance, yet far enough away to appeal to both families and renters on a tight budget.

- Nearly 308,000 people live in the City of Orlando, while the Orlando metropolitan area’s population increased by more than 1.4 percent just in the previous year.

- By 2030, it is anticipated that Orlando’s average employment would have increased by 19 percent, or nearly twice as fast as the US.

- According to studies by the Orlando Economic Partnership, the Orlando metro area is expected to add roughly 500,000 new jobs over the next ten years.

- Orlando’s median home price increased by almost 25% year over year, and homes entered into contracts less than 25 days after they were put on the market.

- The median listing home price in Orlando is $367,000, based on the most recent report from Realtor.com (April 2022).

- The number of jobs in this city in central Florida should rise by almost 7.1% during the next two years, and in three years, the population should climb by nearly 8%.

9. Phoenix, Arizona

Phoenix, the capital and largest city in Arizona, is also known as the Valley of the Sun. There is much to do in Phoenix, from vibrant urban areas to suburban neighborhoods. All four main professional sports leagues play in the city, along with dozens of museums and performing arts centers.

- Phoenix’s population increased by 1.

7 percent annually and 15.8 percent during the last ten years. By 2029, it is anticipated that the Greater Phoenix region will have 5.64 million residents.

7 percent annually and 15.8 percent during the last ten years. By 2029, it is anticipated that the Greater Phoenix region will have 5.64 million residents. - Through the end of the decade, job growth in Arizona is predicted to average 1.6% each year.

- According to the Federal Reserve Bank of St. Louis, the Phoenix-Mesa-Scottsdale MSA’s GDP is over $281 billion and has increased by more than 57% over the last ten years. 7

- Phoenix’s home values rose 29.6% over the previous year and have soared more than 204% since 2016.

- According to the most current research from Realtor.com, the median listing price of a home for sale in Phoenix is $475,000 13

- The median sold home price in Phoenix is $461,000.

- The average monthly rent for an apartment in Phoenix is $1,162, a 5% increase from 2019.

10. Portland, Oregon

Young professionals wishing to reside close to urban areas are flocking to Portland, Oregon. The city has a flourishing arts scene, excellent cuisine, and many outdoor activities.

The city has a flourishing arts scene, excellent cuisine, and many outdoor activities.

- The median home value in Portland, which is currently $564,334, has climbed by 12.7% in the last year.

- The median monthly rent is $1,560, and an 11.2 percent rise in average rental costs over the past year. People are now renting rather than buying in the city of Portland, owing to how much more expensive it is to live there than it was.

- More Portland real estate owners, are moving to the rental market due to rising acquisition costs, declining profit margins, and a shortage of available properties.

- Another factor driving increasing housing prices in the region is the expanding job market in Portland.

- Residents earn more money than usual, and the unemployment rate is lower than the national average. And, over the next ten years, it is predicted that there will be a 41.2% rise in jobs in the city.

If you’re looking to invest in real estate, these are ten of the best places to do so in the United States. All of these cities are experiencing population and economic growth, which is driving up housing prices and making them excellent markets for sellers. So if you’re thinking of investing in real estate, keep these cities in mind.

All of these cities are experiencing population and economic growth, which is driving up housing prices and making them excellent markets for sellers. So if you’re thinking of investing in real estate, keep these cities in mind.

Tips to Keep in Mind Before Investing in Real Estate.

1. Create a budget.

Knowing your budget is essential if you want to buy the perfect property. It would be beneficial if you had a general concept of the final cost and the source of the funds for this transaction, such as a down payment or other alternatives like mortgage refinancing.

2. Recognize the intended use of the property.

Real estate investment in the United States can provide reliable income and capital growth. Real estate in the US has historically been one of America’s best assets, making it one of the most popular reasons people purchase these properties abroad, even though it might not seem like much to some investors or relocators looking for new homes.

The local economy and culture provide options for a healthy work-life balance while being pocket-friendly.

3. Apply for a mortgage.

If you’re not buying the house outright with cash, you’ll need to get a mortgage from a lending company. If you’re a foreign buyer, the mortgage application process can differ from if you were a local buyer. You’ll need to follow specific procedures and submit paperwork to the lender and the US authorities.

If you don’t have any US credit history, then refer to this guide to get a mortgage with a thin or no US credit.

