Best way to buy a house

How to Buy a House in 2022

By Rachel Cruze

By Rachel Cruze

Listen to this article

Buying a home is a huge deal, you guys. And when you throw a crazy real estate market on top of it, shopping for a home can feel like buckling up for an emotional roller coaster.

But I’m here to share a step-by-step process for how to buy a house in 2022. We’ll go over things like figuring out if you’re ready to buy, saving for a down payment, and getting preapproved for a mortgage. Then we’ll look at what you need to know about finding a real estate agent, putting in offers, and making it all the way to closing day.

10 Steps to Buying a House

Use this step-by-step plan to buy a house the smart way.

- Make sure you're actually ready to buy.

- Figure out how much house you can afford.

- Save for a down payment.

- Get preapproved for a mortgage.

- Find the right real estate agent.

- Go house hunting.

- Make an offer on a house.

- Get a home inspection and appraisal.

- Be patient getting your mortgage finalized.

- Close on your house.

Step 1: Make sure you’re actually ready to buy.

I know. The housing market seems insane right now. Like, it’s crazy town. But the basics for figuring out if you’re ready to buy a house are the same no matter what’s going on out there.

Find expert agents to help you buy your home.

First things first: Before you jump into the home-buying process, I want you to be debt-free with 3–6 months of expenses saved up in an emergency fund. Think of this money like an insurance policy against life—it’s important to have this safety net when you get ready to make a big purchase like a house.

Picture this: When you buy a home, your landlord is you! That means paying for repairs is your responsibility. So, if the hot water heater springs a leak two weeks after moving in, it’ll be no big deal because you have an emergency fund to cover the repairs.

But when your budget is eaten up by debt payments and you don’t have any savings to fall back on, you might be eating ramen for the rest of the month just to get that water heater fixed. That’s not fun . . . or tasty. With a full emergency fund and no debt draining your monthly budget, an unexpected repair will just be an inconvenience—not the end of the world.

Another thing to think about before buying a house is your stage of life. It doesn’t make sense to buy a house if you plan to move sometime in the next year. Buying and selling a house is an expensive process, so you’ll want to live in that area for the next 5–7 years. (This is one of the reasons we recommend waiting at least a year after getting married to buy a house.)

Here are seven things to check off your list before you’re ready to buy a house:

- You’re debt-free with a fully funded emergency fund.

- You can afford monthly mortgage payments and home maintenance.

- You have a good down payment.

- You can pay your own closing costs.

- You can cash flow moving expenses.

- You plan on staying put for a while.

- You have a real estate agent you trust.

Still not sure? Take our assessment to see if you’re ready to buy.

Step 2: Figure out how much house you can afford.

If you’re ready to buy, your next step is figuring out your home-buying budget. I tell people to buy a house only when the monthly payment is no more than 25% of their monthly take-home pay. Anything more than that and you risk being house poor. Sticking to a 25% monthly payment leaves plenty of room in your budget to cover home maintenance and repairs while hitting your other money goals, like saving for retirement.

To be clear, that 25% limit includes principal, interest, property taxes, home insurance and private mortgage insurance (PMI)—and don’t forget to take homeowners association (HOA) fees into consideration. Use our mortgage calculator to try out different home prices within your budget.

Now, you might see some housing lenders recommending the 28/36 rule. By this guideline, your house payment would be no more than 28% of your gross monthly pay and 36% of your total monthly debt payments. But if you follow this rule, you could end up not being able to afford your mortgage.

Once you know how much you can afford to spend on your new home, stick to it. And if you’re buying a home with your spouse, make sure you’re both on the same page about your budget. You don’t want any surprises when it comes to saving for a down payment.

Step 3: Save for a down payment.

Real talk. Shopping for a home is way more fun than patiently saving up enough money to buy it. (Delayed gratification doesn’t feel fun, but it sure pays off!) But here’s a tip: Don’t give in to the temptation of looking at house listings before you have a solid down payment saved up. Because guess what could happen? You’ll find a dream home way outside of your budget, and you’ll try to convince yourself your down payment is enough. Don’t do this! A flimsy down payment is a recipe for regret when it comes to buying a home.

Don’t do this! A flimsy down payment is a recipe for regret when it comes to buying a home.

How Much Should You Save?

Just like any goal, buying a home the smart way takes planning and preparation. The most time-consuming part of this whole process is saving cash for the down payment, closing costs and other moving expenses. If you’re not sure how much is enough to save, here are some good starting points:

- Down payment: I want you to put down a minimum of 10% on your new home, but 20% or more is even better because you’ll avoid PMI. PMI is a fee added to your monthly mortgage payment to protect your lender in case you default on your loan, and it won’t go away until you have at least 20% equity in your home. If you’re a first-time home buyer, a 5–10% down payment will be enough, but it means you’ll be paying PMI a little bit longer.

- Closing costs: One of our Endorsed Local Providers (ELPs) tells his clients to save around 3% of a home’s purchase price for closing costs and prepaids.

Closing costs cover any property taxes, insurance items, or fees charged by your title company and lender. That percentage might vary depending on what area you’re buying in.

