Cheap privacy hedges

The Cheapest Trees to Create Privacy in Yards | Home Guides

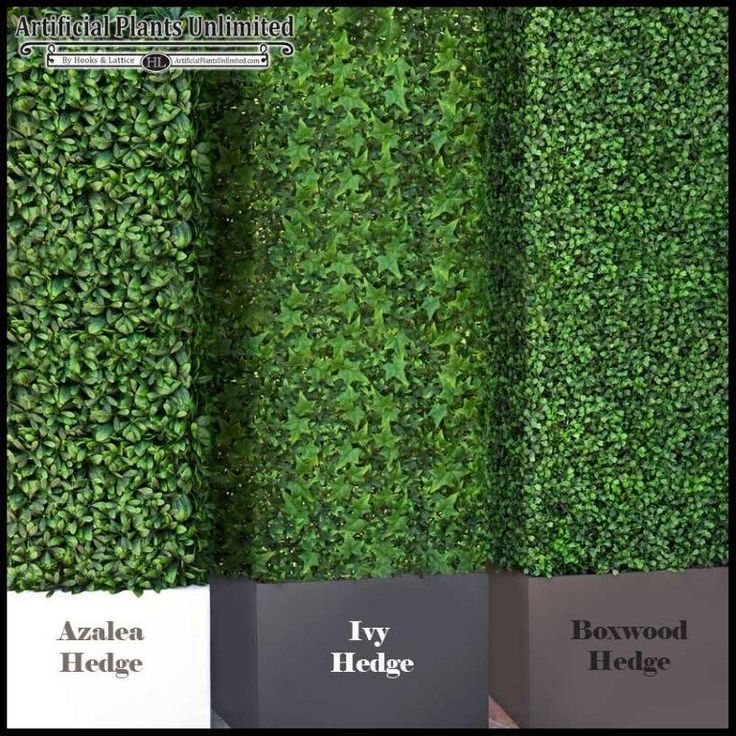

By SF Gate Contributor Updated June 16, 2020

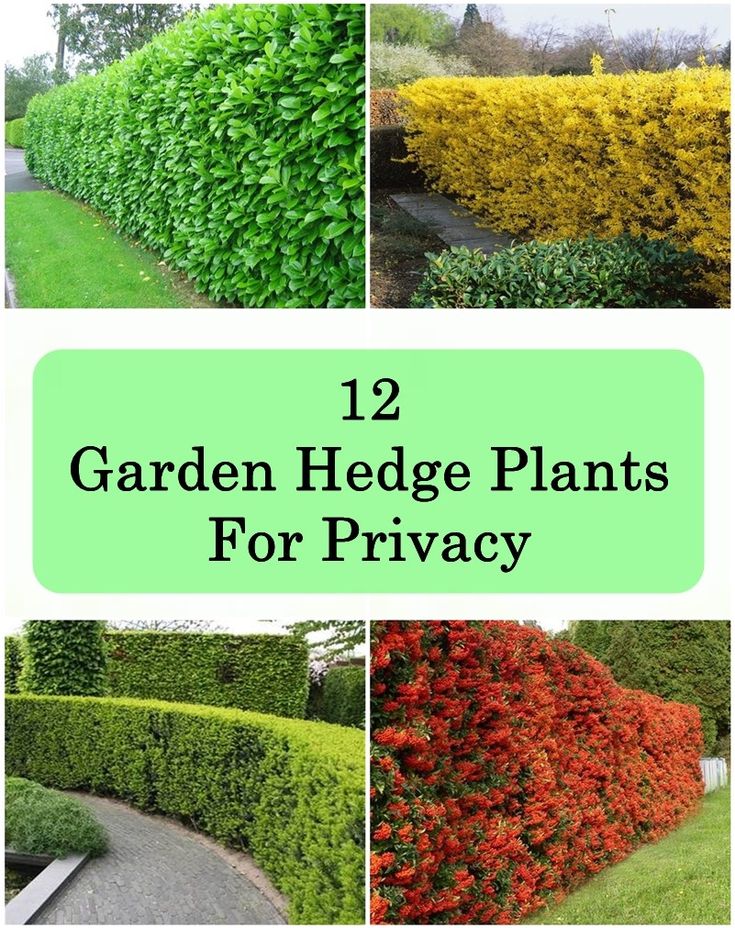

Natural privacy screens add beauty and interest to your yard while blocking the view from nosy neighbors. If you want privacy, trees are an excellent way to create it, but it can be extremely expensive to plant mature trees in mass quantities. With a little patience and planning, though, you can create a cheap, natural privacy fence using common young trees.

Consider Pricing and Other Factors

Common trees and shrubs will cost much less than exotic plants, and they are significantly easier to maintain. Avoid trees that grow outside your plant hardiness zone as these will not flourish.

The larger and more mature a tree is, the more expensive it will be. Growers have spent more time maintaining a large or exotic tree, so that cost is factored into the price. The best choice of tree is common, flourishes in your hardiness zone, and is low-maintenance, disease-resistant and young.

Try Some Inexpensive Evergreens

Evergreens guarantee the same level of privacy in all seasons. Thuja plicata 'Green Giant' is a consistently inexpensive evergreen that grows 3 to 4 feet per year to a mature height of up to 60 feet. According to the Missouri Botanical Garden, it is comfortable in U.S. Department of Agriculture plant hardiness zones 5 through 8 and is adaptable to a variety of soils and conditions.

The Leyland cypress (× Cuprocyparis leylandii) is another fast-growing, inexpensive option that thrives in USDA zones 6 through 10. It is slightly smaller than Thuja 'Green Giant' and reaches up to 50 feet at full maturity with a growth rate of up to 3 feet per year. Although they look similar, the Leyland cypress tends to be a fuller tree.