4. Subtract expenses to pay U.S. taxes from income.

You must file a tax return at the end of each tax year if you decide to purchase a home or any other type of property in the US. Real estate investors must determine whether to deduct expenses from revenue to benefit from the favorable tax treatment that the IRS grants to such assets.

On your tax return, you can accomplish this by making that option (sometimes referred to as an “election”) selection. The IRS will automatically charge you 30% of the gross rental revenue if you choose not to file tax returns or select this option. It can significantly lower profits because costs like depreciation, basic charges, property taxes, repairs, and interest wouldn’t be tax-deductible.

It can significantly lower profits because costs like depreciation, basic charges, property taxes, repairs, and interest wouldn’t be tax-deductible.

Depreciation is a non-cash expense that can be written off, so keep that in mind. As a result, you will initially be displaying tax losses from your investment. You wouldn’t owe the government anything as a result. Even if you have tax losses, you must file your tax return immediately to make that choice.

5 Avoid Paying Death Tax (Estate Tax)

The total federal and state taxes owed in the US might be as high as 46% of the inheritance. The only exemption offered to foreign buyers is $60,000 of it. So, if a US property owner hasn’t planned for this, their passing could result in a significant tax and a resulting loss of inheritance to their heirs.

Both options are directly purchasing the property or putting it in an LLC. Another is to use a foreign corporation having its headquarters outside of the US (which is insufficient to avoid the estate tax). Another option is to purchase affordable term life insurance that is payable to your heirs and, if necessary, will pay the tax.

Another option is to purchase affordable term life insurance that is payable to your heirs and, if necessary, will pay the tax.

The estate tax is quite simple for foreign nationals to avoid, so don’t let it prevent you from investing in US real estate. When investing, planning is crucial. So that we can explain how our overseas clients organize their transactions to reduce taxes, please discuss this with HomeAbroad.

6. CIPS Licensed Representatives

Find an agent that has completed the Certified International Property Specialist (CIPS) program if you need assistance with your purchase. CIPS representatives are more qualified than the typical US real estate agent to assist you in purchasing the best place and property here since they have completed substantial training in international real estate transactions.

Here, HomeAbroad can assist you in making the finest mortgage lender selection. We can also connect you with CIPS Certified Real Estate Agents to streamline the financing and buying processes. Our team is happy to include several CIPS-certified agents. We’re here to assist you at every turn, from choosing the ideal property to negotiating the complexities of an overseas transaction.

Our team is happy to include several CIPS-certified agents. We’re here to assist you at every turn, from choosing the ideal property to negotiating the complexities of an overseas transaction.

Find the best real estate agent with international expertise

Connect with a local US real estate agent(s) with CIPS designation

Get Started

Still, Confused about Where to Buy?

The US is a big country with many places to buy real estate. You might want to live in the property you’re buying or use it as an investment. Different areas have distinct benefits that should be considered when making your decision.

The above options and tips are a great starting point for buying property in the US, but there is still much more to learn. Our team of professionals at HomeAbroad has significant experience assisting foreign buyers in purchasing US real estate, and we would be happy to put our knowledge to work for you.

Our CIPS Certified Professionals have the experience and expertise to take care of every detail, who will study your case, goals, and budgets and then help you find the best place to buy a house in the US. Moreover, we can connect you with the right lender to help you get the mortgage for the US property you are buying.

Moreover, we can connect you with the right lender to help you get the mortgage for the US property you are buying.

Find the best real estate agent and mortgage lender with international expertise.

Connect with a local international real estate agent and mortgage lender

Get Started

Frequently Asked Questions

Where is the best place to buy property in the United States?

There is no easy answer to this question since it depends on each person’s individual needs and goals. Some people might want to purchase a vacation home in a warm climate, while others might be more interested in an investment property in a major city. But some of the best cities to buy investment properties in the US are:

– Atlanta, Georgia

– Austin, Texas

– Charlotte, North Carolina.

Please check our guide to a detailed analysis of the best places to buy property in the US based on your unique.

What are some of the risks of buying US real estate?

The risks of investing in US real estate are relatively low compared to other investments, but there are still a few things to be aware of :

1. Property Taxes and Insurance

Property Taxes and Insurance

2. Estate Taxes

3. Financing Risks

4. Tenancy Risks

Where is the #1 place to live in the US?

