Best place to buy a

10 Best Places to Buy a House Right Now

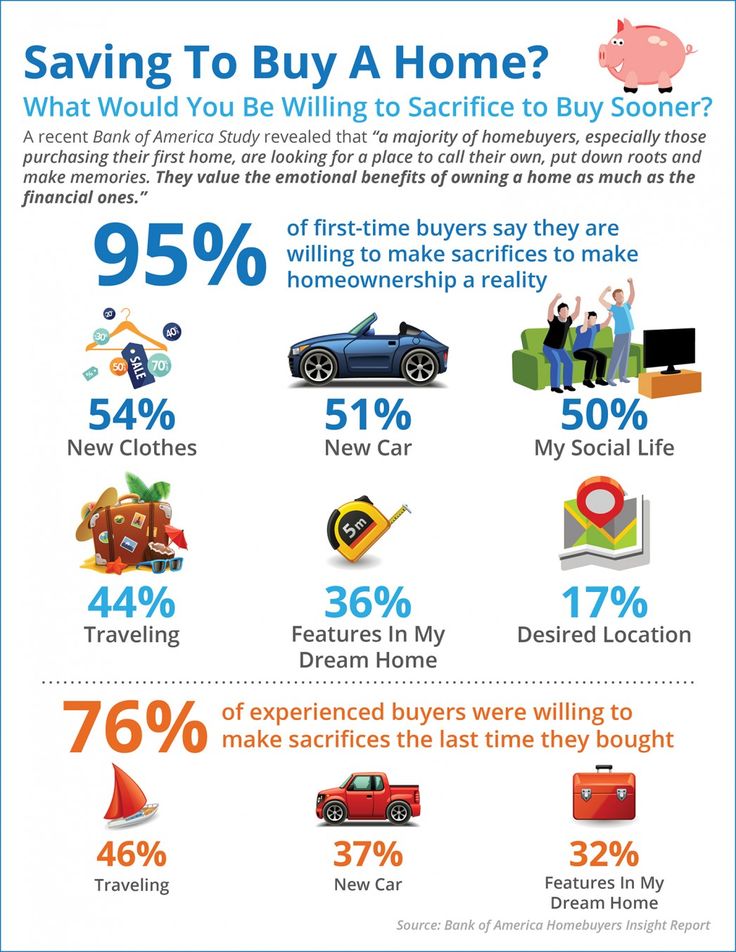

Buying a home is no small task, but it helps to know where to find the best deal. Though home prices are on the rise throughout the country, there are affordable areas still out there—you just need to know where to look.

We’ve put together a list of the 10 best places to buy a home right now to help you find cities with competitively priced homes and ample opportunities for exploring.

Here's our list of the best cities to buy a house right now. Let the home search begin!

10. Miami, Florida

Miami is one of the best cities to buy a house in if you're looking for fun things to do in an electrifying and diverse city. The median sales price in Miami is $410,000, making it more expensive than other areas on this list, but it’s still reasonable when considering all that this dynamic city has to offer.

What's great about living and owning a home in Miami is that there are countless areas to explore right from your doorstep. They don’t call it Magic City for no reason. Head to South Beach for some of the best food in the city, stroll through Vizcaya Gardens, and shop along famous Lincoln Road. Don’t forget Miami Beach is just around the corner.

9. Springfield, Oregon

Though Portland is Oregon’s hot town for new residents and tourists, Springfield’s affordability makes it a desirable place to buy a house. Located just outside of Eugene (about two hours south of Portland), Springfield is a great place to live for those looking for affordable housing, easy access to outdoor adventures, and an exciting nearby city to explore. Springfield is one of the cheapest cities to buy a house in Oregon, with median home prices coming in at just under $400,000.

Once you get settled in your new digs, check out Eugene’s Saturday Market, a popular activity that’s been held in the town for 50 years. Then, sip your way along a wine trail through nearby Willamette Valley. Cheers!

Cheers!

8. Hilo, Hawaii

If you're ready to make the move to a tropical paradise, consider trekking across the Pacific and moving to Hawaii. The state has very low property taxes compared to the rest of the nation, making it one of the best states to buy a house. Hawaii's home prices are largely driven by locals who need affordable homes paired with tourism that allows developers to create areas with higher-priced properties. But where can you find your spot in this sun-drenched state that doesn’t cost a pretty penny?

If a move to Hawaii makes sense for your situation, consider Hilo, the largest city on the Big Island. In Hilo, median home prices are around $400,000, much lower than Hawaii’s median list price of more than $700,000. And though the cost of living in Hawaii is notoriously high, at least you’ll be minutes from a quick swim in the Pacific and the wild beauty of Hawai’i Volcanoes National Park.

7. Fountain, Colorado

So, you want to live in the mountains but can’t quite afford Denver real estate? We’ve got you covered. Head southeast to Fountain, Colorado Springs’s more affordable suburb city. With a median home listing price of $365,000, this is one of the higher-cost cities on our list. We’ve included Fountain in this list because you’ll have the opportunity to live near the mountains and experience all that the great state of Colorado can offer—all with a lower down payment. When you factor in property tax, Colorado is one of the best states to buy a house because it has one of the lowest property tax rates in the country.

Fountain is an adventure sports haven, with plenty of trails for mountain biking, hiking, and running, and famous spots like Garden of the Gods and Pikes Peak aren’t far away. In Fountain, you’ll get a small-town feel near a big city. Some people might call that a win–win.

6. El Mirage, Arizona

Arizona is one of the best places to buy a home because it has that dry desert air, big cities, job opportunities, and outdoor activities. You’ll just need to be willing to put up with the heat.

The metropolitan area of Phoenix—also known as "The Valley"—is one of the most popular places in Arizona, with more than 4 million people living there. It’s consistently been one of the fastest-growing metro areas in the U.S., and that growth shows no signs of stopping.

Take advantage of that big-city growth in a smaller suburb like El Mirage. Median home prices in this desert community are about $330,000, making it a very affordable place to buy a home. If you’re moving here for a job opportunity, you’ll only be about a 30-minute drive from downtown Phoenix. Easy commute plus low housing costs? We like the sound of that.

5.