Look at Deciduous Privacy Trees

Deciduous trees provide effective screening for that portion of the year when they are in leaf, which is also when you are most likely to be enjoying your yard. A stout, hardy option for deciduous screens is the hedge maple (Acer campestre), which is hardy in USDA zones 5 through 8. It is more diminutive than other maples, reaching 25 to 35 feet with a growth rate of about 1 foot per year. What it trades in height, though, it gets back in adaptability. An extremely low-maintenance tree, the hedge maple is suited to almost any soil and sunlight exposure.

A stout, hardy option for deciduous screens is the hedge maple (Acer campestre), which is hardy in USDA zones 5 through 8. It is more diminutive than other maples, reaching 25 to 35 feet with a growth rate of about 1 foot per year. What it trades in height, though, it gets back in adaptability. An extremely low-maintenance tree, the hedge maple is suited to almost any soil and sunlight exposure.

A taller option is the Lombardy poplar (Populus nigra 'Italica'), sometimes also called the black poplar. This columnar tree requires only a 10-foot-wide planting space but reaches a mature height of up to 60 feet. The Lombardy poplar is hardy in USDA zones 3 through 9, according to the Washington State University Clark County Extension.

Choose Smaller Trees and Shrubs

If height is not a major factor to you, some smaller trees or shrubs may function as a cheap, natural privacy fence. The American arborvitae (Thuja occidentalis 'Smaragd'), USDA zones 2 through 7, and north privet (Ligustrum x ibolium), USDA zones 4 through 7, can be trimmed and shaped into desirable shapes or allowed to grow naturally.

The American arborvitae is a semi-dwarf cultivar with a mature height of 12 to 14 feet, while the north privet is a deciduous tree that typically grows to a height of 8 to 12 feet. For those in warmer climates, the Tecate cypress (Hesperocyparis forbesii) is an evergreen with an oval shape that grows in USDA zones 7 through 9 and reaches a mature height of 10 to 25 feet, notes the Urban Forest Ecosystems Institute.

References

- Missouri Botanical Garden: Thuja 'Green Giant'

- Washington State University Extension: Lombardy Poplar

- Missouri Botanical Garden: Acer campestre

- Missouri Botanical Garden: Thuja occidentalis 'Smaragd'

- Missouri Botanical Garden: Ligustrum × ibolium

- Urban Forest Ecosystems Institute: Tecate Cypress

- Missouri Botanical Garden: × Cuprocyparis leylandii

7 Fast-Growing Hedges & Shrubs for Privacy

Home > Fast Growing Hedges

Fast-growing hedges are always in high demand! The main uses are:

- Privacy

- Peace and Quiet

- Hiding eyesores (fences, sheds, AC units, etc.

)

) - Shade

Regardless of the reason for wanting a rapidly-growing tall hedge or privacy screen, we have excellent options for any space. These varieties will grow more than 1 foot per year (some can grow up to 4 feet per year in ideal conditions). They are all well-suited to hedging, so they can also be pruned to remain tight and kept at any desired height. Some are fast growing evergreen trees for privacy, some are deciduous. These plants are fastest growing shrubs in Florida and other states. We’ve included detailed information on each with the best ways to use and maintain them.

QUICK LINKS

7 Varieties of Fast Growing Hedges

ENCOURAGING FAST GROWTH

It is important to note that, although these varieties do grow

fast when compared with some other types, a big factor in the growth rate is the environment. Fast growing privacy hedge and shrubs that are stressed from lack of water,

extreme temperatures, or the wrong exposure (i. e. too much sun or too much shade), will grow much slower

than the typical growth rates.

e. too much sun or too much shade), will grow much slower

than the typical growth rates.

If getting a tall hedge fast is important to you, you will need to make sure to do the following 5 things:

1. Choose the right hedge for the right space.

If you don’t plant your hedge in the right site, fast growing shrubs will never thrive. Full sun plants need to be planted in full sun. Plants that are borderline hardiness will be damaged each winter by frost. Water-loving varieties can’t be planted in deserts. Do your research before planting, choose a plant that suits your site, and you will be just fine. Keep in mind that a plant that tolerates both shade and sun will generally grow faster in more sun.

2. Plant your hedge at the right time.

Planting an Amur Maple hedge in the middle of July in full sun with limited supplemental water

is going to set the plants back significantly. The ideal time to plant is fall, after the hedges

are dormant. You can also safely plant fast growing evergreen trees for privacy through the

winter in areas where the ground does not freeze hard, and spring is also a good time. Doing

this for fast growing shrubs saves your work and worry and saves the plants a lot of stress.

The ideal time to plant is fall, after the hedges

are dormant. You can also safely plant fast growing evergreen trees for privacy through the

winter in areas where the ground does not freeze hard, and spring is also a good time. Doing

this for fast growing shrubs saves your work and worry and saves the plants a lot of stress.

3. Water for the first 1-2 years

Once your hedge has been in the ground for several years and has had a chance to send roots deep into the soil, it will need very little supplemental water, if any. However, it is important to provide ample water during the first 1-2 growing seasons after planting. The best way to do this is to lay a drip line along the length of your fast growing shrubs and run for an hour at a time every few days to water deeply.

4. Fertilize

Fast growing shrubs are very low-maintenance, but if you want optimum growth, applying a

high-nitrogen, slow-release fertilizer will help. It is best to apply in the spring right before

growth begins.

It is best to apply in the spring right before

growth begins.

5. Prune at the right times

Spring is generally the best time to prune, as this stimulates new growth and ensures that no tender new shoots will be frozen if they emerge too close to winter. Yearly pruning, although it seems counterintuitive for a fast-growing hedge, really helps create a nice, dense hedge. You’ll be glad you did it!

Visit our Blog for more Growing Guides!FLAME AMUR MAPLE

Acer Ginnala ‘Flame’

Flame Amur Maple is our favorite deciduous fast-growing hedge. It has outstanding fall color in fiery reds, oranges, and yellows. It is very cold-hardy (down to -40ºF!) and can be grown in most parts of the US.