Closing costs cover any property taxes, insurance items, or fees charged by your title company and lender. That percentage might vary depending on what area you’re buying in. - Moving and other expenses: Moving expenses can vary from hundreds to thousands of dollars depending on how much stuff you’re moving and how far away your new home is from your current place. To help with budgeting, call a few moving companies in your area for quotes ahead of time. If you plan to make updates to your home—like painting, installing new carpet or buying furniture—you’ll need cash for that too.

Ready to get your savings rolling? Saving for a down payment isn’t rocket science. But you do need to be intentional about it. Set a plan and focus on your milestones, and you’ll have that down payment before you know it. You’ve got what it takes!

Step 4: Get preapproved for a mortgage.

The best way to buy a home is with cash—but if you have to get a mortgage, there’s nothing wrong with that. Getting preapproved is the first step to securing a home loan.

Getting preapproved is the first step to securing a home loan.

How Do You Get Preapproved?

A mortgage lender can prequalify you to buy a house with a simple conversation about your income, assets and down payment. But getting prequalified isn’t the same as getting preapproved.

Preapproval takes a little more work. A lender will need to take a look at your paycheck stubs, tax returns and bank statements to figure out how big of a mortgage you can afford. But it pays off when you start your home search because a preapproval letter shows that you’re a serious buyer. Sellers like serious buyers!

Which Mortgage Option Is Right for You?

Bad financing turns your biggest asset—your home—into a liability. That’s why getting the right mortgage is so important. Setting your boundaries on the front end makes it easier to find a home you love that’s also in your budget.

Here are the guidelines we recommend:

- A fixed-rate conventional loan: With this option, your interest rate is secure for the life of the loan, leaving you protected from rising rates.

Adjustable-rate mortgages are a terrible idea because you could get stuck paying a much higher interest rate. Also, steer clear of FHA and VA loans because they have high fees attached to them.

Adjustable-rate mortgages are a terrible idea because you could get stuck paying a much higher interest rate. Also, steer clear of FHA and VA loans because they have high fees attached to them.

- A 15-year term: Your mortgage payment will be higher with a 15-year term than a 30-year term, but you’ll knock out your mortgage in half the time—and save tens of thousands of dollars in interest. That’s a win for me!

Step 5: Find the right real estate agent.

Your home search might start with some online window shopping, but it shouldn’t end there. You can do a lot of research on your own, but you’ll need the help of an expert when it comes to finding and securing your perfect home.

A buyer’s agent can help you navigate the home-buying process. In some cases, they can even help you find a great house before it hits the market, giving you a competitive edge. How’s that for being a smart shopper? And when it comes to making an offer, your agent will negotiate on your behalf so you won’t pay a penny more than you have to.

How Much Does a Buyer’s Agent Cost?

A real estate agent will put your best interests first, and they’re a crucial part of your home-buying team. So, how much should you be prepared to pay for an agent?

How does nothing sound?

That’s right! In most cases, the seller pays your real estate agent’s fees, so using a buyer’s agent is usually free to you. Why wouldn’t you want a pro in your corner as you make your biggest investment?

How to Choose the Best Buyer’s Agent

You may know a lot of real estate agents in your area. But keep in mind, not all agents bring the same knowledge and experience to the table. Don’t work with an amateur just because you want to be nice, and don’t give your business to a friend or family member. Ever. A home is the biggest purchase you’ll ever make, and you need a pro on your side.

That means you’ll want to interview a few agents before you hire one. Yep, make them show you why they deserve your business.

When you’re interviewing a real estate agent, don’t settle. A true rock star will have:

- Specific experience helping home buyers like you. What types of home buyers do they normally work with?

- Full-time real estate experience for at least several years. A part-time agent won’t cut it.

- A history of closing 35 homes a year or closing more homes than 90% of agents in your market.

- Great communication skills. Do they answer calls, texts and emails promptly?

- A super-serving attitude that makes you feel like you’re their only client.

- Expertise in your local market. How well do they know the area?

- A detailed plan in place to guide you through the next five steps of the process (which we’re about to go over). Run for the hills if you find someone who’s flying by the seat of their pants.

A professional agent won’t shy away from tough questions—they’ll encourage them. They’ll be a mover and a shaker with your best interests at heart. They’re going to look after you as you’re searching for the right house and negotiating the terms of the contract. As a home buyer, working with a top-notch agent is one of the biggest advantages you can give yourself.

They’re going to look after you as you’re searching for the right house and negotiating the terms of the contract. As a home buyer, working with a top-notch agent is one of the biggest advantages you can give yourself.

Not sure where to start? We’ve done all the work for you with our ELP program. These real estate pros will help you reach your goals and focus on getting you the biggest bang for your buck in the home-buying process—that’s why they’re RamseyTrusted.

Find a pro in your area today.

Step 6: Go house hunting.

After you’ve been preapproved for a mortgage, you’re ready for the fun part: shopping for your perfect home! (This was my favorite part of the process.) To get started, make a list of must-have home features. When you’re buying a home with your spouse, make separate lists and compare. For example, I valued a bright kitchen with lots of counter space, and Winston wanted a big backyard. A nonnegotiable for both of us was a good school district. Knowing what you and your spouse want will help with the selection process.