Iowa City, Iowa

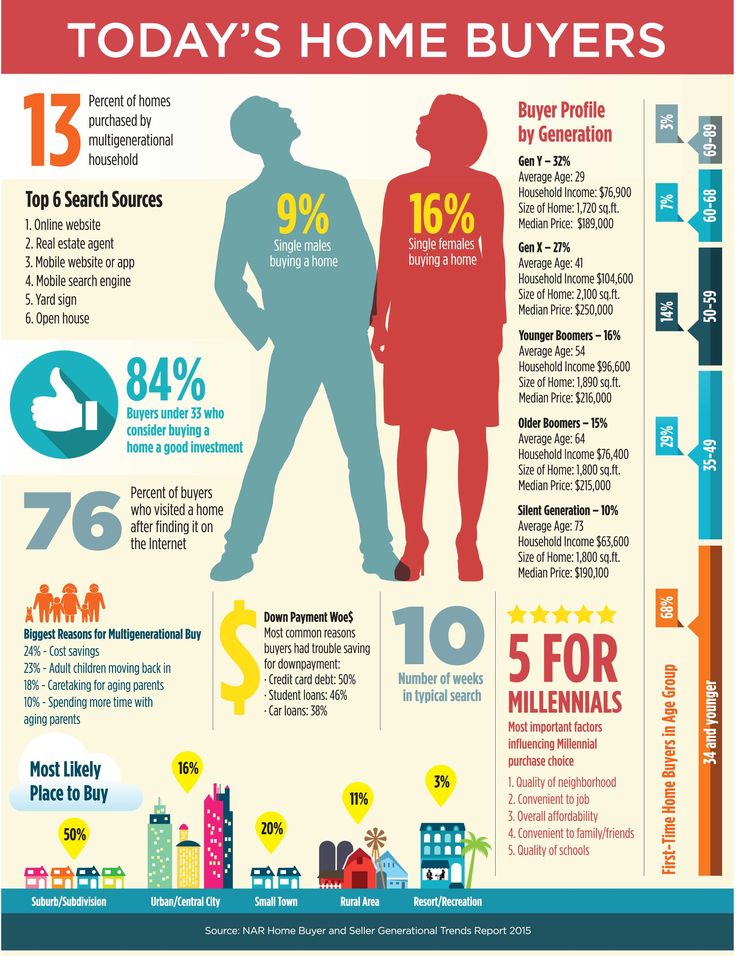

Iowa City, Iowa According to Realtor.com, Iowa City is one of the best places to buy a house in the USA if you are a first-time home buyer. Tucked in the eastern part of the state, Iowa City is a great place for first-time home buyers because of its affordable home prices, a high proportion of home listings (so less potential for bidding wars), and young residents.

Iowa City's population has increased by about 10% since 2010, but it remains affordable for residents, with a median home sale price of $285,000. If you’re looking for one of the cheapest places to buy a house, this is it. Just be sure to read our advice before buying a home if this is your first time going through the process.

4. St. Paul, Minnesota

Minnesota has some very affordable cities to live in, and its ranked as one of the best places in America for raising a family, with high marks for health and safety, education and child care, and overall affordability. So if you have a couple of kids in tow, Minnesota might be the state to settle in.

So if you have a couple of kids in tow, Minnesota might be the state to settle in.

We explored home prices throughout the great state of Minnesota, and St. Paul has competitive median house prices at $270,000, lower than other big cities in the Land of 10,000 Lakes. The only downside might be that houses are on the market for only 12 days on average, according to Redfin. Right now might be the best time to buy a house in St. Paul, before home prices get more expensive.

When you arrive, you’ll have plenty to do. Check out Minnehaha Falls, attend one of the many outdoor music festivals throughout the summer, and kayak along portions of the Mississippi River. You and your family will be glad you invested in this capital city.

3. San Antonio, Texas

Living in Texas definitely has its perks: delicious BBQ, no income tax, and fantastic country music. One of the best places to buy a home right now is in San Antonio. With historical sites, cultural activities, and the famous River Walk, it’s no wonder that more than 1.5 million residents call San Antonio home.

With historical sites, cultural activities, and the famous River Walk, it’s no wonder that more than 1.5 million residents call San Antonio home.

If you move to this great city in the Lone Star State, you’ll enjoy summer temps of around 90 degrees, a great public school system, and ample job opportunities, with large employers like USAA, TaskUs, and H-E-B based in San Antonio. It’s no wonder that San Antonio is one of America’s fastest-growing cities.

But with a 16% population growth since 2010 and a hot real estate market, consider buying a house here sooner than later. Median home prices are around $270,000, about $100,000 less than the national median home price, and trending upward. So put on your cowboy boots and get to San Antonio!

2. Palm Coast, Florida

Palm Coast is the perfect place to live if you are looking for a quiet and affordable town. Palm Coast is one of the most affordable cities to live in on our list because of its low cost of living (9% less than the national average) and median home price of around $260,000. With a low price tag, it may be easier to buy a home here if you have student loans, as your down payment won’t need to be as high as in other areas in the U.S. Though you’ll pay property tax on your new home, Florida doesn’t impose income tax—a huge perk when considering where to buy a home and look for a new job.

Palm Coast is one of the most affordable cities to live in on our list because of its low cost of living (9% less than the national average) and median home price of around $260,000. With a low price tag, it may be easier to buy a home here if you have student loans, as your down payment won’t need to be as high as in other areas in the U.S. Though you’ll pay property tax on your new home, Florida doesn’t impose income tax—a huge perk when considering where to buy a home and look for a new job.

This beach town boasts a gorgeous coastline and plenty of options for the outdoorsy types, from Mala Compra Trail to Washington Oaks Garden State Park. Palm Coast is smack dab between two metro areas, Jacksonville and Orlando, so when you need your big-city fix, it won’t take long to get there.

1. Baltimore, Maryland

The cheapest place to buy a house on our list is Baltimore, home to Lexington Market, the stunning Inner Harbor, and unforgettable crab cakes. With a median home list price of around $230,000, you may get more bang for your buck here compared to other big cities in the U.S.

With a median home list price of around $230,000, you may get more bang for your buck here compared to other big cities in the U.S.

With its proximity to Washington, D.C., Baltimore is a hot spot for people moving for government, finance, and biotech jobs, so plenty of opportunities are here. In fact, the city’s job market index is 7.7 out of 10, meaning it’s healthy and growing. So if cold winters and East Coast living are your thing, make sure to add Baltimore to your list.

Final Thoughts

Choosing where to buy a house isn’t easy, especially if it’s a seller’s market. But if you’re willing to look into inexpensive areas and have some flexibility with your job, picking the perfect spot can become a fun adventure. Your decision will be largely subjective based on your family’s needs, your financial situation, and where you think you’ll be most comfortable living. Make your decision a little easier with this list of the best places to buy a house, familiarizing yourself with each area and its real estate market trends. When you finally close on your dream home, use our homeowner’s checklist to help with the big move.