There is no definitive answer to this question since what makes a city the “best” place to live varies from person to person. Some people might want to live in a bustling metropolis with plenty of things to do, while others might prefer a smaller town with a slower pace of life. However, the #1 place to live in the US is New York City, New York, which offers something for everyone.

How can I get US citizenship through real estate investment?

You cannot get US citizenship through real estate investment alone. However, if you invest in US real estate and meet other requirements, you may be eligible for a green card or US citizenship.

How Can You Get a Green Card Through Real Estate Investment?

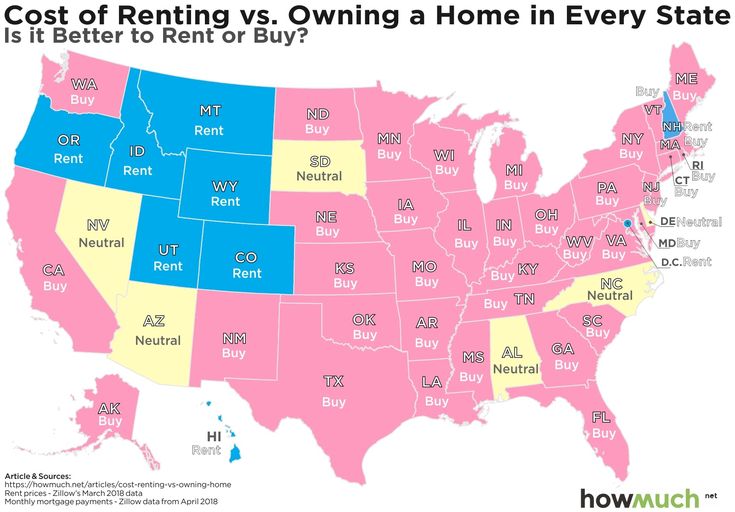

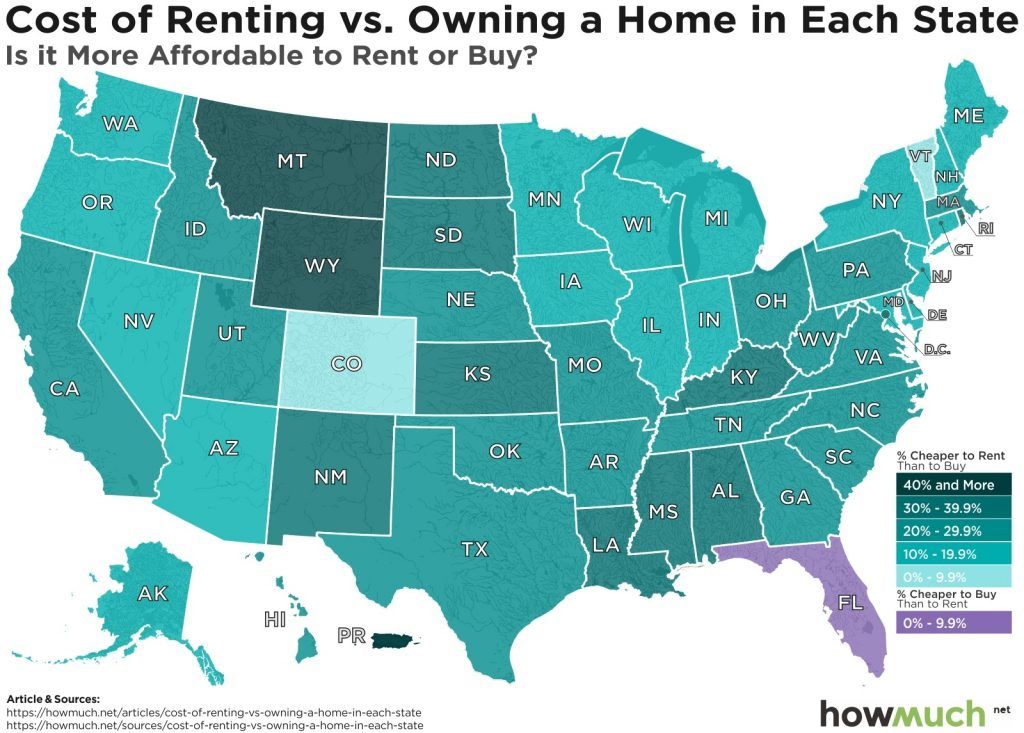

Where in the US is it a buyer’s market?

A buyer’s market is when there are more properties for sale than buyers. This situation often leads to lower prices, which can be an excellent opportunity for investors.