Knowing what you and your spouse want will help with the selection process.

Once you have a clear picture of the features you both want, share them with your real estate agent and use them as the foundation of your home search. Your agent will help you set realistic expectations and target your search to areas and homes you can afford.

Think Long Term

You might think you’re shopping for your forever home—but remember to shop with resale value in mind because no one knows what the future will bring. A job opportunity in another state or a growing family could change your idea of a forever home.

Here are some house-hunting tips to help you make a smart investment:

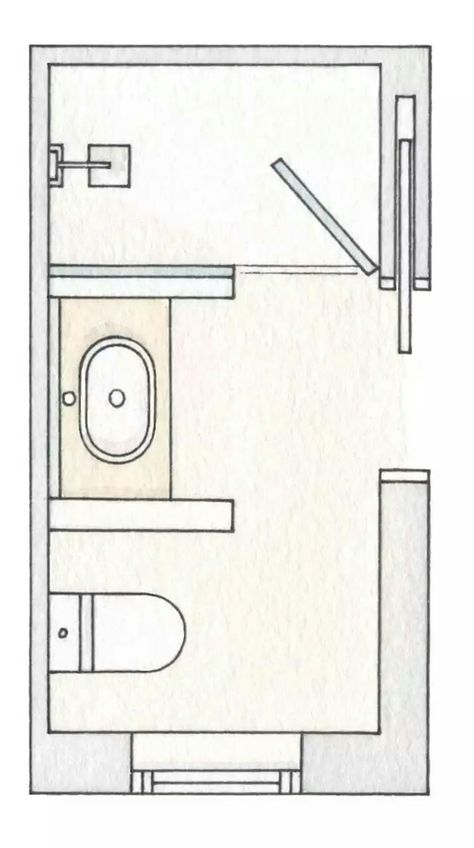

- Don’t compromise on location or layout. These are two things you can’t change about the home you buy. No amount of curb appeal can make up for a truly terrible floor plan. And buying a great house in a not-so-great neighborhood is a bad idea. If you don’t love the location or layout, chances are, buyers years from now won’t either.

- Look past the surface. Don’t let a lime-green bathroom keep you from an otherwise great home. Other buyers may not be able to look past those easy-to-fix details (like décor and paint color), which could score you a deal. That lime-green bathroom could mean more green in your pocket.

- Buy the least expensive home in the best neighborhood you can afford. That gives your home’s value room to grow in the future. Keep in mind, future buyers shopping in an inexpensive neighborhood won't be looking for an expensive home.

- Pay attention to home values in that area. Are they rising or falling? Are businesses booming or closing? You can tell a lot about home values in a neighborhood by what’s happening in the community.

- Research the school districts. Even if you don’t have kids, school districts can be an important factor when you sell. Homes in neighborhoods near great schools are generally known to sell for more money due to high competition—home-buying parents will move heaven and earth to snag those prime locations!

And one more thing: When you start house hunting, you need to be prepared for it to take a while—it could take months before you find a house that’s right for you and your budget. Now there’s a chance (since you’re so prepared from doing your homework on the front end) that a great agent could find you a house the next day. But you shouldn’t count on that happening. Just make sure you’re ready to go either way.

Now there’s a chance (since you’re so prepared from doing your homework on the front end) that a great agent could find you a house the next day. But you shouldn’t count on that happening. Just make sure you’re ready to go either way.

Hang in there, and don’t compromise on your must-haves.

Step 7: Make an offer on a house.

Once you’ve found the right home, it’s time to get serious. That means submitting your offer and signing a purchase agreement with the sellers.

What’s Included in Your Offer?

Your real estate agent will work with you to submit a solid offer. If you end up in a bidding war with other buyers, keep a cool head and put your best foot forward. Being preapproved with your lender and having a flexible closing date can make your offer stand out.

Your purchase agreement will include other details of the real estate transaction, like:

- Buyer and seller information

- Property address

- Purchase price, lender information and down payment amount

- Earnest money deposit (similar to a security deposit)

- Items to be left with the home (like appliances or furniture)

- Contingencies (more on this later) like the home inspection, appraisal and final mortgage approval

- Closing date

Sometimes agreeing on terms is quick and painless, but it can also be one of the hardest parts of the home-buying process. If your negotiations get intense, remind yourself that both parties want the same thing. The sellers want to sell their house, and you want to buy it!

If your negotiations get intense, remind yourself that both parties want the same thing. The sellers want to sell their house, and you want to buy it!

And remember: Sometimes it pays to compromise on little details if that’ll move the process forward. A good real estate agent will give you advice about when to give in and when to hold firm.

Step 8: Get a home inspection and appraisal.

Once you get to this step, you’ll officially be under contract on your new home. (By the way, under contract means the seller has accepted your offer but nothing is final yet.) That’s something to celebrate. This also means you’re done with the most time-consuming stages of the home-buying process. Cheers to that!

But now that you’re under contract, what should you expect? It normally takes about 30 days to close on a house, so you need to work through the contingencies in the contract.

Contingencies are simply conditions that must be met for the home purchase to take place. They provide a safety net for you to back out of a sale without losing your earnest money if something goes wrong.