When you finally close on your dream home, use our homeowner’s checklist to help with the big move.

Wherever you end up, protect your new home with an American Home Shield® home service plan that covers up to 23 important appliances and home systems. Find a home warranty in your state to keep your household and your budget covered.

AHS assumes no responsibility, and specifically disclaims all liability, for your use of any and all information contained herein.

NO TWO HOMES ARE THE SAME. THAT'S WHY WE HAVE OPTIONS. FIND A PLAN THAT FITS.

Shop Plans

Best Places to Buy House in the USA for Price Appreciation

by Michele Lawrie ·

· 17 min read

It’s no secret that the US real estate market has been on fire lately. Home prices have been rising steadily for the past few years, and there’s no end.

However, being a huge real estate market, the US still has relatively lower house prices than other markets like the UK, Canada, China, India, etc. This is one of the reasons to invest in US real estate.

When you are buying a home in the USA as a foreigner, one thing that matters the most is location. It should be at a place where you can get a decent value appreciation. So, whether you live there or rent it out, you’ll have handsome profits when you sell your property.

In this listicle, we compiled the 10 best places to buy a house in the US in 2023 for best value appreciation and other valuable factors.

Table of Contents

- Things to Look for Before Choosing a Location to Buy Your Home in the USA!

- Top 10 Places to Buy a House in the USA for Foreign Investors!

- 1. Atlanta, Georgia

- 2. Austin, Texas

- 3. Charlotte, North Carolina

- 4. Dallas / Fort Worth, Texas

- 5. Denver, Colorado

- 6.

Houston, Texas

Houston, Texas - 7. Las Vegas, Nevada

- 8. Orlando, Florida

- 9. Phoenix, Arizona

- 10. Portland, Oregon

- Tips to Keep in Mind Before Investing in Real Estate.

- Still, Confused about Where to Buy?

- Frequently Asked Questions

Things to Look for Before Choosing a Location to Buy Your Home in the USA!

When you’re ready to purchase your first home or investment property, you must be aware of a few things. The following are some of the most critical factors you’ll want to keep in mind when narrowing down your search for the best places to buy a home, especially as a foreign investor:

1. Growth

Real estate investing may be challenging, especially when you are looking to support out of your home country! To truly maximize the potential of your investment, it’s crucial to strike the appropriate balance between demand and market value. It would help if you looked at the growth trends in particular regions to determine what is now in order and booming.

However, you shouldn’t just rush into the industry with the most alluring growth right now. These cities look attractive to you now but they also appear inviting to everyone else. In light of this, it is possible for the market to become oversaturated and overvalued in a short period, which could cause an investment to stagnate or even lose value when the bubble inevitably bursts.

To determine where a market is predicted to be in three, five, or ten years, you should look at that sector’s forecast growth. Long-term sustainability is considerably better for medium-growth markets, which also have the advantage of being desirable both now and in the future.

2. Jobs Added and Planned

Foreign individuals are willing to relocate and purchase homes in an area if it can offer more jobs, mainly from well-known, reputable, or highly-paying businesses. As a result, a foreign investor should consider investing in a place with substantial job opportunities, has recently been a hub for a significant corporation, or is anticipated to get a trustworthy industry soon.

For instance, as corporations like Amazon establish national centers, towns compete to become the next destination of choice. When a business like this enters the housing market, it guarantees employment, spurs neighborhood development, and brings in new residents and homebuyers.

To find out what plans are in the works for the near future, you may also check current building permits from a particular area. This may give you a sneak preview of significant initiatives that could completely change a city before any announcements are made.

3. Current Home Values and the Vacancy Rate

Even if a region has strong growth potential, you shouldn’t buy property there. A market where there is already a high vacancy rate or sky-high housing costs could make it tough to rent out investment properties.

Even in a thriving economy, a balance between occupancy and profitability will be difficult if the neighborhood has a high vacancy rate. Since you’ll compete with other vacant properties and property rentals to attract tenants, you won’t get the rental rates you deserve, especially if the area is famous.

4. Cost of living and affordability

Several metrics can be used to assess a city’s affordability, including median home value, median rent, median listing price, state and local income tax rates, and the cost of living index, which measures your regional purchasing power in comparison to the national average for things like purchase price, rent, utilities, food, and transit. As a foreign investor spending dollars, you must keep these calculations in mind.

5. Potential Growth and Income

When evaluating a real estate investment in a foreign market, it’s essential to determine the property’s capacity to create rental revenue. To accomplish this, compare the rental records of comparable properties in the area. The possible future worth of the property should also be considered; for example, if a property isn’t renting well but is rising in value, it might still be a wise investment.

To determine whether buying a property is a suitable investment, you should estimate your future income. To determine that amount, divide the income (revenue minus expenses) by the cap rate, which is the anticipated yearly return on an investment property. Ten percent is typically regarded as a respectable cap rate.

To determine that amount, divide the income (revenue minus expenses) by the cap rate, which is the anticipated yearly return on an investment property. Ten percent is typically regarded as a respectable cap rate.

In the last two years, house sales in specific real estate markets in the United States have seen a record increase, especially amongst foreign investors looking to buy a house for investment purposes. Buyers are searching for the best cities that provide contemporary comforts, lovely vistas, and a high return on investment across the United States. Check this list of Top Housing Markets in the US to take your pick from!

1. Atlanta, Georgia

Atlanta, Georgia, is one of the best places to invest in real estate in the United States. The city’s population is increasing, and there is a strong demand for housing. There are several reasons for this being the number 1 city right now!

- The median sales price in Atlanta is relatively affordable, and the city has a diverse economy immune to downturns in specific industries.

In addition,

In addition, - According to experts, Atlanta’s home prices and existing home sales will increase faster than the nation in 2022. Atlanta’s price growth is expected to be 3.5 percent, which is significantly higher than the national average of 2.9 percent, according to Realtor.com.

- Recent statistics show that Metro Atlanta’s population has increased by 1.5% annually and 15% over the last decade. By 2050, the city is expected to add 1.2 million additional employees.

- Atlanta also offers a cost of living that is 60% more affordable than most cities, especially that of Manhattan, and about 50% less expensive than that of San Francisco.

- Atlanta rentals have increased by 23 percent over the past year and continue to rise. For instance, investors can anticipate median rents of $2,095 for a three-bedroom apartment in Atlanta.

As a result, Atlanta has excellent potential for rental income and capital gains. For these reasons, Atlanta is an ideal place to invest in real estate.