It can easily be grown as a hedge thanks to its multi-stemmed natural habit and can be maintained by

pruning once per year.

It thrives in full sun to part shade, and it is quite drought-tolerant once established.

Flame Amur Maple makes one of the best fast growing shrubs screens that provide shade in the summer and still allows light through in the winter.

-

NAME Acer ginnala ‘Flame’ (Flame Amur Maple)

-

EVERGREEN/DECIDUOUS Deciduous (Fiery fall color)

-

HARDINESS ZONE Zones 3-8

-

GROWTH RATE Fast (Up to 2 feet per year)

-

GROWTH HABIT Multi-Stemmed

-

LIGHT REQUIREMENTS Sun to Part Shade

-

DEER/PESTS Deer

-

MAINTENANCE Prune 1 time per year

-

BEST FOR Screening (Shade in summer, light in winter)

ENGLISH LAUREL (CHERRY LAUREL)

Prunus Laurocerasus

English laurel (or Cherry Laurel) can make an enormous fast-growing hedge. Under the right conditions,

it can grow up to 3 feet per year! It does very well in heat.

It has glossy evergreen foliage and makes a very attractive large hedge with regular pruning 1-2 times

per year.

English laurel grows in full sun to partial shade. It tolerates a wide variety of soil types and is very

drought-tolerant once established. It is smog and salt tolerant, and deer will not touch it.

English laurel makes a tough-as-nails, versatile, and seriously fast-growing hedge. The perfect fast

growing shrubs for large spaces where privacy is needed. The hedge is considered as one of the best fast growing evergreen trees for privacy in the USA.

Under the right conditions,

it can grow up to 3 feet per year! It does very well in heat.

It has glossy evergreen foliage and makes a very attractive large hedge with regular pruning 1-2 times

per year.

English laurel grows in full sun to partial shade. It tolerates a wide variety of soil types and is very

drought-tolerant once established. It is smog and salt tolerant, and deer will not touch it.

English laurel makes a tough-as-nails, versatile, and seriously fast-growing hedge. The perfect fast

growing shrubs for large spaces where privacy is needed. The hedge is considered as one of the best fast growing evergreen trees for privacy in the USA.

-

NAME Prunus laurocerasus (English or Cherry laurel)

-

EVERGREEN/DECIDUOUS Broadleaf Evergreen Glossy green leaves

-

HARDINESS ZONE Zones 6-9

-

GROWTH RATE FAST Up to 3 feet per year

-

GROWTH HABIT Large, Rounded

-

LIGHT REQUIREMENTS Sun to Part Shade

-

DEER/PESTS None

-

MAINTENANCE Prune 1 time per year

-

BEST FOR Privacy Thick, evergreen hedge

SCHIP LAUREL

Prunus Laurocerasus ‘Schipkaensis’

Schip laurels (or Skip laurels) are a very popular shrub to use for an evergreen fast-growing hedge. They can easily make a tall and narrow hedge with pruning once per year and occasional shaping. They are

fast growing evergreen trees for zone 5. It has the advantage over most other fast-growing hedge types

of tolerating full sun to full shade. Schip laurels fast growing shrubs also grow well in a wide variety

of soil types, is drought-tolerant once established, and is not bothered by smog or salt. It does well

in heat and is cold hardy to zone 6 or even warmer parts of zone 5.

Schip laurel makes a durable fast-growing hedge that is ideal for privacy and for hiding fences.

They can easily make a tall and narrow hedge with pruning once per year and occasional shaping. They are

fast growing evergreen trees for zone 5. It has the advantage over most other fast-growing hedge types

of tolerating full sun to full shade. Schip laurels fast growing shrubs also grow well in a wide variety

of soil types, is drought-tolerant once established, and is not bothered by smog or salt. It does well

in heat and is cold hardy to zone 6 or even warmer parts of zone 5.

Schip laurel makes a durable fast-growing hedge that is ideal for privacy and for hiding fences.

-

NAME P. laurocerasus ‘Schipkaensis’ (Schip laurel)

-

EVERGREEN/DECIDUOUS Broadleaf Evergreen Glossy green leaves

-

HARDINESS ZONE Zones 6-9

-

GROWTH RATE FAST Up to 2 feet per year

-

GROWTH HABIT Wide Vase

-

LIGHT REQUIREMENTS Full Sun to Full Shade

-

DEER/PESTS None

-

MAINTENANCE Prune 1 time per year

-

BEST FOR Privacy, Hiding Fences Tall, narrow evergreen hedge

PORTUGUESE LAUREL

Prunus Lusitanica

Portuguese laurel is a stunning fast-growing evergreen hedge that works well for warm, coastal regions. It grows quickly but is easy to maintain due to its mostly spreading habit. With pruning once per year,

it quickly makes a very dense hedge.

Portuguese laurel thrives in warm climates and does well in drought, smog, and salt. It grows in a wide

range of soils, including poor soils. It is deer-resistant. It can take full sun and partial shade.

Though a little slower-growing than the English laurel or Schip laurel, Portuguese laurel makes an

excellent fast-growing hedge with less maintenance required. Its thickness makes it one of the best hedges for

privacy, wind-block, and noise-block. It is also perfect for hiding fences.

It grows quickly but is easy to maintain due to its mostly spreading habit. With pruning once per year,

it quickly makes a very dense hedge.

Portuguese laurel thrives in warm climates and does well in drought, smog, and salt. It grows in a wide

range of soils, including poor soils. It is deer-resistant. It can take full sun and partial shade.

Though a little slower-growing than the English laurel or Schip laurel, Portuguese laurel makes an

excellent fast-growing hedge with less maintenance required. Its thickness makes it one of the best hedges for

privacy, wind-block, and noise-block. It is also perfect for hiding fences.