Philadelphia, Chicago, Cleveland, and Miami are currently buyers’ markets. In buyers’ needs, home shoppers expect an average 3.9 percent discount off the final sale price.

Which state in the US has the lowest cost of living?

The cost of living in Mississippi is the lowest in the US, followed by Arkansas, Oklahoma, and Louisiana. These states also have some of the lowest median home prices in the country.

Which is the best state to buy a house in the US in 2023?

The best state to buy a house in the US in 2023 is yet to be determined as the real estate market is constantly changing. However, some of the conditions that are currently considered good markets for buyers are:

Arizona

Colorado

Florida

Georgia

Check our guide for more information!

What are some of the benefits of owning US real estate?

Some of the benefits of owning US real estate include:

1. A Stable Housing Market

2. Competitive Mortgage Rates

3. A Growing Economy

4. A Safe Investment

A Safe Investment

5. A Strong Rental Market

What is the best time to buy property in the US?

The best time to buy property in the US varies depending on the market conditions in each city. For example, if you’re looking to buy in Miami, you might want to wait until the winter, when prices are typically lower.

Where is the cheapest state to buy a house in the US?

The cheapest state to buy a house in the US is West Virginia, where the median home price is just $129,000. Other cheap affordable areas to buy a home include Arkansas, Ohio, and Oklahoma.

What states are booming in real estate in the US in 2023?

Some of the states that are booming in real estate in the US in 2023 are:

1. Texas

2. Colorado

3. Florida

4. North Carolina

5. Tennessee

I’m not a US citizen. Can I still buy property in the US?

Yes, you can still buy property in the US as a foreigner. There are a few extra steps involved in the process, but our team of experts at HomeAbroad can help you navigate the process and find the perfect property for your needs.

About the author:

Michele Lawrie is the Chief Real Estate Officer at HomeAbroad and has worked as a real estate professional for the past 14 years, helping domestic and foreign national clients navigate the home buying and selling process.

She is passionate about real estate and strives to educate read more...

Best place to buy a house in the US in 2022, reveals Zillow |

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

(Image credit: John Coletti / Getty)

Pinning down the best places to buy a house in the US can be tricky as it rests on so many variables beyond return on investment. Job opportunities, amenities, crime rates are all important areas to investigate before moving to a new home.

However, if you're looking to invest in the hottest housing market, real estate platform Zillow has predicted Tampa as one of the best places to buy in the US for 2022.

2021 saw houses selling at a record-breaking pace and often price. Zillow predicts that next year could see another strong year for the housing market, forecasting 14.3 percent national home value growth through November 2022.

However, Tampa is expected to soar past this with home values growing 24.6 percent during that time. Imagine what you could do with a combination of that prediction and the best return on investment home improvements.

Best place to buy a house in US in 2022

The analysis was based on expected home value appreciation, the amount of for-sale inventory, and job opportunities. Alongside Tampa, here are the four other locations predicted to have the hottest housing markets in the US in 2022.

1. Tampa, Florida

(Image credit: John Coletti / Getty)

Zillow insists that a combination of factors will make Tampa in Florida one of the most desirable US cities for buyers.

'Tampa is predicted to be the hottest market for 2022 due to a combination of reasons, keeping sellers in the driver’s seat into 2022,' says Zillow economist, Nicole Bachaud.

'Tampa’s home values are projected to grow 24.6% this year, a strong forecasted growth that helped land it at the top of this list. Additionally, a thriving job market, relatively scarce and fast-moving inventory, year-round sunny weather, and demographics that indicate a good number of potential buyers all contributed to Tampa taking the number one spot.'

If you're looking for the best place to buy a vacation home in Florida, or even a permanent move Tampa could be it.

2. Jacksonville, Florida

(Image credit: Getty )

Jacksonville also in Florida came in second as one of the most popular and best places to buy a house this year.

'The Jacksonville metro area is one of the most exciting markets to buy in right now because it is fair to both sellers and buyers,' says Lazaro Marganon, Leader of The Marganon Group based in Jacksonville. 'We have a somewhat competitive market that is not ballooning home prices nor is coming at below-asking prices. '

'

'My favorite places to look at in the area are Sawgrass and Fleming Island.'

3. Raleigh, North Carolina

(Image credit: Getty)

Raleigh in North Carolina has been attracting homebuyers in huge numbers since 2020 thanks to the low cost of living and job opportunities.