They provide a safety net for you to back out of a sale without losing your earnest money if something goes wrong.

Even if you’re in a competitive market, don’t let your emotions lead the charge. You should never skip these contingencies because they offer important protection for your home purchase and your money.

Home Inspection

As a buyer, you have the right to a professional home inspection before you purchase the house, and it would be crazy not to do it. This is one of the most important precautions you can take before purchasing a home because it keeps you from being blindsided by structural issues or expensive repairs. If the inspection reveals major problems with the home, you can ask the seller to fix the problem, reduce the price, or cancel the contract.

You can also consider getting other pros involved so they can run other tests, like a termite inspection or a radon test, depending on your real estate agent’s advice and the age and condition of the home you’re purchasing. Your new home could look perfect from the outside, but you never know what’s going on under the foundation or in the walls.

Your new home could look perfect from the outside, but you never know what’s going on under the foundation or in the walls.

Appraisal

If you’re getting a home loan, your lender will require an appraisal to assess the value of the property. An appraisal protects you from paying more than the home’s true value. If the appraisal comes in lower than your offer price, your real estate agent can provide the best guidance for what to do next.

Step 9: Be patient getting your mortgage finalized.

If you did get a mortgage, you’ll have another step before you can close on your home: Getting final loan approval. Prepare to be patient for this part. Your lender will be digging through a ton of your financial details to finalize your mortgage, which could take more than a month to hammer out before your closing date.

Whatever you do, don’t open a credit card, go out and buy a bunch of new furniture on credit, or change jobs once you’re under contract. Doing stuff like this affects your debt-to-income ratio and could lower how much of a loan you qualify for.

Doing stuff like this affects your debt-to-income ratio and could lower how much of a loan you qualify for.

Taking on more debt is always a bad idea. But any changes in your financial situation can jeopardize your loan process.

Step 10: Close on your house.

You did it! All the planning, saving, house hunting and waiting are over. The final step in the home-buying process is closing on your new place.

Before you get the keys for your new home and officially call it your own, you have one more sprint ahead of you. Paperwork. Bring on the hand cramps . . .

You should receive a copy of your closing documents to review ahead of time so there are no surprises on closing day. Most likely, you’ll pay for:

- Closing costs

- Property taxes

- HOA fees (if this applies to your neighborhood)

- Home insurance

If there are any confusing terms or conditions as you work through the paperwork, don’t be shy about asking questions. This is one of the biggest purchases you’ll ever make, and you should know exactly what you’re signing up for.

This is one of the biggest purchases you’ll ever make, and you should know exactly what you’re signing up for.

Once you sign all the paperwork, it’s time to breathe a sigh of relief. Ahh. You’re officially a homeowner. Congratulations! The home-buying process may not be easy, but having a beautiful new home to call your own is worth it in the end.

Get More Resources on How to Buy a Home

I know this is a lot of information. That’s why we packaged this info into a single guide for you—along with bonus resources and tools to set you up for success on your home-buying journey. Get your free Ramsey Home Buyers Guide here.

Ready to Start the Home-Buying Process?

If you’re ready to get the ball rolling on your home purchase, finding a real estate agent is your next step. But how do you find an agent you can trust? Try our Endorsed Local Providers (ELP) program. We’ve been vetting agents who meet our high standards for excellence for decades. The agents we recommend are RamseyTrusted, and they’ll walk you through the home-buying process so you can make a smart investment that fits your needs and your budget.

Find a real estate pro today!

Frequently Asked Questions

How do I buy a house for the first time?

Before you do anything else as a first-time home buyer, make sure you’re debt-free and have an emergency fund of 3–6 months of expenses. That can be a tough pill to swallow, but it’s a proven way to set yourself up for homeownership. With that emergency fund in place, you’ll be ready to take care of your home without slipping back into debt. Ideally, you’ll want to save a down payment of at least 20% of the home price to avoid private mortgage insurance (PMI). Although, as a first-time home buyer, a smaller down payment like 5–10% is okay too. But then you’ll have to pay PMI. Whatever you do, never buy a house with a monthly payment that’s more than 25% of your monthly take-home pay on a 15-year fixed-rate mortgage (which has the overall lowest total cost). And stay away from expensive loans like FHA, VA and USDA. Use our mortgage calculator to enter different down payment amounts to find the home price that fits within your budget.

What are the 3 main steps to prepare for when buying a house?

The first step to prepare for when buying a house is to save a big down payment. To free up your income and protect your savings from life’s unexpected costs, make sure you’re debt-free and have an emergency fund of 3–6 months of expenses built up before saving for a house.

The second step is to get your finances in order. If you’re going the mortgage route, work with a home loan provider you can trust to get a preapproval letter—not having this could cause sellers to overlook your offer. For the approval process, organize all the documents you need to get a mortgage so they’re easily available for your lender.

The third step is to find a really excellent real estate agent. An experienced agent will help you find and secure a home that fits your needs and budget—not to mention they’ll be your guide throughout the entire home-buying process. Try interviewing more than one agent to be sure to choose the best one for you.

What are the requirements to buy a house?