-

NAME Prunus lusitanica (Portuguese laurel)

-

EVERGREEN/DECIDUOUS Broadleaf Evergreen Glossy green leaves

-

HARDINESS ZONE Zones 7-9

-

GROWTH RATE Fast Up to 1.

5 feet per year

5 feet per year

-

GROWTH HABIT Broad Column

-

LIGHT REQUIREMENTS Sun to Part Shade

-

DEER/PESTS None

-

MAINTENANCE Prune 1 time per year

-

BEST FOR Privacy, Hiding Fences Thick, dense hedge

AMERICAN ARBORVITAE

Thuja Occidentalis

American Arborvitae is a popular plant for evergreen fast-growing hedges. It is extremely cold-hardy so

it is especially useful in the Northern US.

They are fast growing shrubs but easy to maintain as a clipped hedge with one pruning per year.

It is low-maintenance and fairly drought-tolerant once established. It does well in urban environments.

Unfortunately, deer can be a problem.

American Arborvitae make a wonderful, low-maintenance, evergreen, fast-growing hedge. It works

especially well as a privacy hedge.

It works

especially well as a privacy hedge.

-

NAME Thuja occidentalis (American Arborvitae)

-

EVERGREEN/DECIDUOUS Evergreen Dark green, thread-like foliage

-

HARDINESS ZONE Zones 2-8

-

GROWTH RATE Fast Up to 1-2 feet per year

-

GROWTH HABIT Upright

-

LIGHT REQUIREMENTS Sun to Part Shade

-

DEER/PESTS Deer

-

MAINTENANCE Prune 1 time per year

-

BEST FOR Privacy Low-maintenance privacy

GREEN GIANT ARBORVITAE

Thuja X ‘Green Giant’

Green Giant Arborvitae is the big exception to the rule that Arborvitae grow slowly. This hybrid Thuja

typically grows 3 feet per year, with some reports circulating of it growing 5 feet in one year!

If you need a fast-growing, large, evergreen Arborvitae hedge, Green Giant is a perfect choice. It will

take some work to maintain if you want to keep it as a medium-sized hedge, but one pruning per year will

suffice for a large hedge.

Green Giant grows in full sun to partial shade and is resistant to many diseases and pests, including

deer. It tolerates many soils, but consistently damp and poor-draining sites should be avoided. It grows

well in the humidity of the Southeastern US.

Green Giant Arborvitae is a classic fast-growing hedge. It is a popular choice for privacy and

wind-breaks, and will remain healthy in many areas where other Arborvitae would struggle.

This hybrid Thuja

typically grows 3 feet per year, with some reports circulating of it growing 5 feet in one year!

If you need a fast-growing, large, evergreen Arborvitae hedge, Green Giant is a perfect choice. It will

take some work to maintain if you want to keep it as a medium-sized hedge, but one pruning per year will

suffice for a large hedge.

Green Giant grows in full sun to partial shade and is resistant to many diseases and pests, including

deer. It tolerates many soils, but consistently damp and poor-draining sites should be avoided. It grows

well in the humidity of the Southeastern US.

Green Giant Arborvitae is a classic fast-growing hedge. It is a popular choice for privacy and

wind-breaks, and will remain healthy in many areas where other Arborvitae would struggle.

-

NAME Thuja x ‘Green Giant’ (Green Giant Arborvitae)

-

EVERGREEN/DECIDUOUS Evergreen Dark green, thread-like foliage

-

HARDINESS ZONE Zones 5-8

-

GROWTH RATE FAST Up to 3-5 feet per year

-

GROWTH HABIT Pyramidal

-

LIGHT REQUIREMENTS Sun to Part Shade

-

DEER/PESTS None

-

MAINTENANCE Prune 1 time per year

-

BEST FOR Privacy, Wind-break

VIRESCENS WESTERN RED CEDAR

Thuja Plicata ‘Virescens’

Virescens Western Red Cedar is a wonderful fast-growing hedge for warmer regions where other Arborvitae

might not thrive. It has a unique upright-branching habit and responds well to hedging.

Virescens naturally grow tall and narrow, so it lends itself well to a tall privacy hedge. One pruning

per year is sufficient to maintain a nice hedge.

Native to the Pacific Northwest, Virescens does well everywhere that isn’t too hot or too cold. It

tolerates partial shade as well as full sun, and it holds its green color all year. Deer leave it alone.

Virescens Western Red Cedar is so well-suited to forming a fast-growing hedge that it requires very

little maintenance. Virescens’ fast growing shrubs make a very handsome privacy hedge and hide fences

well. So if you are looking for a non-toxic privacy hedge to hide ugly fence of neighbors or your

breakfast area that looks ugliest like never before then this is one of the best fast growing privacy

hedges to consider.

It has a unique upright-branching habit and responds well to hedging.

Virescens naturally grow tall and narrow, so it lends itself well to a tall privacy hedge. One pruning

per year is sufficient to maintain a nice hedge.

Native to the Pacific Northwest, Virescens does well everywhere that isn’t too hot or too cold. It

tolerates partial shade as well as full sun, and it holds its green color all year. Deer leave it alone.

Virescens Western Red Cedar is so well-suited to forming a fast-growing hedge that it requires very

little maintenance. Virescens’ fast growing shrubs make a very handsome privacy hedge and hide fences

well. So if you are looking for a non-toxic privacy hedge to hide ugly fence of neighbors or your

breakfast area that looks ugliest like never before then this is one of the best fast growing privacy

hedges to consider.

-

NAME Thuja plicata ‘Virescens’ (Virescens Western Red Cedar)

-

EVERGREEN/DECIDUOUS Evergreen Bright green, thread-like foliage

-

HARDINESS ZONE Zones 5-8

-

GROWTH RATE Fast Up to 2 feet per year

-

GROWTH HABIT Upright, Pyramidal

-

LIGHT REQUIREMENTS Sun to Part Shade

-

DEER/PESTS None

-

MAINTENANCE Prune 1 time per year

-

BEST FOR Privacy, Hiding Fences

Interested in purchasing?