'Raleigh, North Carolina will give your property sustained appreciation. In college areas like Raleigh, you can count on a stable marketplace for homes,' says Daniel Osman, Head of Sale at Balance Homes .

He adds that if you're looking to invest in a property to rent out Raleigh is a reliable investment. 'Many buyers will be looking to purchase homes remotely to rent the property out to itinerant students, which means real estate will always be in demand, no matter the state of the local economy.'

'In other words, Raleigh gives you sustained appreciation--and the flexibility to rent your property out for additional income.

However, if the City isn't for you, just under 2 hours from Raleigh is Little Washington one of the best places to buy a beach house in North Carolina.

4. San Antonio, Texas

(Image credit: Getty )

Austin topped the list as 2021's hottest housing market, however, nearby San Antonio, Texas, is expected to draw a lot of attention this year.

'Homes that are priced well are drawing multiple bids due to tight inventory and steadily increasing value prices,' explains Gordon von Broock, Douglas Elliman agent. 'There is currently a lot of attention on Austin, but with San Antonio only an hour away, people are starting to discover it in a big way.'

'It is a no-brainer as far as investment and return,' he adds. 'With the rolling Texas Hill Country along with nearby lakes and beaches, it makes for a phenomenal playground for owning multiple properties similar to that of a New Yorker owning a house in the Hamptons.'

5. Charlotte, North Carolina

(Image credit: Getty)

Charlotte in North Carolina is both a University Town and both a financial and business hub making it attractive to young professionals.

'We’re continuing to see lots of young professionals and families move to North Carolina,' says Jon Enberg, Charlotte General Manager at Opendoor . 'Charlotte is seeing more demand than most cities in the Southeast - median prices up 22% year-over-year - and at a higher price point, up to $450K in many suburbs.'

Jon points to surrounding suburbs such as Fort Mill and Rock Hill to the south, and Hunterville and Concord to the north as good future investments. 'They are growing in popularity as residents can get more space and access good schools.'

Rebecca is the News Editor on Homes and Gardens. She has been working as a homes and interiors journalist for over four years. She first discovered her love of interiors while interning at Harper's Bazaar and Town & Country during my Masters in Magazine Journalism at City, University of London. After graduating she started out as a feature writer for Women's Weekly magazines, before shifting over to online journalism and joining the Ideal Home digital team covering news and features. She is passionate about shopping for well-crafted home decor and sourcing second-hand antique furniture where possible.

She is passionate about shopping for well-crafted home decor and sourcing second-hand antique furniture where possible.

Where is the best place to buy real estate in the USA

In the past 10 years, Americans have bought property less frequently than in any other ten-year period in the last 170 years. But according to data from the Census Bureau and Pew Research, some states and cities have all managed to set personal records for real estate sales.

Unfavorable states for buying a home

The most unfavorable state for buying real estate was West Virginia - the only region with a minus indicator. Here, there are 3% more houses for sale than those sold. One of the reasons is the low cost of rent - the rent for housing is almost 30% lower than the mortgage payment. High unemployment, conservatism of local residents, underdeveloped infrastructure - all this also repels Americans from acquiring real estate in West Virginia. nine0003

The three anti-leaders also included Illinois (+3%) and Connecticut (+3%). The main factors pushing people away from buying a home in these states are high crime and unemployment rates, as well as low salaries. Many locals work for the Minimum Wage - $11 for Illinois and $13 for Connecticut. Also in the past few years, these states have regularly been included in the list of US regions with poor ecology.

The main factors pushing people away from buying a home in these states are high crime and unemployment rates, as well as low salaries. Many locals work for the Minimum Wage - $11 for Illinois and $13 for Connecticut. Also in the past few years, these states have regularly been included in the list of US regions with poor ecology.

Kansas, Wyoming, Missouri, Minnesota, Mississippi, Ohio, Pennsylvania and Alaska (+4%) joined the list of states that are considered unfavorable for buying real estate. Here, people aged 55+ have their own homes, while young people are increasingly leaving the states in search of more comfortable living conditions. nine0003

The once-elite communities of Pennsylvania and Alaska are now being turned into slums due to increased levels of drug addiction and crime, and there are more and more houses with delinquent mortgages.

New York (+5%) continues to rapidly slide down. Americans believe that life in the state is expensive, uncomfortable and unsafe. Neighboring New Jersey (+7%) also shows not very good growth. Moreover, it is New Yorkers who most often move to the Garden State.