The main requirements to buy a house include a down payment, money for closing costs and proof that a lender can trust you to make mortgage payments. This proof could be in the form of a good credit score in the mid-600s or higher. But really, you don’t need a credit score to buy a house. If you’ve been living a debt-free lifestyle, you probably don’t even have a credit score—and that’s a good thing!

Keep in mind: No credit isn’t the same as bad credit. Buying a house with bad credit is a terrible idea. If your credit score is lower than the mid-600 range, you’ll only be eligible for loans with super high interest rates and risky features. If you have bad credit, first cut up your credit cards and cancel the accounts. Then, be patient as you focus on paying off all your debt before buying a house. You’ll thank yourself later!

About the author

Rachel Cruze

Rachel Cruze is a #1 New York Times bestselling author, financial expert, and host of The Rachel Cruze Show. Rachel writes and speaks on personal finances, budgeting, investing and money trends. As a co-host of The Ramsey Show, America’s second-largest talk radio show, Rachel reaches 18 million weekly listeners with her personal finance advice. She has appeared on Good Morning America and Fox News and has been featured in publications such as Time, Real Simple and Women’s Health magazines. Through her shows, books, syndicated columns and speaking events, Rachel shares fun, practical ways to take control of your money and create a life you love. Learn More.

Rachel writes and speaks on personal finances, budgeting, investing and money trends. As a co-host of The Ramsey Show, America’s second-largest talk radio show, Rachel reaches 18 million weekly listeners with her personal finance advice. She has appeared on Good Morning America and Fox News and has been featured in publications such as Time, Real Simple and Women’s Health magazines. Through her shows, books, syndicated columns and speaking events, Rachel shares fun, practical ways to take control of your money and create a life you love. Learn More.

Conquer the real estate market.

Show Me Local AgentsConquer the real estate market.

Don’t navigate the housing market alone. Work with a real estate agent who cares more about helping you find your dream home than about scoring a paycheck.

Show Me Local Agents

Conquer the real estate market.

Don’t navigate the housing market alone. Work with a real estate agent who cares more about helping you find your dream home than about scoring a paycheck.

Show Me Local Agents

Buying A House In 2022: Step-By-Step

Buying a house is a major commitment. Before you begin shopping for properties or comparing mortgage options, you need to make sure you’re ready to be a homeowner.

Wondering if you should buy a house? Let’s look at some of the factors that lenders and homeowners alike should consider.

Income And Employment Status

Your lender won’t just want to see how much money you make. They’ll also want to see a work history (usually about 2 years) to make sure your income source is stable and reliable.

Preparing your income is all about pulling the right documentation together to show steady employment. If you’re on payroll, you’ll likely just need to provide recent pay stubs and W-2s. On the other hand, you’ll need to submit your tax returns and other documents the lender requests if you’re self-employed.

If you’re on payroll, you’ll likely just need to provide recent pay stubs and W-2s. On the other hand, you’ll need to submit your tax returns and other documents the lender requests if you’re self-employed.

Debt-To-Income Ratio

Debt-to-income ratio (DTI) is another financial instrument mortgage lenders use to evaluate your loan application. Your DTI helps your lender see how much of your monthly income goes to debt so they can evaluate the amount of mortgage debt you can take on.

DTI is calculated by dividing your monthly debt by your gross monthly income. For example, if your monthly debts (credit card minimum payments, loan payments, etc.) total $2,000 per month and your gross monthly income is $6,000, your DTI is $2,000/$6,000, or 33%. Your lender will use the debts shown on your credit report to calculate your DTI.

Depending on the type of loan you’re applying for, your lender may also calculate your housing expense ratio, also sometimes referred to as front-end DTI. This is a ratio that looks at your total monthly house payment (principal, interest, taxes and insurance) compared to your monthly income. For example, if you have a $1,200 house payment and the same $6,000 monthly income, your housing expense ratio is $1,200/$6,000, or 20%.

This is a ratio that looks at your total monthly house payment (principal, interest, taxes and insurance) compared to your monthly income. For example, if you have a $1,200 house payment and the same $6,000 monthly income, your housing expense ratio is $1,200/$6,000, or 20%.

It’s smart to review your DTI before you apply for a loan. In most cases, you’ll need a back-end DTI of 43% or less to qualify for the most mortgage options, although this number varies based on your lender, loan type and other factors.

Liquid Assets

Even with the help of a mortgage, you’ll still need liquid assets to fund the purchase of a home, specifically your:

Down payment: Buying a home with no money down is possible, but most homeowners need to have some cash for a down payment. A down payment is the first major payment you make on your loan at closing.

The amount of money you’ll need for a down payment depends on your loan type and how much money you borrow. You can buy a home with as little as 3% down (though there are benefits to putting down more).

Closing costs: You’ll also need to pay for closing costs before you move into your new home. Closing costs are fees that go to your lender and other third parties in exchange for creating your loan.

The specific amount you’ll pay in closing costs will depend on where you live and your loan type. It’s a good idea to be prepared for 3 – 6% of your home’s value as an estimate of your closing costs. In some situations, part of closing costs can be rolled into your mortgage or paid by the seller using seller concessions.