For retail customers, find pricing and purchase online here.

For green industry professionals, please fill out our quote request form.

Hedging - what is it, mechanism, strategy, types, tools, examples

Hedging helps businesses protect themselves from risks and maintain the price of an asset in an unfavorable situation. Assets are all the assets of a business that contribute to generating income.

What are assets

Kolosok grows and sells wheat. When the wheat harvest in the world is small, its price rises to 20,000 rubles per ton, because there is not enough for everyone. When the harvest is good, the price drops to 15,000 rubles per ton, because there is a lot of wheat on the market. nine0003

In the spring, the head of Kolosok thinks that this year the harvest will be good, and the price of wheat will be low. He decided to insure against losses. To do this, he finds the company "Sdoba", whose owner is sure that this year, on the contrary, there will be little wheat and it will be expensive.

Kolosok agrees with Doba to sell it 100 tons of wheat at a price of 17,000 rubles per ton in six months. Each party to the contract believes that it is beneficial to them.

In this situation, both companies hedge risks and are hedgers.

When is hedging useful?

Hedging is useful when the price of a good, service, or work is highly dependent on demand or the exchange rate. Usually, risks are hedged in situations where a company or individual entrepreneur:

What is the exchange rate

- buys raw materials or goods in one currency and sells in another;

- trades in goods, services or works, the value of which can change rapidly; nine0028

- conducts operations with securities;

- conducts operations with foreign currency;

- purchases commodities and energy products;

- receives loans, but doubts whether the rate is profitable.

At the same time, the hedger agrees to lose part of the possible income if the market turns favorably.

Oksana buys clothes in RMB in China on the 15th of every month and then sells them in Russia. In 2021, the average exchange rate was ₽11.5 per yuan. nine0003

At the end of February 2022, the exchange rate began to grow, and Oksana decided to play it safe - she thought that by March 15, the exchange rate might turn out to be completely unprofitable. She agreed with a clothing supplier that on March 15 she would buy 50 T-shirts and pants from him at the rate of 15 ₽ to one yuan.

On March 15, 2022, one yuan cost 18.22 ₽. As a result, Oksana saved ₽3.22 for every yuan spent. Delighted with the benefits, Oksana signed the same contract for April 15.

On April 15, the exchange rate was 12.75 ₽ per yuan. As a result, Oksana lost ₽2.25 for every yuan spent on this deal.

The potential profit and loss in hedging is usually not equal. Therefore, in such transactions, it is important to calculate the possible outcomes in advance and understand what conditions will be more profitable for the business.

Hedging instruments

Hedging instruments are types of contracts entered into between companies or individuals.

Instruments can be combined, for example, hedging a third of an asset in one way, a third in another, and another third without hedging at all, leaving it to the will of the market. Such a hedging strategy will help not only reduce, but also distribute risks. nine0003

The simplest and most effective types of hedging are forwards and options, although there are other ways to insure risks.

Forward

A forward is a contract that obliges one party to buy a specific asset from the other. At the same time, the price and date of purchase are agreed in advance. This is a strict agreement that is binding on both parties.

Above we looked at two examples of hedging - with wheat and clothing. These were forward contracts: the parties were obliged to complete the transaction by a certain date on predetermined terms. nine0003

Under this hedging mechanism, the seller may not have the goods on hand at the time the forward contract is entered into. The main thing is that the goods should be at the time of the transaction on the date on which the contract was concluded.

The main thing is that the goods should be at the time of the transaction on the date on which the contract was concluded.

The document can be drawn up in free form. At the same time, there remains a high risk that the counterparty will not fulfill its obligations under such an agreement. But you can play it safe: provide for the responsibility of the parties for non-fulfillment of the conditions or demand the fulfillment of the terms of the contract in court. nine0003

After the execution of the forward contract, most likely, one of the parties will be in less favorable conditions. But at the same time, both parties received insurance against risks in a sharply negative scenario.

Option

An option similar to a forward is a contract to sell an asset at a predetermined price by a certain date. The difference is that an option gives the buyer of the asset the right, not the obligation, to make a deal.

What is an option

A company or individual who wishes to enter into an option pays another option premium for entering into an agreement. The option premium works like collateral. Its amount will remain with the counterparty, even if the option owner refuses to make a deal. nine0003

The option premium works like collateral. Its amount will remain with the counterparty, even if the option owner refuses to make a deal. nine0003

The Children's Cook company makes apple puree. In six months, she wants to buy 100 tons of apples at 20,000 rubles per ton, for a total of 2,000,000 rubles. The organization found another company, Golden Fill, which sells these apples.

While the "Children's Chef" does not have 2,000,000 rubles, and the company decides to enter into an option. She understands that such hedging leaves her with more options than a forward. The company pays ₽200,000 to Golden Bulk for entering into the option. Now the "Children's Chef" will be able to buy 100 tons of apples in six months for the remaining 1,800,000 rubles. nine0003

There are two scenarios. In the first one, a ton of apples became more expensive - 25,000 rubles. This is beneficial for the "Children's Chef", and he uses his right to buy apples.

So, thanks to the option, the company saved 500,000 rubles.

In the second scenario, apples fell in price to 17,000 rubles per ton. Now the option is no longer profitable, and the "Children's Chef" decides not to use it, but to buy apples separately for 1,700,000 ₽. This is 300,000 rubles cheaper than exercising the option. At the same time, ₽200,000 of the option premium remains with the seller. The decision to refuse to exercise the option saved "Children's Chef" 100,000 rubles. nine0003

An option is a more flexible method of risk hedging. It is useful when the potential loss from making a deal may be too large. Then you can refuse the deal and get off with less damage.

Things to remember

- Hedging is the protection of an asset from a fall in value.