2. Austin, Texas

Austin’s housing market is poised for a boom due to a lack of supply, high demand, rising prices, and a booming labor market. Tesla, Samsung, and Apple have all accepted the city’s offers of tax cuts for corporations coming here, either by moving entirely or by establishing sizable offices of major companies, such as Tesla and Apple. Texas continues to recruit new inhabitants, and Austin relocations in 2021 are down by 45% from those in 2020.

- The progressive and resolutely eccentric city has expanded by more than 30% over the past ten years, partly due to an infusion of new tech firms and the growth of the regional semiconductor and software industries.

- The unemployment rate in Austin is at 4.2 percent, which is significantly lower than the national average.

- Austin has far cheaper living expenses than San Francisco and New York City. According to Numbeo’s cost of living index, which takes into account the price of consumer goods such as groceries, restaurants, transportation, and utilities, Austin scored 62.

96 out of 100 in March 2021, which means that living there is over 40% less expensive than living in New York City. It is one of the cheapest cities to reside in!

96 out of 100 in March 2021, which means that living there is over 40% less expensive than living in New York City. It is one of the cheapest cities to reside in! - Although the median home rent is an inexpensive $1,431, rents are steadily increasing.

- The Austin housing market is a wise long-term investment, with property values increasing by almost 90% since 2012.

3. Charlotte, North Carolina

The financial and tech sectors of Charlotte have experienced significant job growth. A young workforce is supported by its 25 colleges and institutions. It is simpler to acquire there than in other IT clusters, thanks to its low property taxes. Some of the reasons why it’s one of the best places to buy a house in the US are:

- By 2050, the Charlotte region is anticipated to have grown by 50%, with suburban York and Lancaster counties likely to see the most significant growth rates in real estate sales.

- Over the last 12 months, the Charlotte region generated 75,491 jobs, with the fastest increase occurring in transportation and warehousing, finance, insurance, and real estate.

The majority of the 300,000 new jobs expected to be produced in North Carolina through 2028 will be in Charlotte and the neighboring city of Raleigh.

The majority of the 300,000 new jobs expected to be produced in North Carolina through 2028 will be in Charlotte and the neighboring city of Raleigh. - As of May 2022, Charlotte’s Zillow Home Value Index (ZHVI) is $396,619 per square foot. According to the most current Realtor.com study, a single-family home in Charlotte has a median list price of $400,000. (as of April 2022).

- In Charlotte, rents have gone up 8% since last year. According to the most recent research from Zumper, a 3-bedroom property in Charlotte may be rented for an average monthly rate of $1,900. (as of June 2022).

- Charlotte home prices have decreased by 12.4% since the last real estate cycle’s high. Home prices in Charlotte have increased by more than 77 percent since the latest real estate cycle market bottom.

- Surrounding Suburbs such as Fort Mill and Rock Hill, as well as Cabarrus County’s downtown area of Concord, are excellent future investments. They’re becoming more popular among families who can purchase extra space and access good schools.

4. Dallas / Fort Worth, Texas

Dallas’ mixed economy, offering jobs for individuals at every income level, is one of its economic strengths. Renting is more inexpensive than buying, and the demand for rental properties has risen sharply in recent years. It has one of the cheapest rates of homeownership in the nation.

- The Dallas-Fort Worth area continues to grow in population and is now the 4th largest metro area in the US, up from 6th place in 2010. According to the latest recent census, the number of people in the City of Dallas increased by nearly 9% over the previous ten years.

- Dallas’s median family income is $72,882, and its per capita income is $36,368.

- According to the BLS, employment growth in Dallas-Fort Worth is 5.6 percent annually, and the metro area is home to close to 3.9 million people.

- Dallas’s $390,505 Zillow Home Value Index (ZHVI) is valid through May 2022. Over the previous year, home values in Dallas rose by 30.

3 percent.

3 percent. - Dallas’s single-family homes are selling for an average of $430,000, according to the most recent report from the Texas Real Estate Research Center (May 2022).

5. Denver, Colorado

One of the top 10 cities in the nation to live in is Denver, Colorado. The metropolis of Denver is situated in northern Colorado, in the center of the country. Kids, yuppies, families, retirees, and people of all ages have enough to choose from. It’s a terrific area for locals, tourists, and in-migrants because there are many family-friendly activities available during all four seasons.

- Denver’s median house price is $599,742. Denver’s median house value has already climbed by 19.1% in the past year. Nevertheless, despite the quick rate of appreciation, prices are anticipated to rise gradually.

- Rental rates rise sharply in a year, rising 14.9 percent year over year, similar to their counterparts in property prices.

- Over the last ten years, its population increased by around 20%, and there are no indicators that this growth will soon decrease.

The need for housing will rise as a result of this inflow of people.

The need for housing will rise as a result of this inflow of people.

6. Houston, Texas

Houston is the most populous city in Texas and the fourth-largest in the United States. It is a multicultural city with a strong economy, making it a great place to live and work. The energy industry, health care, and transportation are some main sectors.

- The job market in Houston is very diverse, with opportunities in the energy, healthcare, and aerospace industries, attracting foreign students and job seekers. The city’s population is diverse, with over 145 languages spoken.

- According to the most recent census, there are now more than 205,000 more people living in the City of Houston than there were ten years ago. Through 2029, Houston’s population is projected to increase by more than 1.2 million, continuing a decade-long trend of rapid growth.

- Houston’s median property values increased by 7.03 percent over the previous year, while the city’s median household income increased by 5.

8 percent.

8 percent. - The Greater Houston Partnership claims that home prices in Houston are still increasing at double-digit rates. Recently (May 2022), the median sale price of a single-family home in Houston surpassed $350,000, an increase of more than 40% from two years prior.

- The Houston Association of Realtors estimates that a single-family home in Houston will sell for a median price of $314,000.

- Although the cost of living is high, it is still cheaper to live in Houston than in other major cities such as New York or Los Angeles.

- The average monthly rent for a one-bedroom apartment is $1,191, and the median home price is $261,171.

7. Las Vegas, Nevada

The market in Las Vegas has been erratic, possibly witnessing one of the worst busts in the country during the Great Recession. However, its comeback has been rapid due to several circumstances, including a low cost of living, the absence of state taxes, and a diversified economic environment. Additionally, Californians who can work remotely will find it simple to relocate. Traditionally reliant on tourism and hospitality, the city has expanded into the high-tech, healthcare, and commercial real estate sectors.