Credit Health

Your credit score plays a huge role in what loans and interest rates you qualify for. Your credit score tells lenders how much of a risk you are to grant a loan.

Taking steps to improve your credit score and reduce your debt can pay off big as you prepare to get a mortgage. Better numbers mean better loan options with lower interest rates.

Your credit score is based on the following information:

- Your payment history

- The amount of money you owe

- The length of your credit history

- Types of credit you’ve used

- Your pursuit of new credit

What score will you need to qualify for a home loan? Most lenders require a credit score of at least 620 to qualify for the majority of loans. A score above 720 will generally get you the very best loan terms.

A score above 720 will generally get you the very best loan terms.

At Rocket Mortgage®, you can qualify for an FHA or VA loan with a 580 median FICO® Score. However, to qualify for these with a median score below 620, you’ll need a housing expense ratio of no more than 38% and an overall DTI no higher than 45%.

Willingness To Live In One Place

A mortgage can be a 30-year-long commitment. Though you don’t need to live in your home for the entirety of your mortgage term, it’s still a big decision. When you own a home, it’s more difficult to move. Unless you’re buying a second home or investment property, you might need to sell your current home first, which can take time.

Decide whether you’re ready to live in your current area for at least a few more years. Consider your career goals, family obligations and more. Each of these factors will play a major role in the type of home you buy and where you set up your primary residence.

Timing

Deciding whether it’s a good time to buy a house or not depends on a variety of personal factors (such as financial readiness and lifestyle preferences) and market conditions (such as economic health and current mortgage rates).

Ultimately, the right time to buy a home comes down to your own unique situation. Be sure to consult a financial expert before making any big financial decisions such as buying a house.

Which houses to avoid in the secondary market

- Home

- Articles

- What houses to avoid in the secondary market

"Buy, move in and live" - this is how sellers of apartments in dilapidated Khrushchevs lure buyers. At the same time, buyers are hearing claims that the Khrushchev houses are nearing the end of their useful life and are about to fall apart. Similar conversations are also being held around stalins, panel houses ... In fact, everything is not so simple. If you, for example, are interested in buying an apartment near the metro, you need to pay attention not only to the location of the house, but also to its condition, regardless of the year of construction.

The age and condition of the house is much more important than construction technology

The maximum service life of concrete and brick buildings with concrete floors usually exceeds 100 years. The same applies to houses called Stalinist. So most of the houses on the secondary market, subject to conscientious construction and normal operation, can provide conditions for a normal life for another 30-60 years. But unfortunately, with the construction and operation, not everything goes smoothly.

Not all Khrushchev houses and more modern brick and panel houses were built to last. Poor-quality building materials and non-compliance with technology were commonplace. The most obvious sign is crooked walls that do not fit into any building codes. Bricks falling out of the masonry, and cement, more like packed sand, are also not something extraordinary.

If you don't want to level and insulate crooked walls - you can buy an apartment in New Tushino from the developer

You need to pay attention to such nuances when buying both secondary and primary real estate. But if all these problems are hidden under a beautiful renovation, it’s difficult to “get to the bottom” of them. But if you decide, for example, > to buy a one-room apartment from the developer, you will have the opportunity to look at the bare walls and evaluate the quality of the builders' work.

But if all these problems are hidden under a beautiful renovation, it’s difficult to “get to the bottom” of them. But if you decide, for example, > to buy a one-room apartment from the developer, you will have the opportunity to look at the bare walls and evaluate the quality of the builders' work.

Repairs and communications

Periodically (once every several decades) major repairs must be carried out in residential buildings. Therefore, if you are going to buy an apartment in a building that is, for example, 40 years old, ask when it was overhauled. If it was not held at all and is not planned in the near future, it is worth looking for other options.

Even if everything is done perfectly in your apartment, worn-out communications and a leaky roof will not let you enjoy comfort. By the way, communications are not as durable as brick or concrete walls.

Those who decided to buy >apartments in Kuntsevo appreciated the benefits of a modern parking lot from the developer

The service life of plumbing and heating pipes depends on the material used and usually does not exceed 30 years. Not eternal and electrical wiring. Depending on the material - copper or aluminum, it must be replaced after 40 or 20 years respectively.

Not eternal and electrical wiring. Depending on the material - copper or aluminum, it must be replaced after 40 or 20 years respectively.

Problems may not be visible, but sooner or later they will make themselves felt. A leaky riser may not bother you if the water runs straight into the basement. But the fact is that dampness will gradually destroy the foundation, lead to improper shrinkage and cracks in the walls. The process is slow and imperceptible, but it can lead to very unpleasant and difficult to eliminate consequences. By the way, you probably paid attention to the fact that dampness in the basements of old houses is not such a rare occurrence.

When choosing an apartment on the secondary market, you need to be interested in the condition of not only the apartment being purchased, but also the entire house, including its communications.

Paying attention to weak points

As for prefabricated houses, their weak point is numerous seams. Behind them are the joints of the panels. And if in civilized countries it is customary to make embedded elements from stainless steel, then in our country they are simply painted with anti-corrosion paint. Combined with poor quality grouting and lack of proper maintenance, this can lead to a reduction in the life of houses. Therefore, when buying an apartment in a panel house, you should pay special attention to the condition of the seams between the panels.