- Hedging is useful if the price of a product, service or work can change dramatically.

- Not all assets can be hedged, but only a part of them.

- Before hedging, you need to carefully calculate possible price fluctuations.

tools, methods, strategies, differences from diversification

Victor Jean

private investor

Author's profile

Hedging is a technique that helps smooth out the fall in the price of an asset. A kind of insurance against a market crash.

Suppose you own shares of a company and plan to keep them, but you are afraid that the shares will suddenly collapse. In this case, you can "buy insurance" - that is, bet on the fall of these shares. If the fall does not occur, you will lose a small part of the capital that you put in the opposite direction. On the other hand, if the fall does occur, this bet in the opposite direction may well compensate for your losses from owning shares. This is how the principle of hedging can be briefly described: when we buy ordinary insurance, we also hope that an insured event will not occur, although this will mean that the money for insurance was wasted. nine0003

nine0003

Both private investors and large funds use hedging. Some of the funds are called "hedge funds". They offer professional money management, where cunning trading strategies and hedging with derivatives are used to maximize profit for a given risk. Such organizations manage the money of large players: for private investors, the entry threshold for American hedge funds is $5 million.

More modest investors have to optimize the risks themselves. The main problem is that typical hedging instruments are complex. Most often, futures, options, and swaps are used for hedging - knowledge is needed to use them. nine0003

/futures/

What are futures on the stock exchange? and return the debt to the broker. But the market can move in the opposite direction - in inept hands, the use of shorts can turn into large losses.

As a result, more understandable hedging instruments appeared on the market — inverse ETFs. In fact, these are the same exchange-traded funds as regular ETFs, only they move in the opposite direction. nine0003

nine0003

For example, consider the US stock market - the S&P 500 index. VOO and SPY funds repeat it with a minimum error. At the same time, ProShares offers the SH fund - it behaves like a mirror: when the S&P 500 rises, it falls, and when it crashes, it rises.

Let's take a closer look at the pros and cons of inverse ETFs and what they are. I note right away that so far there is not a single reverse ETF on the Moscow Exchange, so they are available only to qualified investors and those who trade through a foreign broker. But, one way or another, this article will help you better understand the principles of hedging and improve your approach to portfolio optimization. After all, even with the tools at the disposal of an ordinary investor, risks can be managed. For example, a natural hedge against falling stocks is often gold, as well as securities of gold mining companies like Polyus. nine0003

6 reasons to invest in gold

Should hedging at all

In general, for a “lazy” investor who works on the principle of “buy and hold” over a long distance, hedging is not necessary: according to statistics, markets rise more often than they fall, and every recession in the economy is followed by its recovery and a new cycle of growth. After the 2008 crisis, the business cycle lasted 11 years until we faced a crash in 2020. During this period, despite all the local drawdowns, the S&P 500 index showed more than 300% growth. Therefore, a patient investor could calmly wait out the correction and stay in the black even without portfolio management. nine0003

After the 2008 crisis, the business cycle lasted 11 years until we faced a crash in 2020. During this period, despite all the local drawdowns, the S&P 500 index showed more than 300% growth. Therefore, a patient investor could calmly wait out the correction and stay in the black even without portfolio management. nine0003

On the other hand, rising unemployment and active stimulus to economies by central banks back in 2018-2019 spoke of an approaching recession. It remained unknown what event would serve as a trigger for the collapse of the markets, but it was clear that this would happen. Thus, it was possible to prepare for the collapse - at least through sectoral rebalancing of stocks in the portfolio - by focusing on defensive industries.

/sectors/

How to diversify your portfolio by sectors

The so-called bear markets, that is, the collapse of quotes by more than 20%, we observed in 2008 and 2020 - the drawdowns were 56.8 and 33. 9%, respectively. Counting back to 1950, a bear market occurs every 7.78 years on average. In addition, every 1.84 years there are corrections - when the market falls by 10-20%. For example, in the period from 2008 to 2020, investors went through 6 such falls. They also witnessed 7 drawdowns ranging from 5 to 10%.

9%, respectively. Counting back to 1950, a bear market occurs every 7.78 years on average. In addition, every 1.84 years there are corrections - when the market falls by 10-20%. For example, in the period from 2008 to 2020, investors went through 6 such falls. They also witnessed 7 drawdowns ranging from 5 to 10%.

In addition to the fact that the markets regularly storm, the strength of these unrest increases. Blackstone research shows that the volatility of the S&P 500 has increased every decade. If we count the number of days when the index moved by 3% or more in a trading session, then in the period from 2000 to 2009there were 95 of them in a year, which is more than in the previous 50 years. From 2010 to 2020, there were 50 such days, which is less than in the zero days, but still confirms the upward trend in volatility.

As a result: investors often face drawdowns and volatility, so you can insure yourself with the help of hedging.

The S&P 500 rises over 300% in the 11 years after the 2008 crisis until the next bear market. Source: TradingView The S&P 500 has risen over 300% in the 11 years since the 2008 crisis until the next bear market. Source: TradingView Red background - bear markets, blue background - corrections and drawdowns of 5-10%. The numbers in brackets are their duration in days. Source: Yardeni Research

Source: TradingView The S&P 500 has risen over 300% in the 11 years since the 2008 crisis until the next bear market. Source: TradingView Red background - bear markets, blue background - corrections and drawdowns of 5-10%. The numbers in brackets are their duration in days. Source: Yardeni Research What is the difference between diversification and hedging

Diversification removes most of the specific risks associated with the issuer, sector, specific country and asset class and generally smoothes portfolio volatility. But it works best only in normal market conditions, and loses its effectiveness in crisis scenarios.

The fact is that in falling markets, the correlation between assets greatly increases: during a panic, investors massively throw off a wide range of securities, regardless of sectors, capitalization of issuers and geography. nine0003

Moreover, bonds, which are considered the classic stock portfolio diversifier, can fall in the same way as risk assets during a crash. So it was in March 2020 during the coronavirus collapse. This is shown in the charts below.