Additionally, Californians who can work remotely will find it simple to relocate. Traditionally reliant on tourism and hospitality, the city has expanded into the high-tech, healthcare, and commercial real estate sectors.

- Nearly 671,000 people call Las Vegas home, and the Las Vegas-Henderson-Paradise metropolitan area is home to more than 2.2 million people. According to the most recent census, Las Vegas’s population has grown by 1.57 percent annually and 10 percent in the past ten years.

- The typical family income in the Las Vegas metro region is $61,048, while the per capita income is $31,651.

- The Federal Reserve Bank of St. Louis estimates that the Las Vegas-Henderson-Paradise, NV MSA’s GDP is over $119 billion and has increased by about 38 percent over the last ten years.

- At the end of May 2022, the median sale price of a single-family home in Las Vegas was $483,000, up more than 25% from the same period in 2017.

8.

Orlando, Florida

Orlando, FloridaOrlando is the fourth-largest and the state’s largest inland city in Florida. It is the center of the Orlando metropolitan area, with a population of about 2.5 million. Orlando, the location of Disneyworld, is in the middle of the Sunshine State. It’s close enough to major cities like Miami and Daytona Beach to be a driving distance, yet far enough away to appeal to both families and renters on a tight budget.

- Nearly 308,000 people live in the City of Orlando, while the Orlando metropolitan area’s population increased by more than 1.4 percent just in the previous year.

- By 2030, it is anticipated that Orlando’s average employment would have increased by 19 percent, or nearly twice as fast as the US.

- According to studies by the Orlando Economic Partnership, the Orlando metro area is expected to add roughly 500,000 new jobs over the next ten years.

- Orlando’s median home price increased by almost 25% year over year, and homes entered into contracts less than 25 days after they were put on the market.

- The median listing home price in Orlando is $367,000, based on the most recent report from Realtor.com (April 2022).

- The number of jobs in this city in central Florida should rise by almost 7.1% during the next two years, and in three years, the population should climb by nearly 8%.

9. Phoenix, Arizona

Phoenix, the capital and largest city in Arizona, is also known as the Valley of the Sun. There is much to do in Phoenix, from vibrant urban areas to suburban neighborhoods. All four main professional sports leagues play in the city, along with dozens of museums and performing arts centers.

- Phoenix’s population increased by 1.7 percent annually and 15.8 percent during the last ten years. By 2029, it is anticipated that the Greater Phoenix region will have 5.64 million residents.

- Through the end of the decade, job growth in Arizona is predicted to average 1.6% each year.

- According to the Federal Reserve Bank of St.

Louis, the Phoenix-Mesa-Scottsdale MSA’s GDP is over $281 billion and has increased by more than 57% over the last ten years. 7

Louis, the Phoenix-Mesa-Scottsdale MSA’s GDP is over $281 billion and has increased by more than 57% over the last ten years. 7 - Phoenix’s home values rose 29.6% over the previous year and have soared more than 204% since 2016.

- According to the most current research from Realtor.com, the median listing price of a home for sale in Phoenix is $475,000 13

- The median sold home price in Phoenix is $461,000.

- The average monthly rent for an apartment in Phoenix is $1,162, a 5% increase from 2019.

10. Portland, Oregon

Young professionals wishing to reside close to urban areas are flocking to Portland, Oregon. The city has a flourishing arts scene, excellent cuisine, and many outdoor activities.

- The median home value in Portland, which is currently $564,334, has climbed by 12.7% in the last year.

- The median monthly rent is $1,560, and an 11.2 percent rise in average rental costs over the past year.

People are now renting rather than buying in the city of Portland, owing to how much more expensive it is to live there than it was.

People are now renting rather than buying in the city of Portland, owing to how much more expensive it is to live there than it was. - More Portland real estate owners, are moving to the rental market due to rising acquisition costs, declining profit margins, and a shortage of available properties.

- Another factor driving increasing housing prices in the region is the expanding job market in Portland.

- Residents earn more money than usual, and the unemployment rate is lower than the national average. And, over the next ten years, it is predicted that there will be a 41.2% rise in jobs in the city.

If you’re looking to invest in real estate, these are ten of the best places to do so in the United States. All of these cities are experiencing population and economic growth, which is driving up housing prices and making them excellent markets for sellers. So if you’re thinking of investing in real estate, keep these cities in mind.

Tips to Keep in Mind Before Investing in Real Estate.

1. Create a budget.

Knowing your budget is essential if you want to buy the perfect property. It would be beneficial if you had a general concept of the final cost and the source of the funds for this transaction, such as a down payment or other alternatives like mortgage refinancing.

2. Recognize the intended use of the property.

Real estate investment in the United States can provide reliable income and capital growth. Real estate in the US has historically been one of America’s best assets, making it one of the most popular reasons people purchase these properties abroad, even though it might not seem like much to some investors or relocators looking for new homes.

The local economy and culture provide options for a healthy work-life balance while being pocket-friendly.

3. Apply for a mortgage.

If you’re not buying the house outright with cash, you’ll need to get a mortgage from a lending company. If you’re a foreign buyer, the mortgage application process can differ from if you were a local buyer. You’ll need to follow specific procedures and submit paperwork to the lender and the US authorities.

You’ll need to follow specific procedures and submit paperwork to the lender and the US authorities.

If you don’t have any US credit history, then refer to this guide to get a mortgage with a thin or no US credit.

4. Subtract expenses to pay U.S. taxes from income.

You must file a tax return at the end of each tax year if you decide to purchase a home or any other type of property in the US. Real estate investors must determine whether to deduct expenses from revenue to benefit from the favorable tax treatment that the IRS grants to such assets.

On your tax return, you can accomplish this by making that option (sometimes referred to as an “election”) selection. The IRS will automatically charge you 30% of the gross rental revenue if you choose not to file tax returns or select this option. It can significantly lower profits because costs like depreciation, basic charges, property taxes, repairs, and interest wouldn’t be tax-deductible.

Depreciation is a non-cash expense that can be written off, so keep that in mind. As a result, you will initially be displaying tax losses from your investment. You wouldn’t owe the government anything as a result. Even if you have tax losses, you must file your tax return immediately to make that choice.

As a result, you will initially be displaying tax losses from your investment. You wouldn’t owe the government anything as a result. Even if you have tax losses, you must file your tax return immediately to make that choice.

5 Avoid Paying Death Tax (Estate Tax)

The total federal and state taxes owed in the US might be as high as 46% of the inheritance. The only exemption offered to foreign buyers is $60,000 of it. So, if a US property owner hasn’t planned for this, their passing could result in a significant tax and a resulting loss of inheritance to their heirs.