Neighboring New Jersey (+7%) also shows not very good growth. Moreover, it is New Yorkers who most often move to the Garden State.

Best regions to buy real estate

Utah (+20%) led the states with the best prices to buy real estate with an average house price of $493,221. By the end of 2022, the state should become the first in the country to have 100 percent 5G high-speed Internet coverage. Developed infrastructure attracts large corporations to the state. In addition, the region creates excellent conditions for remote work.

Texas is in second place (+18%) with an average house price of $257,628. For this amount you can buy a house for 10-12 people with an impressive plot of land. The rapid development of small and large businesses, excellent climate and low cost of living are the main attractions of Texas. nine0003

Next on the list are Idaho (+17%) and Nevada (+17%). Areas that were once considered depressive are now actively developing. The average house in Idaho costs $427,410 and in Nevada $389,397.

Almost 80% of Americans who choose housing would like to live in the suburbs (Suburban), it is here that the highest price increases are observed. 73% important low crime rate. 61% pay attention to schools, shops and other businesses nearby.

Experts point out that some of the most profitable mortgage offers are currently operating in the US. It is expected that at the end of the year, the interest rate on a 30-year mortgage will be no more than 3.40%, and on a 15-year mortgage - no more than 2.72% per annum. nine0003

US new builds from developers on Geoln.com

G

New buildings

New buildings

Resellers

Commercial real estate

In any city

Country

All countries Georgia Australia Austria Azerbaijan Albania Andorra Argentina Armenia Belarus Belize Belgium Bulgaria Bosnia and Herzegovina United Kingdom Hungary Germany Greece Denmark Egypt Israel India Indonesia Ireland Spain Italy Kazakhstan Canada Cyprus Kyrgyzstan Latvia Lithuania Luxembourg Malawi Malaysia Malta Mexico Moldova Monaco Netherlands New Zealand Norway UAE Panama Paraguay Poland Portugal Russia Romania USA North Macedonia Serbia Singapore Slovakia Slovenia Thailand Turkey Ukraine Uruguay Finland France Croatia Montenegro Czech Switzerland Sweden Estonia nine0039

Pharmacy

Bank

Medical Center

Car Service

supermarket 9000

Shop 9000 9000

Price

Price, $/m 2

Price, $

Instrom

Hot offer

Cryptocurrency Payment

9000 9000002 Crowdfunding

Cashback available

More filters

Square, m 2

Square, m 2

floors

distance to the sea, m

Vyustodia12345 and more than

The number of bedrooms

9000Any Foundation Pit Completed 30% Frame erected Facade completed Fully completed