And if in civilized countries it is customary to make embedded elements from stainless steel, then in our country they are simply painted with anti-corrosion paint. Combined with poor quality grouting and lack of proper maintenance, this can lead to a reduction in the life of houses. Therefore, when buying an apartment in a panel house, you should pay special attention to the condition of the seams between the panels.

You can >buy an apartment in Odintsovo in a monolithic house from FGC "Leader", which will stand quietly for 150 years. Hinged facades and insulation not only contribute to comfort, but also protect the house from environmental influences. The insulation and concrete walls of such a house always remain dry and do not freeze through. But it can be quite difficult to determine the quality of construction of such a house, so it is better to focus on the reputation of the developer.

Investment property in New Zealand

Search articles and news

-

-

Article

-

News

-

Video

-

Special project

-

Webinar

-

Photo report

-

Rating

-

Editor-in-Chief Blog

-

Opinion

-

Test

-

Calculator

-

affiliate material

Show

-

Search title only

Publication period:

- For the entire period

Interesting to read

- 95613

- 01/02/2022

Over the past years, Poland has become an established labor market for citizens of Ukraine, Russia and Belarus. It is easy for citizens of the former USSR to go to a neighboring state: to the proximity of the language and ...

It is easy for citizens of the former USSR to go to a neighboring state: to the proximity of the language and ...

- 4252

- 30.04.2022

- 74819

- 01/06/2022

- 8767

- 05/17/2022

Rating

Digest

Digest

Digest

Best Offers

756,000 €

Apartments in Ras Al Khaimah, UAE

245 m 2 4 3 3

The complex is located on the island of Marzhan, where you can find everything for a comfortable life, private beach, swimming pool , a promenade for walking, a bike path, a playground, as well as five-star hotels and Al Hamra Mall. - We can also help you set up a business in Ras Al Khaimah or Umm Al Qaiwain. When buying or opening...

- We can also help you set up a business in Ras Al Khaimah or Umm Al Qaiwain. When buying or opening...

ALPHA REAL ESTATE RAK

153,000 €

Apartments in Antalya, Turkey

140 m 2 3

Residence permit upon purchase

3+1 apartment, Kepez/Antalya - buy at Azpo

Azpo3 470 000 €

Commercial property in Porto, Portugal

763 m 2

Residence permit upon purchase Online display Remote deal Loan

This is a project for the rehabilitation of a building located on one of the central and historical streets of the city. The building consists of 5 spacious apartments and an additional public service located on the ground floor and a large terrace. It has a tourist accommodation license (RNAL). Opportunity to get Golden Visa for up to 7 investors! He...

The building consists of 5 spacious apartments and an additional public service located on the ground floor and a large terrace. It has a tourist accommodation license (RNAL). Opportunity to get Golden Visa for up to 7 investors! He...

Amber Star Real Estate

64 443 €

Apartments in Kvariati, Georgia

36 m 2 1 1 1

Online show Remote deal Credit

12-storey apart-hotel located in the first sea lines, includes a natural beach area, paths for running and cycling. And the final project will be surrounded by green spaces. THE COMPLEX INCLUDES: Isolated territory Recreational and entertainment establishments 103 apartments of different sizes 2-storey parking...

Gumbati Group

225,000 €

Penthouse in Alanya, Turkey

125 m 2 3 2

Residence permit upon purchase of

TAPU for the apartment is ready! Suitable for citizenship! A new project is growing in the attractive Oba area of Alanya. Construction is scheduled to start at the end of 2021, and until the end of construction, simple payment options will be available, such as 0% interest rate * and installment payment. Project location - 1300 meters from the turquoise beach...

Construction is scheduled to start at the end of 2021, and until the end of construction, simple payment options will be available, such as 0% interest rate * and installment payment. Project location - 1300 meters from the turquoise beach...

renaissance estate

500,000 €

Hotel, hotel in the Algarve, Portugal

105 m 2 5% per year

Residence permit upon purchase Online display Remote transaction

Profitable object suitable for investment residence permit *Golden visa* with subsequent citizenship! Luxury apartment with two bedrooms and a terrace in a tourist complex in the Algarve. The design of the apartments creates a sense of privacy and escape from the demanding urban lifestyle. All ground floor apartments have a private. ..

..

PORTUGALITY

129 729 €

Apartments in Thailand

40 m 2 1 1

Description of the project New investment project The Marin from one of the best developers in Phuket! This time, the architects have embodied in the concept of the hotel luxury and elegance of details, incredible comfort and coziness, so that you can completely immerse yourself in the relaxing atmosphere of Phuket. The hotel will consist of 265 rooms. Available for your choice:...

Dream Phuket

300 960 €

Apartment in Dubai, UAE

80 m 2 2 1 Online display Remote deal Payment in rubles Credit

Designer renovated apartment with a very advantageous location in Dubai! Free property selection. Objects from the best developers. Full legal support of the transaction. We will provide you with: - A selection of the best apartments from reliable developers; - A guarantee of annual income from investments; - Interest-free installments for a period of 7 years; - Free...