Both options are directly purchasing the property or putting it in an LLC. Another is to use a foreign corporation having its headquarters outside of the US (which is insufficient to avoid the estate tax). Another option is to purchase affordable term life insurance that is payable to your heirs and, if necessary, will pay the tax.

The estate tax is quite simple for foreign nationals to avoid, so don’t let it prevent you from investing in US real estate. When investing, planning is crucial. So that we can explain how our overseas clients organize their transactions to reduce taxes, please discuss this with HomeAbroad.

When investing, planning is crucial. So that we can explain how our overseas clients organize their transactions to reduce taxes, please discuss this with HomeAbroad.

6. CIPS Licensed Representatives

Find an agent that has completed the Certified International Property Specialist (CIPS) program if you need assistance with your purchase. CIPS representatives are more qualified than the typical US real estate agent to assist you in purchasing the best place and property here since they have completed substantial training in international real estate transactions.

Here, HomeAbroad can assist you in making the finest mortgage lender selection. We can also connect you with CIPS Certified Real Estate Agents to streamline the financing and buying processes. Our team is happy to include several CIPS-certified agents. We’re here to assist you at every turn, from choosing the ideal property to negotiating the complexities of an overseas transaction.

Find the best real estate agent with international expertise

Connect with a local US real estate agent(s) with CIPS designation

Get Started

Still, Confused about Where to Buy?

The US is a big country with many places to buy real estate. You might want to live in the property you’re buying or use it as an investment. Different areas have distinct benefits that should be considered when making your decision.

You might want to live in the property you’re buying or use it as an investment. Different areas have distinct benefits that should be considered when making your decision.

The above options and tips are a great starting point for buying property in the US, but there is still much more to learn. Our team of professionals at HomeAbroad has significant experience assisting foreign buyers in purchasing US real estate, and we would be happy to put our knowledge to work for you.

Our CIPS Certified Professionals have the experience and expertise to take care of every detail, who will study your case, goals, and budgets and then help you find the best place to buy a house in the US. Moreover, we can connect you with the right lender to help you get the mortgage for the US property you are buying.

Find the best real estate agent and mortgage lender with international expertise.

Connect with a local international real estate agent and mortgage lender

Get Started

Frequently Asked Questions

Where is the best place to buy property in the United States?

There is no easy answer to this question since it depends on each person’s individual needs and goals. Some people might want to purchase a vacation home in a warm climate, while others might be more interested in an investment property in a major city. But some of the best cities to buy investment properties in the US are:

Some people might want to purchase a vacation home in a warm climate, while others might be more interested in an investment property in a major city. But some of the best cities to buy investment properties in the US are:

– Atlanta, Georgia

– Austin, Texas

– Charlotte, North Carolina.

Please check our guide to a detailed analysis of the best places to buy property in the US based on your unique.

What are some of the risks of buying US real estate?

The risks of investing in US real estate are relatively low compared to other investments, but there are still a few things to be aware of :

1. Property Taxes and Insurance

2. Estate Taxes

3. Financing Risks

4. Tenancy Risks

Where is the #1 place to live in the US?

There is no definitive answer to this question since what makes a city the “best” place to live varies from person to person. Some people might want to live in a bustling metropolis with plenty of things to do, while others might prefer a smaller town with a slower pace of life. However, the #1 place to live in the US is New York City, New York, which offers something for everyone.

However, the #1 place to live in the US is New York City, New York, which offers something for everyone.

How can I get US citizenship through real estate investment?

You cannot get US citizenship through real estate investment alone. However, if you invest in US real estate and meet other requirements, you may be eligible for a green card or US citizenship.

How Can You Get a Green Card Through Real Estate Investment?

Where in the US is it a buyer’s market?

A buyer’s market is when there are more properties for sale than buyers. This situation often leads to lower prices, which can be an excellent opportunity for investors.

Philadelphia, Chicago, Cleveland, and Miami are currently buyers’ markets. In buyers’ needs, home shoppers expect an average 3.9 percent discount off the final sale price.

Which state in the US has the lowest cost of living?

The cost of living in Mississippi is the lowest in the US, followed by Arkansas, Oklahoma, and Louisiana. These states also have some of the lowest median home prices in the country.

These states also have some of the lowest median home prices in the country.

Which is the best state to buy a house in the US in 2023?

The best state to buy a house in the US in 2023 is yet to be determined as the real estate market is constantly changing. However, some of the conditions that are currently considered good markets for buyers are:

Arizona

Colorado

Florida

Georgia

Check our guide for more information!

What are some of the benefits of owning US real estate?

Some of the benefits of owning US real estate include:

1. A Stable Housing Market

2. Competitive Mortgage Rates

3. A Growing Economy

4. A Safe Investment

5. A Strong Rental Market

What is the best time to buy property in the US?

The best time to buy property in the US varies depending on the market conditions in each city. For example, if you’re looking to buy in Miami, you might want to wait until the winter, when prices are typically lower.

Where is the cheapest state to buy a house in the US?

The cheapest state to buy a house in the US is West Virginia, where the median home price is just $129,000. Other cheap affordable areas to buy a home include Arkansas, Ohio, and Oklahoma.

What states are booming in real estate in the US in 2023?

Some of the states that are booming in real estate in the US in 2023 are:

1. Texas

2. Colorado

3. Florida

4. North Carolina

5. Tennessee

I’m not a US citizen. Can I still buy property in the US?

Yes, you can still buy property in the US as a foreigner. There are a few extra steps involved in the process, but our team of experts at HomeAbroad can help you navigate the process and find the perfect property for your needs.

About the author:

Michele Lawrie is the Chief Real Estate Officer at HomeAbroad and has worked as a real estate professional for the past 14 years, helping domestic and foreign national clients navigate the home buying and selling process.

She is passionate about real estate and strives to educate read more...

Forbes has named the best places to buy a home in the US

https://realty.ria.ru/20071009/13828.html

Forbes has named the best places to buy a home in the US

Forbes has named the best places to buy a home in the US - Real Estate RIA Novosti, 11/21/2019

Forbes named the best places to buy a home in the USA

Fort Worth in Texas, Long Island in New York, as well as Washington, Las Vegas and Orlando in Florida are the most promising places to buy residential real estate in the US.