Condition

AnyBlack frameWhite frameTurn key

Condition

Any black frame white frame New renovation Requires repair nine0003

Near the kindergarten

near the school

near the supermarket

near the hospital

Fitness room

Service

Parking Parking

Basin

9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 2Security

Video surveillance

Price

Date added

Popularity

Found objects: 891

Blade

From $5869 / m 2

ID: 14786 | 52 floors

One Chicago

From $11840 / m 2

ID: 12868 | 77 floors

EVEQ West Loop nine0003

From $6430 / m 2

ID: 12867 | 5 floors

56W Huron

From $7980 / m 2

ID: 12866 | 13 floors

1400 Monroe

From $6080 / m 2

ID: 12865 | 7 floors

56 Leonard

From $24670 / m 2

ID: 12864 | 60 floors

Twenty Garfield

From $15500 / m 2

ID: 12863 | 4 floors

1399 Park

From $12170 / m 2

ID: 12862 | 23 floors

Three Waterline Square

From $24700 / m 2

ID: 12861 | 34 floors

Sabbia Beach

From $6730 / m 2

ID: 10152 | 19 floors

First light nine0003

From $18400 / m 2

ID: 10103 | 47 floors

La Clara

From $11200 / m 2

ID: 9969 | 25 floors

Westlake

From $1340 / m 2

ID: 9535 | 2 floors | House

lakewood ranch

From $1860 / m 2

ID: 9506 | House

From $11665 / m 2

ID: 9418 | 21st floor

Savina

From 5000$ / m 2

ID: 9415 | 36 floors

Summer hour

From $1450 / m 2

ID: 9214 | 2 floors | House

Reserve at North Caldwell

From $3370 / m 2

ID: 9213 | 2 floors | House

Carmel Creek nine0003

From 1800$ / m 2

ID: 9210 | 2 floors | House

Daventry

From $2185 / m 2

ID: 9208 | House

Turner's Pointe

From $1520 / m 2

ID: 9207 | 3 floors | House

Greyhawk at Golf Club of the Everglades

From $2600 / m 2

ID: 9205 | 2 floors | House

Meadows at Spring Creek

From $1480 / m 2

ID: 9204 | 2 floors | House

Avondale On Main Street nine0003

From $2200 / m 2

ID: 9203 | 2 floors | House

%name%

% name%

New buildings USA

Country position on the map, climate

United States of America (USA, United States, colloquially - America) - country, permanent member of the UN Security Council, founder of NATO, World Bank, International Monetary Fund , Organization of American States (OAS), other international organizations, located on the North American continent. In the jurisdiction of the United States is the state of Hawaii in the Pacific Ocean, islands in the Caribbean. nine0003

In the jurisdiction of the United States is the state of Hawaii in the Pacific Ocean, islands in the Caribbean. nine0003

The climate over a large area is the most diverse: from arctic in Alaska to tropical in Hawaii and southern Florida.

For the information of the investor: economics, culture, education

The United States is the largest economy in the world, the undisputed global leader in a number of significant indicators. Services, knowledge, logistics sectors (science, finance, education, transport, communications, healthcare, trade) dominate over the manufacturing sector. Production here is: agriculture, forestry, fishing, mining, manufacturing, construction. The rest of the industrial sector was brought abroad in the form of outsourcing of the production of American companies. nine0003

The USA excels in the field of scientific research, technological innovations, their introduction into the sphere of production, in licensed exports for inventions, unique developments. In a sense, the country can be called a planetary superpower. However, its balance sheet has been in a chronic deficit since the early 1980s, and the economy has the highest nominal external debt.

In a sense, the country can be called a planetary superpower. However, its balance sheet has been in a chronic deficit since the early 1980s, and the economy has the highest nominal external debt.

There are about 4,500 universities in the United States that offer four-year programs (bachelor's) and six-year programs (bachelor's plus master's). The country's higher education is one of the best in the world. In 2022, 26 American universities entered the top 100 best universities in the world. About 1 million international students come to the US every year. nine0003

The culture of the country was formed under the influence of ethnic and racial characteristics. The decisive contribution was made by immigrants from England, spreading the English language, the Anglo-Saxon legal system, popular culture, and the Internet.

Why is it profitable to buy an apartment in the USA in a new building

Experts are confident that the primary housing market will gain momentum in the short term, real estate agents expect a boom in sales. US real estate in a new building remains in demand, demand has not decreased, it is of a deferred nature. Investors are waiting, being at a low start. nine0003

US real estate in a new building remains in demand, demand has not decreased, it is of a deferred nature. Investors are waiting, being at a low start. nine0003

Confidence among international buyers about the value of investing in residential developments in the US will grow as the US economy recovers. Some regions of the country, in particular, South Florida, were not affected by falls and stagnant processes. In the Miami market, if earlier the majority of buyers of apartments in the residential complex were foreigners, now they prefer to buy local ones. True, experts note that the interest of foreign investors in new buildings is significant. It all depends on the conditions of entry into the country. The sale of apartments from developers provides for the availability of infrastructure nearby, the possibility of installments. nine0003

The minimum price per square meter of a new building in the USA from a turnkey developer in Washington (in accordance with the information of the GEOLN.COM search engine) is 2620 US dollars.

Purchase of an apartment in the USA from a developer by foreigners

The legislation of the country does not provide for special conditions restricting the purchase of an apartment in a new building by foreign investors. You can freely buy an apartment from a developer in the USA.

An apartment in a new building in the USA is a prestigious, profitable investment that allows you to receive high income from rent, resale, live in a country that is a global center of innovation, which determines the economic and political processes in the world.

new buildings in US cities

alphabet

ANAHAM

Atlanta

Austin

Ava Maria

Belve

Brandenton

Brentwood

Canton

Cantiles

Count0007

Is it possible to buy a home in the US remotely?

Can citizens of other countries buy an apartment in a new building in the USA?

Is there an installment plan for buying an apartment in a new building in the USA?

How many new buildings from the developer in the US?

What is the minimum price per sq.