So it was in March 2020 during the coronavirus collapse. This is shown in the charts below.

In a calm market, for example, in the period 2014-2017, high-risk assets - S&P 500, global equities, emerging markets, REITs - are only positively correlated with each other. Low-risk assets, such as municipal bonds, corporate bonds, and long-term treasuries, are also linked only to each other. And there is practically no correlation between these two groups of assets. But during the collapse in March 2020, all correlations intensified - not only within each of these groups, but also between all asset classes. As a result, bonds fell along with stocks. nine0003

That is, at critical moments when the protective function of diversification is most needed, it fails. In this sense, the hedging mechanism is fail-safe and better protects against crisis scenarios.

A hedge is essentially an investment designed to move in the opposite direction from the underlying asset. The hedge-to-asset correlation remains negative under any scenario, which means that the mechanism is guaranteed to compensate for drawdowns.

Hedging is a flexible strategy. It can be applied broadly to minimize losses across all instruments in a portfolio, be it stocks, bonds, gold, and commodities. And it can be used narrowly, to protect a specific position. nine0003

This can be done tactically, for example, when an investor creates short-term protection in anticipation of a correction. Or you can use hedging as part of an investment strategy. It all depends on the needs of the investor, his goals and risk tolerance. But most often, hedging is tactical in nature, because the hedging mechanism itself also carries risks and additional costs. For example, in the case of inverse ETFs, this is an increased fund fee. Therefore, it is important to clearly understand how, when and why to use this tool. nine0003 Classes of high-risk, low-risk assets and gold have implicit relationships - within values from -0.5 to 0.5. These relationships are not shown in the diagram. Source: Marker The high-risk, low-risk asset classes and gold have implicit relationships ranging from −0. 5 to 0.5. These relationships are not shown in the diagram. Source: Marker Source: Marker Source: Marker Until March 9, 2020, long-term treasuries and the S&P 500 showed an inverse correlation, but during the market crash, they also went down. Source: Marker Up to 9In March 2020, long-term treasuries and the S&P 500 showed an inverse correlation, but during the market crash, they also went down. Source: Marker Source: Marker Source: Marker

5 to 0.5. These relationships are not shown in the diagram. Source: Marker Source: Marker Source: Marker Until March 9, 2020, long-term treasuries and the S&P 500 showed an inverse correlation, but during the market crash, they also went down. Source: Marker Up to 9In March 2020, long-term treasuries and the S&P 500 showed an inverse correlation, but during the market crash, they also went down. Source: Marker Source: Marker Source: Marker

Main types of hedging

I will list the most popular hedging instruments.

Opening short positions. The investor in this case borrows shares, sells them, and then buys them at a lower price. The difference between selling and buying back shares is the profit made in a falling market. nine0003

Disadvantages of the method: margin trading requires a collateralized account, because you borrow shares. The broker also takes a commission for renting shares and can forcibly close the investor's position at an unfavorable price.

Purchase of PUT options. This is a contract between two investors in which the buyer of the contract is given the option, but not the obligation, to sell an asset at a predetermined price, regardless of its future quotes. In other words, if an investor expects a fall in the price of an asset, he buys a PUT option on it, fixing the current price of the asset. In the future, if quotes really start to fall, the investor will be able to sell his asset at the original price - as if there was no fall. And if the quotes do not fall, then the right to sell can not be used - the investor will lose only the premium paid for the option. nine0003

/option/

How to trade options on the Moscow Exchange

Sale of futures contracts. This is a similar contract between two investors to buy and sell an asset at a certain date in the future at a predetermined price. If the investor believes that the price of an asset will fall, he sells the futures. In the future, the buyer of a futures contract will be obliged to buy the asset not at the current price, but at the price agreed upon at the time of the conclusion of the futures contract.

In the future, the buyer of a futures contract will be obliged to buy the asset not at the current price, but at the price agreed upon at the time of the conclusion of the futures contract.

Swaps. Another type of term transaction, when the parties exchange payments within a certain period. Often used by banks and funds for currency hedging. In particular, FinEx uses this mechanism when managing its ETFs: FXRB, FXMM, FXRW.

Purchase of inverse ETFs. These ETFs are designed to mirror the benchmarks. In other words, when the index falls, they grow. At the same time, there are inverse ETFs that offer both proportional growth - 1x, and with a multiplicity of 2x and 3x. The first ones, when the base index falls by 1%, grow by the same amount, while the other two give out 2 and 3% returns, respectively. This profitability is achieved through the use of credit leverage, that is, "shoulders". nine0003

If an investor has a high risk tolerance and is interested in using less capital when hedging, he can turn to similar ETFs - with double and triple effect. In an article about an all-weather strategy, I touched a little on the use of leveraged ETFs. Separately, I want to note that this is more of a trading tool, although it can be used in a long-term strategy, and there is a mathematical justification for this. But we do not recommend investors to use any margin instruments , including inverse ETFs with 2x and 3x multiples. Therefore, further in the article we are talking exclusively about 1x reverse ETFs.

In an article about an all-weather strategy, I touched a little on the use of leveraged ETFs. Separately, I want to note that this is more of a trading tool, although it can be used in a long-term strategy, and there is a mathematical justification for this. But we do not recommend investors to use any margin instruments , including inverse ETFs with 2x and 3x multiples. Therefore, further in the article we are talking exclusively about 1x reverse ETFs.

/all-weather-long/

How an all-weather portfolio works

Although short positions and derivatives are the main hedging methods, they are quite difficult for the investor and require additional conditions - for example, the use of margin accounts with collateral, that is, additional cash reserves. And the most significant disadvantage of shorts and futures is that an investor can lose more than he invested. In fact, the amount of losses in this case is not limited. nine0003

At the same time, you do not need to open a special account to buy an inverse ETF. Although the risks of using this tool are also there. Let's consider them in more detail.