2007-10-09T12:24

2007-10-09T12:24

2019-11-21T09:20

/html/head/meta[@name='og:title']/@content

2 /html/head/meta[@name='og:description']/@content

https://cdnn21.img.ria.ru/images/sharing/article/13828.jpg?1574317235

Real Estate RIA Novosti

1

5

4.7

96

7 495 645-6601

Federal State Unitary Enterprise MIA Rossiya Segodnya

https: //xn---c1acbl2abdlkab1og. xn--p1ai/Awards/

xn--p1ai/Awards/

2007

Real estate RIA Novosti

1

9000 54.7

9000

Internet.ru

49000 49000 49000 645-6601

Rossiya Segodnya

https://xn--c1acbl2abdlkab1og.xn--p1ai/awards/

News

ru-RU

https://realty.ria.ru/docs /about/copyright.html

https://xn--c1acbl2abdlkab1og.xn--p1ai/

Real Estate RIA Novosti

1

5

4.7

96

7 495 645-6601

Federal State Unitary Enterprise MIA RUSSIA TODEDSED TOMEN C1ACBL2ABDLKAB1OG.xn--p1ai/ Awards/

Real estate RIA Novosti1

5

4.7

9000 9000

495 645-6601

FSUP MIA today "

https://xn--c1acbl2abdlkab1og.xn--p1ai/awards/

Real Estate RIA Novosti

1

5

4.7

96

7 495 645-6601

Federal State Unitary Enterprise MIA RUSSIA TODEDSED TOMEN c1acbl2abdlkab1og. xn--p1ai/awards/

xn--p1ai/awards/

news - real estate, housing

news - real estate, housing

MOSCOW, October 8 - RIA Novosti. Fort Worth in Texas, Long Island in New York, as well as Washington, Las Vegas and Orlando in Florida are the most promising places to buy residential real estate in the US, writes the American magazine Forbes.

According to a study conducted by the publication, it is in these places that buying a home can be profitable against the background of the stagnation of the US residential real estate market caused by the US mortgage crisis.

“The level of home sales in the country has reached its lowest level since 2001. Investors jump ship, borrowers lose their mortgage foreclosures. But still there are places where it is still worth buying a house. After all, in a situation of a sharp decline in the market, sellers, trying to get rid of houses, sell them to buyers at a lower price. New construction is also slowing down. And both of these factors bode well for those who hope to win home purchases if the market starts to show an increase in the number of sales again, ”Forbes notes.

And both of these factors bode well for those who hope to win home purchases if the market starts to show an increase in the number of sales again, ”Forbes notes.

The most undervalued markets, according to the magazine, are those similar to the Fort Worth housing market in Texas, where "there were no significant price corrections after the boom, but where a significant increase in sales is now expected."

According to the publication, the median home sale price in Fort Worth is currently $156,500, up 1.7% from 2006. Next year, according to experts, the turnover ratio of funds invested in the purchase of housing may reach 6.03% here.

The Long Island markets in New York and Washington, writes Forbes, are traditionally considered strong markets, quickly recovering from speculation, "especially when it comes to the Long Island apartment market and the secondary housing market in Washington." “Now these areas are stabilizing, and the housing market in them is generally recovering,” the publication says.

Today, the average selling prices of homes in Washington fluctuate at the level of 445.3 thousand dollars, and in Long Island - 482.3 thousand dollars, the magazine notes. Thus, according to the publication's statistics, the cost of housing in Washington and Long Island, compared with last year, has changed by 0.3% and 1.7%, respectively. Next year, according to Forbes, the turnover ratio of funds from buying a house could be 4.05% in the US capital, and 4.52% in Long Island.

The third place in the rating of places attractive for buying a home in the United States is occupied by the risky markets of Las Vegas and Orlando (Florida), according to Forbes experts.

“Right now, these locations are having trouble with credit... but since they are connected to regional markets like Las Vegas, Los Angeles, Tampa and Miami, they are expected to experience significant sales growth soon as they continue to remain the best buyers and continue to be the least risky markets,” the magazine said in a publication.

Currently, according to Forbes, the average sale price of a home in Las Vegas is 307.9 thousand dollars, and in Orlando - 265.1 thousand dollars. This is, respectively, 3.6% and 2.4% less than last year. In 2008, the publication's experts expect, the turnover of investments in the purchase of housing in these regions may reach 6.6% and 5.8%.

The best area to buy an apartment in Turkey in 2022 || Imtilak Property

The best place to buy an apartment in Turkey in 2022

Contents

- Where is the best place to buy an apartment in Turkey in 2022?

- ● The best place to buy an apartment in Istanbul, Turkey

- ● The best area to buy an apartment in Antalya, Turkey

- ● The best area to buy an apartment in Ankara, Turkey

- ● Best area to buy an apartment in Trabzon, Turkey

- ● The best place to buy an apartment in Bursa, Turkey

- ● The best place to buy an apartment in Sakarya, Turkey

- ● The best place to buy an apartment in Kocaeli, Turkey

Where is the best place to buy an apartment in Turkey in 2022?

To answer the question of where is the best place to buy an apartment in Turkey , we will look at a report published by the Turkish real estate platform Hepsi Emlak, which talks about the annual increase in the investment value of residential apartments in major states. Turkey in January 2022.

Turkey in January 2022.

The classification of the main Turkish states in the report was based on the share of the annual increase in the investment value of its apartments.

● Best place to buy an apartment in Istanbul, Turkey

According to the aforementioned report, Istanbul ranked first among major Turkish states in terms of the annual increase in the investment value of its apartments in January 2022.

The growth of apartments in Istanbul reached 118% during the whole year, which lasted from January 2021 to January 2022.

In details related to the increase in the investment value of residential apartments in the districts of Istanbul, Umraniye district ranked first among the regions of the state, as it experienced the highest growth rate during the year from January 2021, so the annual increase in the investment value of apartments within the city limits amounted to 179%.

The report includes the census of districts of Istanbul in which the investment value of apartments increased by more than 100% during the specified period, namely:

Kartal - Avcilar - Kagitane - Beylikduzu - Bandak - Bahcelievler - Besiktas - Silivri - Sisli - Buyukcekmece - Eyup Sultan - Beykoz.

Here we can say that these areas mentioned in the report are among the best places for purchase apartments in Istanbul due to their high investment value on an annual basis.

● The best area to buy an apartment in Antalya, Turkey

As for the capital of Turkish tourism - Antalya , it is noted that the value of real estate in it is constantly growing, especially within the summer areas and recreation areas in the city. According to real estate experts, when it comes to the best area to buy an apartment in Antalya, Kepez, Dusmealti and Konyaalti are described as being at the forefront of Antalya regions in terms of high property values in them, due to their high potential for growth and prosperity.