Objects from the best developers. Full legal support of the transaction. We will provide you with: - A selection of the best apartments from reliable developers; - A guarantee of annual income from investments; - Interest-free installments for a period of 7 years; - Free...

DDA Real Estate

258 192 €

Apartments in Dubai, UAE

85 m 2 2 1 2

Residence permit upon purchase

I will sell an apartment with 1 bedroom in the iconic Dubai Marina PROPERTY FEATURES: -Fully furnished apartment -Balcony -Built-in wardrobes - Central air conditioner -Covered parking -Fully equipped kitchen - swimming pool -Metro station -Public transport -Restaurants -Shopping center -The shops -2 min...

Dubai - Real Estate

68 500 €

Apartment in Mersin, Turkey

66 m 2 2 1 1

Residence permit upon purchase Remote deal Payment in rubles

We present to your attention a new modern complex under construction LIPARIS KREMLIN. Apartments 1+1 from 68,500 euros 2+1 from 102,000 eurosFrom the developer. In the complex: Three buildings with a total of 416 apartments0012

Apartments 1+1 from 68,500 euros 2+1 from 102,000 eurosFrom the developer. In the complex: Three buildings with a total of 416 apartments0012

Em Group

175,000 €

Apartments in Paphos, Cyprus

61 m 2 2 1 1

Residence permit upon purchase Online display Remote deal Payment in rubles

Pafos City is a new turnkey complex consisting of two 4-storey houses with a modern design, which is located in the center of Paphos. Modern luxurious finishes complement the architectural concept with a stunning sense of luxury that is sure to leave a lasting impression. The complex includes a 4-storey building with 16...

EMPIRE Property Cyprus

3 600 000 €

Apartments in Monaco, Monaco

72 sq. m. Living area 72 sq.m., living room with closed loggia, equipped kitchen, bedroom with bathroom, guest toilet. Storage room and parking place in the underground garage of the house. In the immediate vicinity there is a supermarket, tennis court, sports...

m. Living area 72 sq.m., living room with closed loggia, equipped kitchen, bedroom with bathroom, guest toilet. Storage room and parking place in the underground garage of the house. In the immediate vicinity there is a supermarket, tennis court, sports...

SERVICEAZUR

350,000 €

Cottage in Paphos, Cyprus

132 m 2 4 3 3

Residence permit upon purchase Online display Remote deal Payment in rubles

A new complex of 28 villas and townhouses, conveniently located in the center of Peyia - a resort suburb of Paphos - within walking distance of all infrastructure - supermarkets, pharmacies, medical centers, a stadium, public transport stops - and just a few minutes drive from sandy beaches, bars and restaurants of Coral Bay. Houses are different...

Houses are different...

METR 777

28 582 €

Apartments in Batumi, Georgia

25 m 2 1

Online show Remote transaction

Start Residential complex DEL MAR is located next to the Botanical Garden in Chakvi In a quiet and cozy place. about the project The project is modern in its architecture, it consists of 2 11-storey blocks that fit perfectly into the environment. All apartments offer panoramic sea and mountain views. From the balconies you can admire the beautiful...

Complex Del Mar

225,000 €

Apartments in Finestrat, Spain

64 m 2 3 2 2

Online show Remote deal Loan 3-4%

Favorable offer in terms of investment and subsequent leasing. Elite view duplex apartments with 2 entrances and a private garden in a dynamically developing area near Benidorm. Invest and multiply your capital by purchasing a property in a new and ultra-modern residential complex from a reliable developer - a leader in...

Elite view duplex apartments with 2 entrances and a private garden in a dynamically developing area near Benidorm. Invest and multiply your capital by purchasing a property in a new and ultra-modern residential complex from a reliable developer - a leader in...

SPAINLUXINVEST

€115,000

Apartment in Alanya, Turkey

45 m +1 area up to 80-84 m². The price of the apartments includes: full finishing with high-quality materials, built-in cabinet furniture in the kitchen area and complete bathrooms....

PROFIT REAL ESTATE

209 250 €

Apartment in Dubai, UAE

44 m 2 1

SALE NO COMMISSION, INDEPENDENT CONSULTING Payment plan for 3 years: 1st payment - only 14%! 1st year - 40% + 4% (registration in DLD) 2nd year - 46% 3rd year - 14% Object advantages: - guaranteed income of 8% for 5 years, paid every 6 months (from the date the hotel opens) - 14 nights per year for private. ..

..

Immotrading GmbH

520,000 €

Apartment in Becici, Montenegro

146 m 2 4 3 2 Online display Remote transaction

Gorgeous picture in a guarded complex in the village of Becici. 3 bedrooms, large living room with kitchen, 2 bathrooms, spacious terraces. Designer renovation. Italian furniture. Quality technology. Jacuzzi on the terrace. Garage space in a guarded garage. In the complex: swimming pool, spa, gym, bar. The management company that keeps order. To the sea...

CountMontenegro

97,000 €

Apartment in Avsallar, Turkey

43 m 2 2 1 1

Online show Remote deal Payment in rubles

COMPREHENSIVE INFORMATION: Luxurious compact residential complex located on a plot of 725 m2 in Avsallar.