Although the risks of using this tool are also there. Let's consider them in more detail.

How inverse ETFs work

The main difference between conventional ETFs and inverse ETFs is that the latter are designed to achieve a stated goal within one day. This is to ensure that no matter when you buy the fund, it will provide the stated multiplier for that day - 1x, 2x or 3x. And on the horizon of many days, the total return of the fund is distorted, and it ceases to be a mirror to the standard. nine0003

The problem is that inverse ETFs suffer losses in a volatile market: if the price of an asset first falls and then bounces back, then the result on the inverse ETF will be negative, not zero, as is the case with conventional instruments and short positions. But when the market is trending and the benchmark falls for several days in a row, the result of an inverse ETF outperforms a short position. Thus, on periods longer than a day, the reverse ETF acts as a non-linear instrument: its mirror result is not proportional to the movement of the benchmark. nine0003

nine0003

Consider a hypothetical example: we invested in an inverse ETF with an underlying asset worth $100 (7381 R). Then the asset quotes fell on the first day by 20% to $80 (5904 R), on the second day by 25% to $60 (4428 R). Accordingly, the value of the inverse ETF will first increase by 20%, then by 25%. It will be 100 $ (7381 R) × 1.2 × 1.25 = 150 $ (11 071 R). Earned profit — $50 (3690 Р).

At the same time, if we opened an equivalent short position, then its increase would be equal to the value of the fall of the benchmark in absolute terms: 100 $ (7381 R) − 60 $ (4428 R) = 40 $ (2952 R). Thus, when the market is trending, the return on the reverse ETF exceeds the return on the short.

Now suppose that on the third day the value of the asset returned to $100 (7381 R). Then the profit on the short position will be equal to zero. But for the reverse ETF, the picture is different: the asset grew by 66.7% that day - from $60 (4428 R) to $100 (7381 R). Therefore, the reverse ETF will lose 66.7% of $150 (R11,071), which is $100 (R7381). As a result: the investor's position will be $50 (3690 R) - he will receive a loss of 50% of the initially invested 100 $ (7381 R).

Therefore, the reverse ETF will lose 66.7% of $150 (R11,071), which is $100 (R7381). As a result: the investor's position will be $50 (3690 R) - he will receive a loss of 50% of the initially invested 100 $ (7381 R).

As you can see from the example, even if the investor correctly predicted the correction for the asset by betting on its fall, strong volatility can lead to losses. Theoretically, if the value of an asset drops from $100 (R7381) to $1 (R73) in one day, and rises to $2 (R146) the next day, the value of an inverse ETF position will become zero. But this is a hypothetical example, as in practice the S&P 500 has never moved more than 12% in a trading session. nine0003

Community 02/09/21

What is a Hedged ETF?

Loss on volatility is the main reason why reverse funds provide the stated multiplier only within one day and rebalance their positions daily. This, among other things, leads to a higher management fee compared to conventional ETFs - about 1%. Although the commission may seem normal for Russian investors: conventional funds listed on the Moscow Exchange often charge a comparable fee for their services. But this only means that reverse ETFs on the Moscow Exchange would take even more. nine0003

Although the commission may seem normal for Russian investors: conventional funds listed on the Moscow Exchange often charge a comparable fee for their services. But this only means that reverse ETFs on the Moscow Exchange would take even more. nine0003

Thus, in a multi-day market decline, inverse ETFs will rise more than the benchmark index falls. In other cases, when we hold an inverse ETF for a long time, for example, a year, we will go through a large number of waves replacing each other and losses from volatility will greatly affect the final result - the return on inverse ETFs will obviously be lower than when opening short positions if do not take into account related commission costs. For example, if we compare the SPY ETF with its reverse variant SH, then the benchmark has grown by 15.73% over the past year. Accordingly, with a short position, we would have received a loss of -15.73%, but with SH we will have -24.97%.

Let's summarize the intermediate result: the longer an investor owns a reverse fund, the more its total return will diverge from the benchmark. This is due to the action of compound interest in a volatile market, when losses and profits alternate. And on short trend periods, the addition of daily results, on the contrary, increases the profitability of funds.

This is due to the action of compound interest in a volatile market, when losses and profits alternate. And on short trend periods, the addition of daily results, on the contrary, increases the profitability of funds.

The table below shows the hypothetical return of an inverse ETF in a rising, falling, and volatile market. As you can see, two days of -5% returns in an up market result in a -9 inverse ETF return..75%. Two days of 5% profit in a down market gives a total return of 10.25%. In an unstable market, when a loss of 5% alternates with a subsequent increase of 5%, this does not lead to zero profitability, but to a loss of -0.25%. This data is provided for illustrative purposes and does not take into account the costs associated with buying and managing ETFs.

The indicated deviation of inverse ETFs from the sample leads to the fact that investors who use inverse funds for long periods, for example more than a month, should periodically rebalance their hedge position. At the same time, it is desirable to keep abreast and monitor the state of the market daily. nine0003

At the same time, it is desirable to keep abreast and monitor the state of the market daily. nine0003

Reverse 1x ETF behavior in different market situations

25 $ 9000,0002

25 $ 9000,0002  25 $

25 $  Rebalancing can be done regularly or at a certain deviation from the norm - when the difference between the initial size of the hedge and its current share reaches a given percentage. For example, when the deviation of the hedge from the original share reaches 10%.

Rebalancing can be done regularly or at a certain deviation from the norm - when the difference between the initial size of the hedge and its current share reaches a given percentage. For example, when the deviation of the hedge from the original share reaches 10%.

02%

02%  7%, and volatility by 6.85%. In addition, the portfolio with gold performed better on the rebound.

7%, and volatility by 6.85%. In addition, the portfolio with gold performed better on the rebound.