Recently, Imtilak Real Estate has tracked the growth of property prices in Antalya, which sometimes reached 23%, and rental yields during the last period have been constantly increasing, due to the recovery of tourism and the increase in the number of tourists, after the gradual decline of the Coronavirus, this has led to a high demand for rentals in Antalya.

● The best area to buy an apartment in Ankara, Turkey

As for the best area to buy an apartment in Turkey, Imtilak Real Estate experts put Ankara to the second place in terms of investment value among Turkish states.

Research conducted by the British real estate company Knight Frank has shown the Turkish state of Ankara as one of the cities with the highest investment value of its real estate for two consecutive years, 2020 and 2021.

The study showed that the state of Ankara ranked tenth in the world in increasing the investment value of its properties in 2021 with a growth of 25.8%.

According to the "Hepsi Emlak" report mentioned at the beginning of this article and the figures relating to the regions of the Turkish capital Ankara, the region "Eti Mesgut" topped the regions of the Turkish capital with an annual increase in the investment value of its apartments is 121% throughout the year, which lasted from January 2021 to January 2022.

While the central district of Çankaya ranked second with an annual growth of 115%, the district of Busaklar ranked third with an annual growth of 109%.

● The best area to buy an apartment in Trabzon, Turkey

Green city Trabzon , the pearl of the Black Sea and the paradise of the Turkish north, its mountain villages are spread like pearls on the tops of clouds, above the cold highlands, even in the hottest summer days.

Breathtaking beauty surrounds the quiet villages at Uzungöl Lake, or on the slopes of the village of Ayder, and the highlands of Haydarnabi, adjacent to the modern city of Trabzon, with its international airport and seaport, which is one of Turkey's most important ports on the Black Sea. Sea.

Among the areas of Trabzon suitable for buying an apartment, we will mention Yomra, one of the important areas of Trabzon, as it has a group of luxury residential projects, and a large number of services and social facilities are available that will make your life in Trabzon Yomra quiet and calmly, away from the hustle and bustle of crowded cities.

Yalincak province is also one of the ideal areas in Trabzon. It is distinguished by fresh air and a temperate climate, not to mention the fact that it is located in the bosom of nature, where on the one hand you feel the splendor of the Black Sea, and on the other you see the beauty of green nature.

If you are interested in investing in property in Trabzon and buying an apartment there, read our article on property prices in Trabzon , Turkey 2022 and find out about price changes.

● The best place to buy an apartment in Bursa, Turkey

The investment value of Bursa lies in the fact that it is a major tourist and industrial city in Turkey, so the demand for real estate in it remains high.

Regarding rental income real estate in Bursa , it is considered one of the highest in comparison with other Turkish states.

Among the areas of Bursa where real estate values are rising, we find the area of Mudanya, surrounded by high forests, green meadows and coastline overlooking the Sea of Marmara. Mudanya is also the third most oxygen rich region in the world! This has made this area an important place for living and housing through consistent real estate investments that would become a link between the beauties of the land and the sea, so that the buildings were located in a quiet area, free from the noise and difficulties of life.

Mudanya is also the third most oxygen rich region in the world! This has made this area an important place for living and housing through consistent real estate investments that would become a link between the beauties of the land and the sea, so that the buildings were located in a quiet area, free from the noise and difficulties of life.

We also find among the distinguished districts of Bursa Karajabai district, Nilufer district and other districts that attract the attention of investors.

● The best location to buy an apartment in Sakarya, Turkey

Being close to Istanbul, Sakarya has gained high investment value as the investment value of real estate in the city is expected to increase significantly in the coming periods, especially after the discovery of natural gas off its coast, and the beginning of work on the construction of its extraction stations.

Imtilak Real Estate experts also emphasize the importance of this area for investment as the demand for properties in Sakarya is growing, especially among foreigners as it is a quiet city close to Istanbul.

The Karasu area is considered one of the most important investment areas in Sakarya, with seaport construction underway in the area, offering a promising future for the region. This comes after the Karasu region, where there is a constant increase in the value of real estate in the tourist areas of Ak Yazi and Trakli.

● The best place to buy an apartment in Kocaeli, Turkey

Kocaeli is one of the most important Turkish coastal states, facing directly to the Sea of Marmara and characterized by its proximity to Istanbul and its proximity to Istanbul Sabiha International Airport. It is characterized by being a first-class industrial city as it has many factories and plants, which makes real estate investment in this city a profitable project par excellence.

Since Kocaeli is a pioneer in the industrial and tourism sectors, it has been recognized as a preferred location for real estate investment due to the lack of overcrowding like its counterparts Istanbul and Bursa, and at the same time close to each of them, which made it a place a destination for lovers of life in areas of tranquility and tranquility who do not want to leave the beauty and business capital of Istanbul.

Kocaeli has attracted significant interest from construction companies in recent years as the city has prospered with its high-end real estate projects, the city's population has gradually grown, and tourist activity in the state has rebounded sharply.

Kocaeli is also one of the cities with a great investment future, based on the government's official plans for the development of this city, and on the basis of the remarkable development and unprecedented interest that is taking place in the field, and therefore the city is expected to provide profitable investment opportunities in real estate in the medium and long term.

If you are interested in investing in real estate in the Turkish city of Kocaeli, Imtilak Real Estate offers you many properties in Kocaeli 2022.

As for the best areas to live and live in Kocaeli, we will mention:

- Izmit: This is the central area of Kocaeli, a coastal town near the eastern end of the bay.

Izmit, a famous historical city, enjoys an excellent geographical position on the route between Asia and Europe in Turkey.

Izmit, a famous historical city, enjoys an excellent geographical position on the route between Asia and Europe in Turkey. - Gebze: Gebze is located on the road between Izmit and Istanbul, 51 km from Izmit, and is administratively part of the state of Kocaeli. In addition to large industrial sectors, the region is home to the Scientific and Technical Research Center, known in Turkey as TÜBITAK.

- Kandyra: The Kandyra region is located on the Black Sea coast, north of the Gulf of Izmit, next to the Black Sea with its panoramic view to the north, and borders the Kinarca region in Sakarya province to the east and is connected to the Şile district in Istanbul on the western border.

- Kartepe: Administratively, Kartepe is connected with the city of Kocaeli. It is located about 16 km from the most famous tourist area Masukiye. It enjoys a favorable geographical position between Izmit and Sapanca Lake in the eastern part of Kocaeli province, and the distance between Kartepe and Istanbul is only about 140 km.

Learn more